For the moment the downward trend stays intact as the market and media embrace more negative news.

News of a housing market top, increasing inflation, geopolitical stress, and more add a dampener to investor sentiment. However, when everyone becomes bearish and is calling for more decay, it could be a sign that selling is becoming temporarily exhausted.

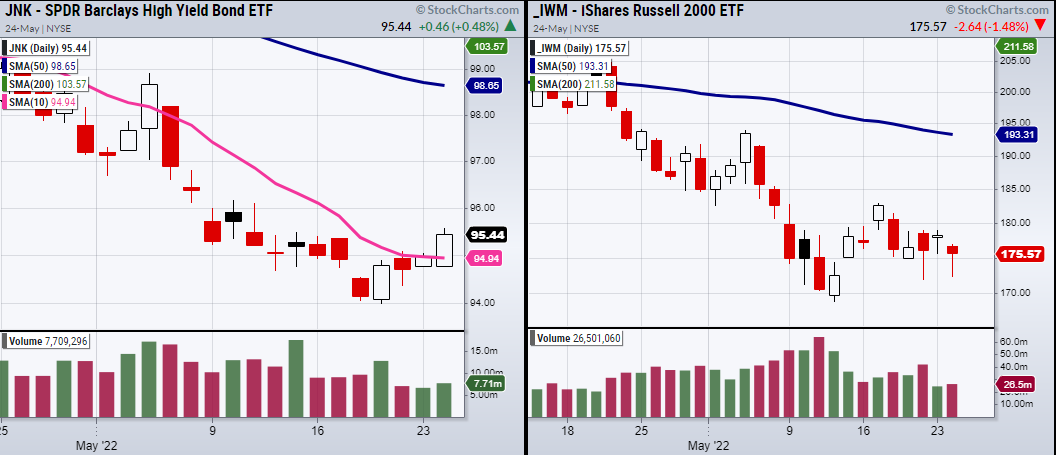

Additionally, while the Small-cap index Russell 2000 (NYSE:IWM) ended Tuesday in the red, it has not broken last week’s low of $171.79.

Having said that, here are two contrary signals the market is giving towards the upside, or at least for holding its current price area.

In the past, we have talked about using high yield corporate debt (JNK) as a risk on or off indicator.

Recently JNK saved us from loading up on equities in the rally attempt when the market moved higher while JNK stayed behind. Now, JNK could save us from becoming too bearish as it closed well over its 10-DMA at $94.93.

If buyers continue to show support for JNK over the 10-DMA, anyone who is looking for another break lower might want to heed some caution.

A lower amount of average daily volume since Monday in IWM is also worth noting. If liquidity dries up it becomes easier to move the price as it takes less buying or selling.

On top of that, if selling becomes weak, it won’t take much buying for the market to pop.

This doesn’t mean that the economic outlook is about to improve, but it does shed light on the potential for the stock market to jump from oversold territory.

With that said, bottom searching in a downward trending market can be a great way to lose money. Therefore, watch for JNK to stay over its 10-DMA as a confirmation it’s improving in strength.

Key Levels

S&P 500 (SPY) 397 pivotal. 380 minor support.

Russell 2000 (IWM) 168 support.183 resistance.

NASDAQ (QQQ) 285 minor support.

KRE (Regional Banks) 62.17 to clear.

SMH (Semiconductors) 215 support. 239 resistance.

IYT (Transportation) 223 needs to hold.

IBB (Biotechnology) 116.68. to clear and hold. 112.60 to hold.

XRT (Retail) Currently, the weakest member of the Modern Family.

USO (Oil) Doji day. Watch for a breakout over 83.60.

DBA (Agriculture) Closed over the 50-DMA at 22.14