Things To Keep An Eye On

Below is an overview of important US interest rates and yield curve spreads. In view of the sharp increase in stock market volatility, yields on government debt have continued to decline in a hurry. However, the flat to inverted yield curve has not yet begun to steep – which usually happens shortly before recessions and the associated bear markets begin.

2-Year note yield, 3-month t-bill yield, 10-year note yield, 10-year/2-year yield spread, 10-year/3-month yield spread. As indicated in the chart annotation, the signal that normally indicates that a boom has definitely ended is a reversal in these spreads from inversion to rapid steepening. This has yet to happen.

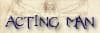

The above-mentioned reversal which sees the yield curve steepening after a severe flattening/inversion is usually actually a reasonably good timing tool for the economy and the stock market. Here is an illustration:

The last two transitions from boom to bust – first the yield curve inverts, then it starts steepening very quickly as investors begin to bet on Fed easing. This is usually when recessions/bear markets are about to start.

The next chart shows a slightly longer history of the same 10-year minus 2-year treasury yield spread with the last three recessions highlighted – it tells the same story. The sequence seems to be the same every time:

Boom-bust transitions with respect to GDP growth.

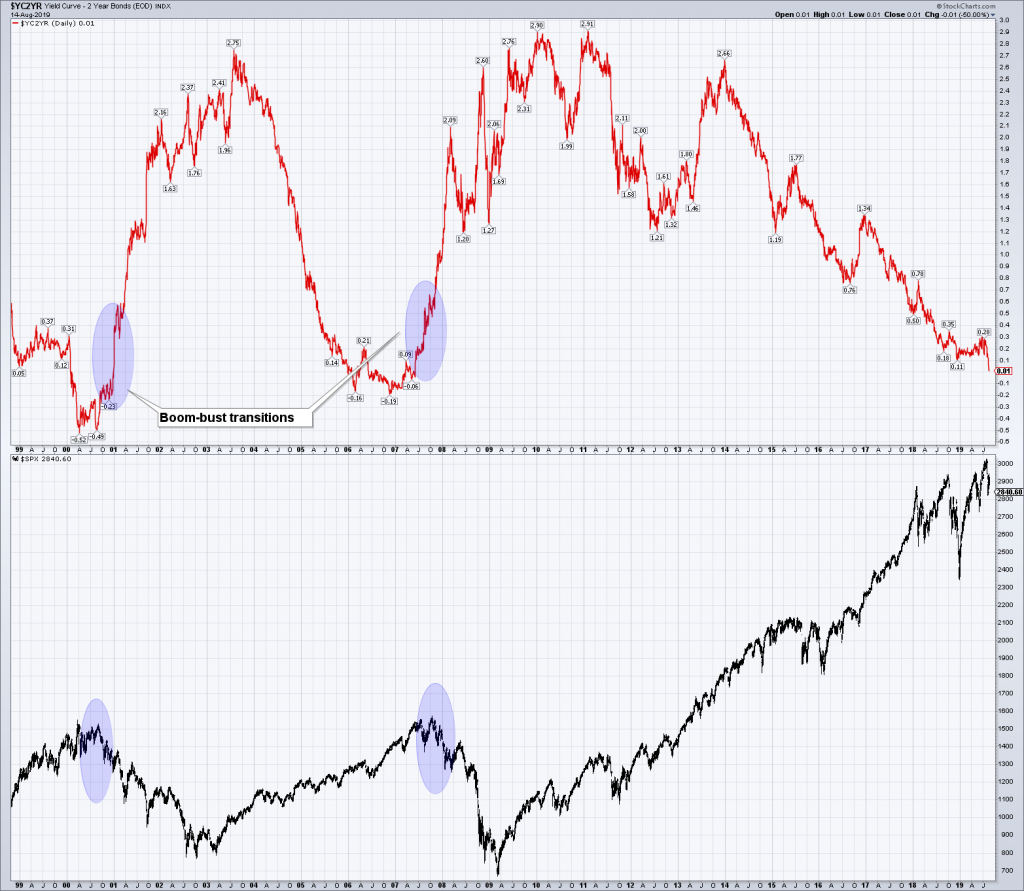

Economic data – particularly leading indicators – have been weakening noticeably of late and the markets are already pricing in another Fed rate cut at the September meeting:

Rate cut probabilities based on Fed Funds futures – as of August 14 the market sees a 74.2% probability of a 25 bps rate cut and a 25.8% probability of a 50 bps rate cut.

What’s more, even though long term rates have recently declined faster than short term rates, the fact is that short term rates are falling quite rapidly as well. This would probably not happen if market participants were still convinced that the economic expansion will continue.

The rate hike cycle didn’t really go very far this time. In 2007, the 3-month t-bill yield peaked at 5.045%, while the effective federal funds rate peaked at 5.34%. This time t-bill rates peaked at 2.408% and the federal funds rate peaked at 2.44%. This is quite extraordinary.

Don’t Cry For Me Argentina…

We recently mentioned Austria’s 100-year bond as an illustration of the convexity effect. It turns out that Austria is not the only country that has issued a 100-year bond in recent years. Argentina of all places did as well. Let us just say that lending money to Argentina for 100 years seems more than adventurous considering the country’s financial and economic history.

On Monday a first round presidential election in Argentina delivered a painful reminder to investors that Argentinian assets can be quite dangerous to one’s financial health. The stock market crashed by 38%, the peso initially lost more than 20%, but recovered a little after the central bank intervened foreign exchange markets. Alas, the 100-year government bond joined the Argentinian crash-fest with great gusto over the past three days:

It doesn’t happen very often that government bonds move this much in three days…

Another Bond Market Curiosity…

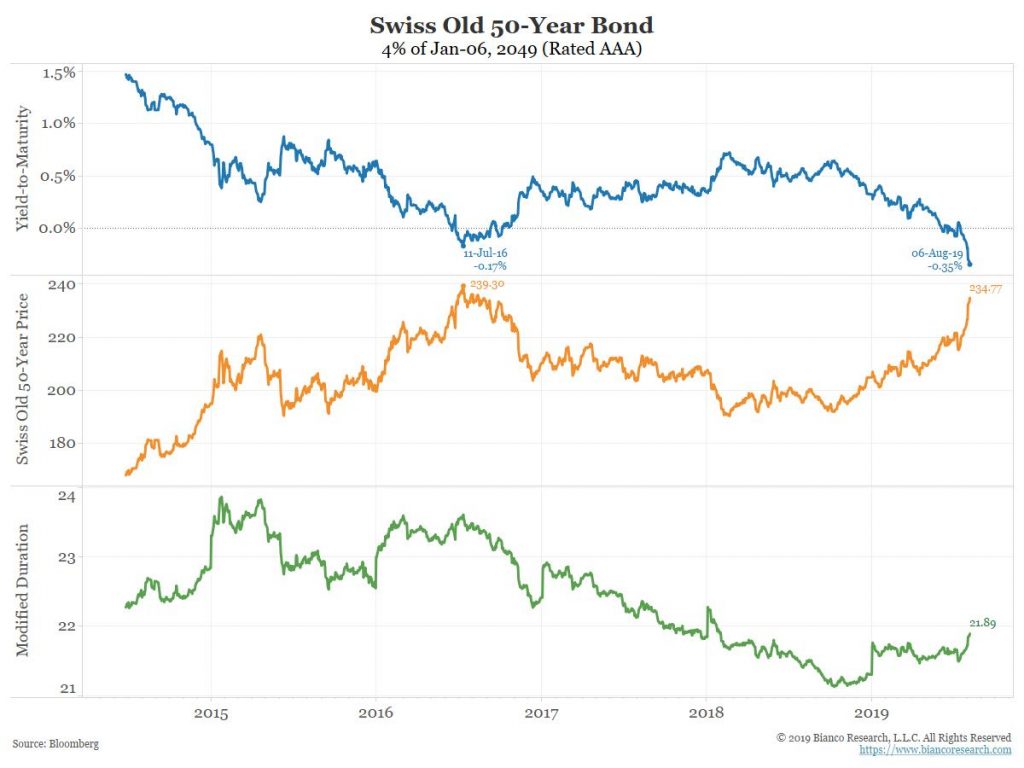

Back in 1999, when developed market government bonds still had yields worth mentioning, Switzerland issued a 50-year bond with a 4% coupon. In the meantime, the entire Swiss yield curve has moved into negative territory and the 50-year bond maturing in 2049 traded at a yield-to-maturity of -0.35% on August 06.

It seems it is trading at the highest nominal price ever achieved by a government bond – namely ~SFR 234,- (keep in mind that it will eventually be redeemed at par). Switzerland is undoubtedly a lot safer than Argentina, but we have no idea what buyers of this bond are actually thinking. Maybe they aren’t. Thinking, that is.

Swiss 50-year bond maturing in 2049 – this rarity is selling at the bargain price of SFR 234.77.

Oh well – at least Argentina offers strongly positive government bond yields these days. Argentina, home of the silver lining.