One of my favorite economic thinkers is Michael Mauboussin.

His book – More Than You Know: Finding Financial Wisdom in Unconventional Places – and various other ‘white papers’ by him have impacted my thought process (and trading philosophy) deeply.

But there’s one specific concept that really stuck with me – and I believe should be in your ‘mental toolbox’.

I’m talking about ‘Expected Value Analysis’ (EVA) – or what Mauboussin called – the Babe Ruth Effect.

We can summarize EVA up like this: it’s not the frequency of correctness that matters. But rather the magnitude of correctness that does. . .

Just like how even though Babe Ruth struck out a lot. He was still one of the greatest hitters ever to play baseball.

Even Charlie Munger – aka “Warren Buffet’s smarter half” – uses EVA often when making decisions.

He said – “… Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we’re trying to do. It’s imperfect, but that’s what it’s all about…”

Keep in mind that EVA is critical across various fields that depend on probabilities – such as investing, gambling, and horse-and-sport betting.

Prospect Theory: Humans Really Hate Losing

So, what exactly is EVA?

For starters – it all begins with a flaw in human cognition. . .

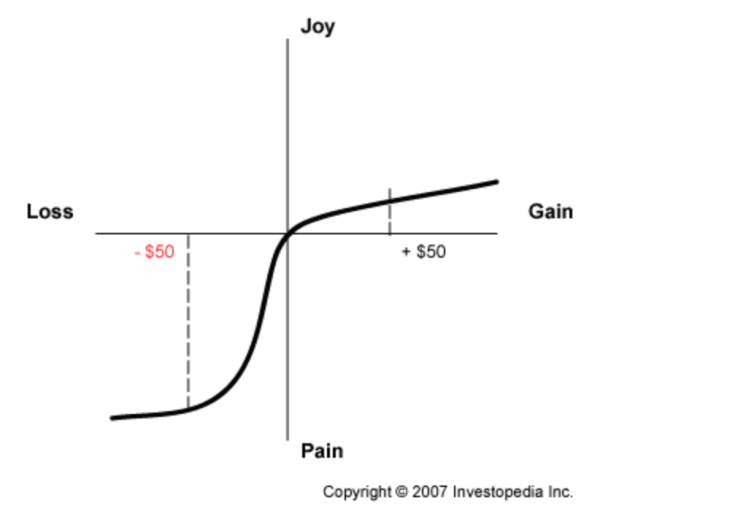

Back in the late 1970s, the famous behavioral economists – Daniel Kahneman and Amos Tversky – created Prospect Theory.

Prospect Theory’s the concept that humans value losses and gains very differently. Specifically, that individuals really don’t like losses – no matter how small the stakes.

In fact – Kahneman and Tversky found that losses have about two-and-a-half times (2.5x) the impact that a similar gain does. Meaning people feel a loss much more deeply than when they get a win.

This behavioral fact has dealt a blow to conventional financial wisdom – especially the Efficient Market Hypothesis (EMH)

Prospect Theory thus implies that humans naturally will feel a lot happier when they’re correct. So they try to be correct as often as they can (which leads to herd following).

But what’s interesting is that to outperform the market (or gambling house) – it’s not about being correct as often as is the upside from being correct.

For instance, when former-trader-turned-risk-philosopher Nassim Taleb wrote his book Fooled By Randomness, he described how he dealt with a magnitude over frequency from his own experience.

While Taleb was talking with fellow traders on the floor – a peer asked Taleb about his views on the market.

Taleb responded – saying that he believed (like the rest of the market) there was a high probability that the market would rise over the next week.

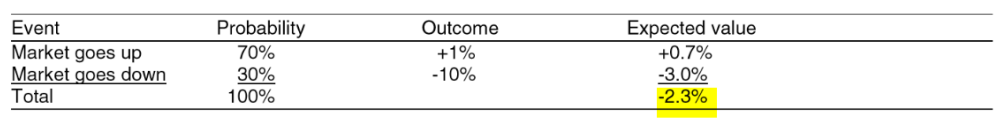

The peer heckled him further for greater clarity – so Taleb put a 70% chance on a rising market.

Suddenly – another trader chimed in. Noting that Taleb’s positions were heavily short S&P 500 Futures (meaning he’d profit from the market declining).

This was a sharp contradiction from his “high chance of a rising market” outlook.

In other words – why was Taleb positioned for a declining market when he saw a high chance that the market would rise?

He clarified his thought process in Expected Value terms. . .

Although he (and the crowd) believed the most probable outcome was for the market to rise – the low chance the market declined created an asymmetric opportunity (greater upside vs. downside risk).

For instance – since the high-probable outcome (70%) was priced in already (because markets are relatively efficient). Thus there isn’t much more to gain.

But on the off chance the market actually does decline (a 30% chance) – the effect is dramatic as the market re-prices the news.

Thus in Taleb’s mind – using EVA – he saw that betting on the high-probability outcome had a negative expected value compared to the greater risk/reward betting on the low chance the market declined.

How many times have we seen this happen before? Where the market focuses on frequency (probability) instead of magnitude (outcome)?

For example – imagine if Apple’s about to post its quarterly earnings.

If the majority of investors expect Apple (NASDAQ:AAPL) to post positive results – they price it in ahead of time. And even if they do beat their earnings estimates – the stock doesn’t rise much since the crowd expected it already (frequency).

But if Apple misses their earnings (under-performs) – the downside is huge (magnitude).

Therefore – a speculator using EVA would see that betting on the low chance of Apple missing earnings would have a significant gain rather than the potential gain of being right.

Another example of using EVA was Brexit. . .

Remember how the market priced in the ‘remain’ vote to win? Thus if the ‘remain’ camp won – the market wouldn’t have risen much.

But in reality – when the ‘leave’ camp ended up winning – the market sharply re-priced the new reality.

Thus speculators who bet against the market’s expected result (that the ‘remains’ would win) made a huge profit.

(I bet on Brexit occurring – aka the ‘leaves’ winning – not because I had any opinion of my own. But because I saw the huge asymmetric opportunity on the off-chance, the market was wrong).

In Conclusion

Investors (and gamblers) must always look past frequencies and instead study the potential outcomes (magnitude).

To do so is fighting human nature – since suffering greater losses doesn’t make us feel well. So don’t expect the average competitor to do this (giving you an advantage).

But from a risk/reward angle – it’s much more important to focus on the magnitude of correctness rather than the frequency of correctness.

It’s not an easy task to formulate accurate probabilities – one must study many situations to gather lots of information and intuitive knowledge.

And most likely, many bets will be wrong – since the market usually prices things correctly. But for the few times that the market is wrong – the gains can more than make up for any previous losses.

I always look at every probabilistic situation (especially in markets and betting houses) in expected value terms. It’s very important to my own trading style.

I’m frequently ridiculed by peers when I open a position betting against the high-probability outcome that’s priced in as a “sure thing.”

That’s because I’m not looking at the probability of being right or wrong – but what I stand to gain or lose.

And in my experience – most of the time – those “sure things” offer significant upside if they go the other way (meaning the market’s wrong).

Always keep in mind – it generally pays to be contrarian.

*Note: both the books listed in the above article are recommended in the Speculators Anonymous Comprehensive Reading List.