Talking Points:

US DOLLAR TECHNICAL ANALYSIS:

Prices rebounded as expected aftercompleting a bullish Piercing Line candlestick pattern. Initial resistance lines up in the 10469-84 area, marked by the underside of a previously broken falling channel and the 23.6% Fib retracement. A break above the latter barrier exposes the 38.2% Fib at 10536. Near-term support is at 10400, the April 10 low.

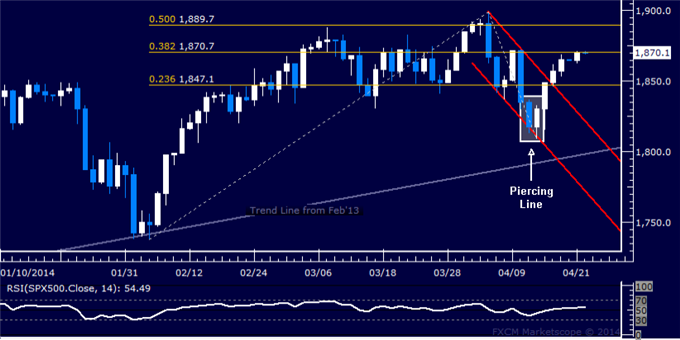

S&P 500 TECHNICAL ANALYSIS:

Prices rebounded as expected after putting in a Piercing Line candlestick pattern. Buyers are now poised to challenge the 38.2% Fibonacci expansion at 1870.70, with a break above that exposing the 50% level at 1889.70.Near-term support is at 1847.10, the 23.6% Fib, followed by the previously broken top of a rising channel at 1821.50.

GOLD TECHNICAL ANALYSIS:

Prices reversed sharply downward, edging past support at 1303.93 marked by the 23.6% Fibonacci expansion and exposing the 38.2% level at 1287.14. A further push beneath that aims for the 50% Fib at 1273.57. Alternatively, a reversal back above 1303.93 sees the first layer of resistance at 1331.06, the April 15 high.

CRUDE OIL TECHNICAL ANALYSIS:

Prices turned sharply lower below the 105.00 figure, sinking to challenge support at 103.11 marked by the 23.6% Fibonacci expansion. A break below this boundary initially exposes the 38.2% level at 101.96. Near-term resistance is at 104.96, the April 16 high, followed by the March 3 top at 105.19.