Summary: Corporate insiders are bullish equities at precisely the same moment that outside investors have become bearish. Other factors may intervene to drive the price of equities lower. But sentiment, at least short-term, is quite clearly biased in favor of higher prices.

There's a marked divergence of opinions in the US stock markets at the moment.

On bearish side are equity investors. The ISE equity-only call/put ratio has closed below 100 in each of the last 3 days. This means equity investors are buying protection against falling share prices to an extreme degree. In other words, they are bearish and this is normally a positive for equity prices.

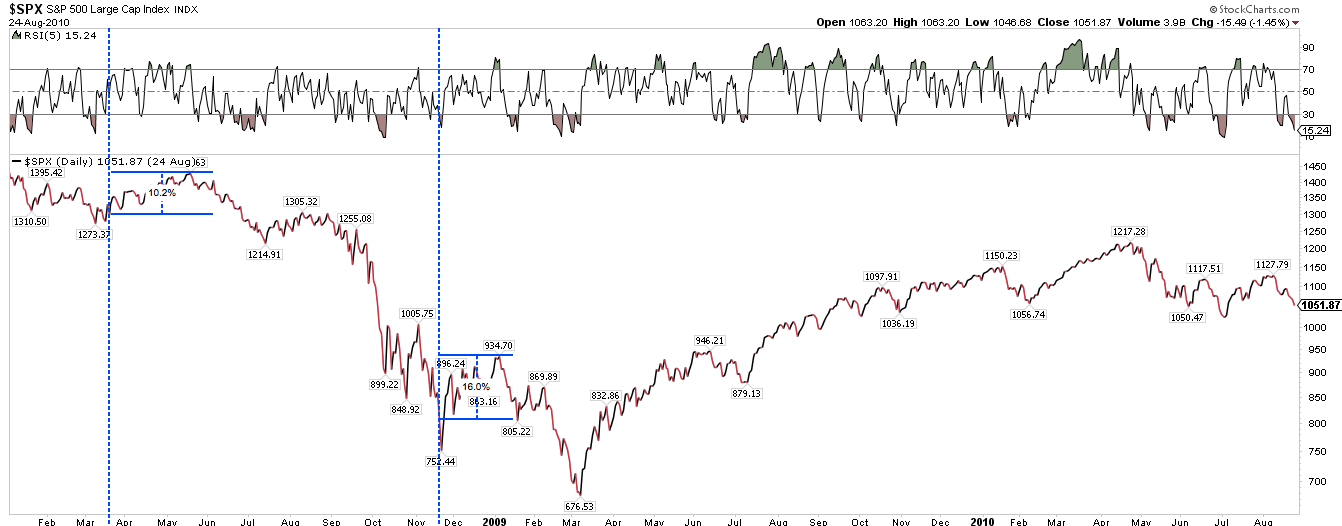

This ratio has only twice before closed below 100 three days in a row: mid-March and mid-November 2008. In both cases, the S&P was near a short-term low and rose over 10% in the weeks ahead. Both of those rallies later failed.

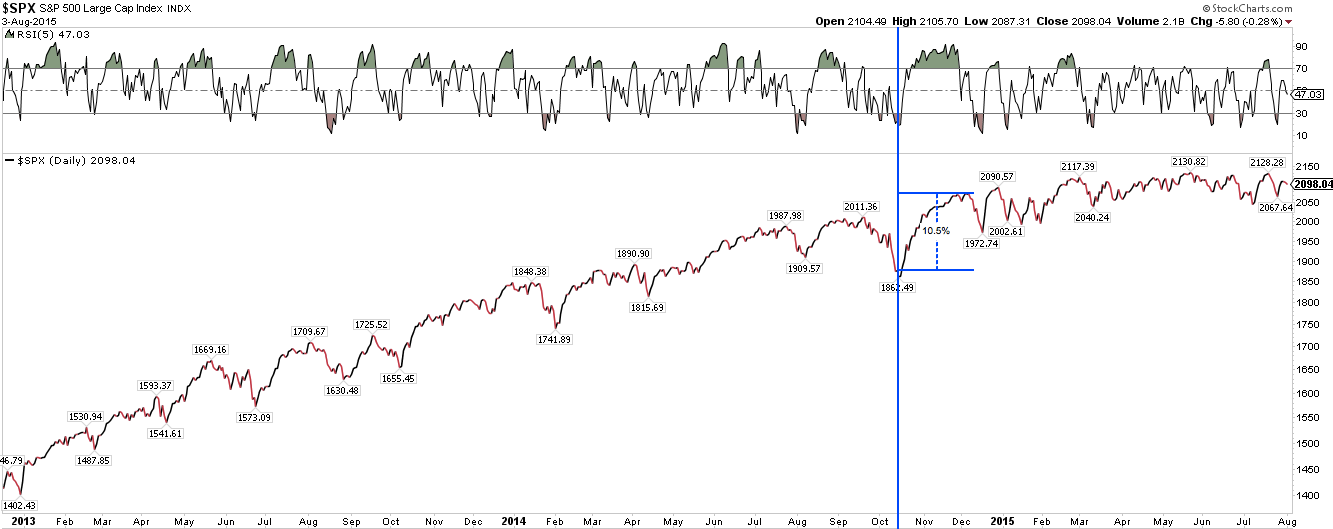

We can add one other instance where the ISE equity-only call/put ratio closed below 100 in 3 of 4 days: mid-October 2014. The S&P bottomed the next day and then rose over 10% in the next few weeks.

To be sure, this a small sample, but there is some comfort in knowing this reading of short-term investor sentiment is consistent with others (post).

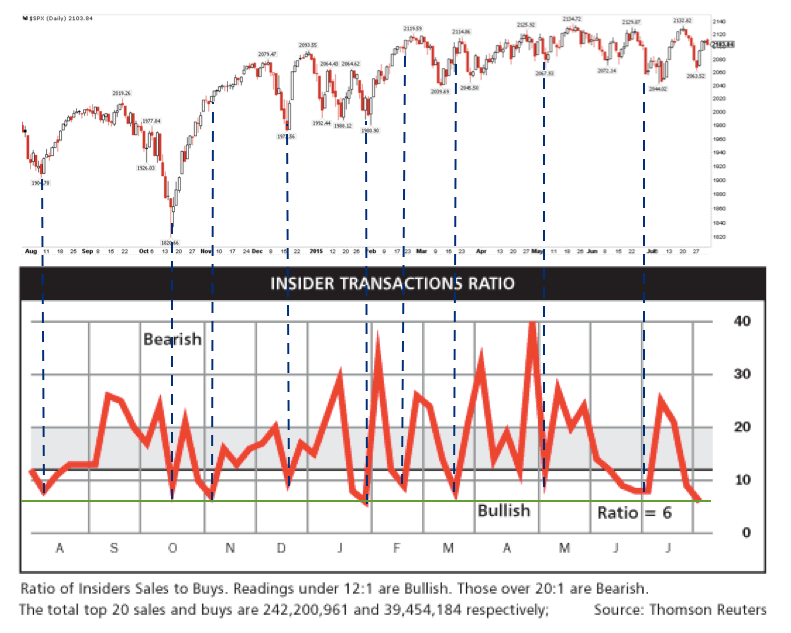

On the bullish side are corporate insiders. They are currently bullish (i.e., buyers of) equities to the largest degree in the past year. This is most often associated with higher equity prices in the weeks ahead (insider transaction information from Barron's).

That corporate insiders are bullish at precisely the same moment that investors are bearish is not unique. In the charts above you should note that this same set-up existed at the mid-October low in the S&P.

Other factors may intervene to drive the price of equities lower. But sentiment, at least short-term, is quite clearly biased in favor of higher prices.

(Note: ISE measures use only opening long customer transactions. This excludes market maker and firm trades in order to form a clean measure of investor sentiment. More on this here).