Last week’s review of the macro market indicators suggested, heading into the first full week of June that the Equity markets had a good week but may need a pause or pullback before continuing, as they were overbought on some measures. Elsewhere looked for Gold to consolidate with a downward bias while Crude Oil consolidated with an upward bias. The US Dollar Index seemed content to move sideways in the long term consolidation but with a short term upward bias while US Treasuries were biased lower in the short term. The Shanghai Composite looked to be stuck in a rut, moving sideways, and iShares MSCI Emerging Markets (ARCA:EEM) were biased to the upside. Volatility S&P 500 looked to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves higher, although the VIX was near historic lows. The Equity Index charts themselves all looked good for more upside, but were becoming overbought on the shorter timeframe. On the weekly charts they looked strong, so perhaps some sideways or a pullback before more upside. Of course they could just keep rising and get more overbought short term.

The week started out with Gold consolidating before moved higher while Crude Oil broke out to the upside. The US Dollar started higher but pulled back while Treasuries found support and bounced. The Shanghai Composite moved higher but stalled at resistance while Emerging Markets met some resistance and pulled back. Volatility moved back higher but barely moved the needle. The Equity Index ETF’s moved lower on the week but found some buyers on Friday, holding over support in what could be a mild pullback. What does this mean for the coming week? Lets look at some charts.

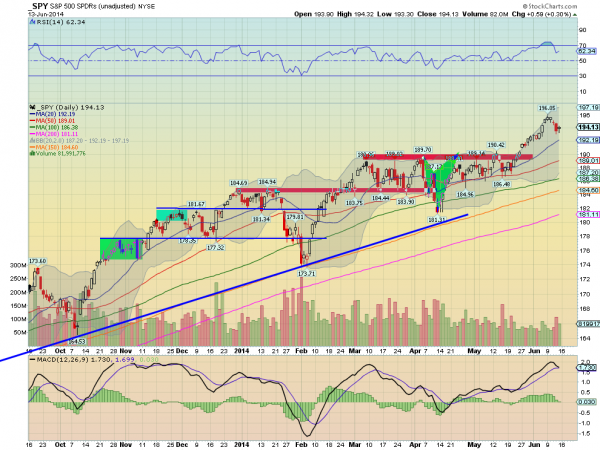

The SPY made a new all-time high to start the week but the upper shadow gave a hint that a reversal may be in store. The rest of the week pulled back and then held on Friday above prior consolidation at the 193 level. The RSI on the daily chart has worked off the technically overbought condition and remains strong in the bullish range. The MACD started the week pulling back and looking ready to cross down. At the end of the week it now looks like it may just kiss the signal line and turn back. The weekly chart shows consolidation at the highs, no damage. The RSI on this timeframe is kinking slightly lower but very bullish with a MACD that is rising. There is resistance at 195 established this week and a target of 197.30 above that. Support lower may come at 193 and 190.42 followed by 188.90. Short Term Consolidation or Pullback in the Uptrend.

Heading into June Options Expiration week the equity markets have shown a preference for some consolidation. For next week look for Gold to bounce higher in its intermediate downtrend while Crude Oil may consolidate or pullback in its uptrend. The US Dollar Index looks to continue to move sideways while US Treasuries consolidate in the uptrend. The Shanghai Composite and Emerging Markets are biased to the upside with risk that the Chinese market just moves sideways. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show that the short term downside might continue, but it may be short lived with all biased higher in the intermediate trend. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.