Ahead of the Herd

As a general rule, the most successful man in life is the man who has the best information

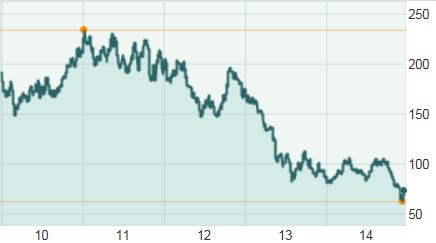

HUI/Gold Ratio, National Inflation Association

When the HGR is rising, gold stocks are outperforming gold. Conversely when the HGR is falling, gold is outperforming gold stocks.

Since 1996, the HUI/Gold ratio has averaged 0.363.The all time low HUI/Gold ratio was set on November 17, 2000 when it bottomed at 0.135.

The HGR closed Wednesday November 20that .148.

The above data tells me gold mining stocks are extremely undervalued and way oversold compared to the price of gold. Can I make some money off that bit of knowledge, am I looking at a potentially profitable investment into a few well chosen gold company’s, do I wait a bit or pull the trigger now?

Let’s investigate further and look at a couple of charts (the following four charts are from marketwatch.com)…

NYSE Gold Bug index (HUI)

PHLX Gold/Silver Index

The two above index’s are excellent proxies for what’s going on in the gold sector. But you can’t invest in an index so let’s look at a couple of investable barometers and see what they show us…

Gold Miner ETF (ARCA:GDX)

Junior Gold miner ETF (ARCA:GDXJ)

It looks to this writer like a bottom.

BUT

What are gold and gold stocks going to do. Are they going up, down or staying flat?

Because we’re smart ahead of the herd contrarian buyers – the buy low sell high kind of buyer - we need additional confirmation if there’s a buying opportunity currently being presented in gold stocks, or, is there perhaps a little more pain before the golden gains?

The Federal Reserve tried to fix the U.S. economy by Quantifornication - stimulus measures.

Investors reacted to the Fed's unconventional efforts. Since the US Dollar is the world’s reserve currency and precious metals are priced in dollars they bought gold and silver to protect their wealth against currency devaluation and inflation. Gold catapulted to a record in 2011 as investors wagered on higher inflation and a weakening dollar.

The Fed ended its bond-purchasing program in October of 2014 and is expected to start raising interest rates sometime in 2015, experts are talking June/July. How things have changed - the dollar has recently gained a lot of new friends while gold has very few left.

The reality we now have is a global wide quantitative easing(QE) is happening, every central bank is now creating, or will soon be creating money as fast as they can. All of this money is looking for a home where it will earn a return - a return that isn’t being eroded by inflation - and right now their best option is supporting the U.S. dollar by printing their currency and buying assets denominated in dollars.

Is U.S. dollar strength going to continue? If so I would not expect an upward move in gold’s or gold stock prices - gold is priced in U.S. dollars, when the dollar is strong gold’s price is weak. Gold stock prices react, or feed off investors sentiment towards gold.

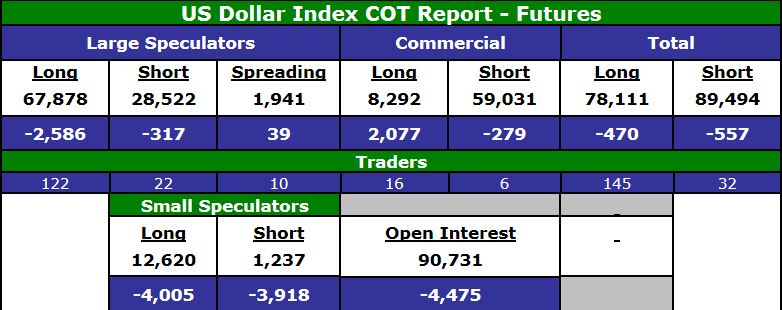

Perhaps the best way to see where the U.S. dollar might be heading is to look at the latest Commitment of Traders reports (COT).

This report tracks three main groups; large speculators, small speculators and commercial traders. The commercial trader category is made up of the businesses that actually use the products they're trading. They have access to the best information, models and traders available.

They are the “smart money” in the markets. Speculators, most often positioned on the wrong side of momentous changes, are considered dumb money.

When the Commercials are so massively on one side of the trade and speculators on the other side I pay attention.

Commercial traders are massively short the dollar. Speculators are on the other side of the trade.

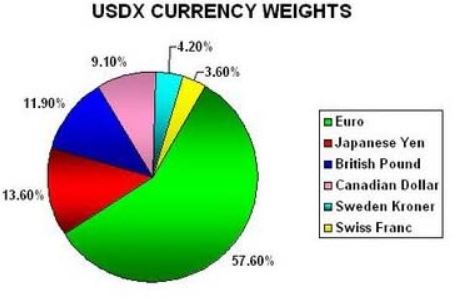

The Yen and Euro are responsible for 70% of the make-up of the dollar index, meaning just those two currencies are responsible for 70% of the dollars moves, up or down - both currencies Central Banks are ‘QEing,’ Japan unbelievably so and the EU is just getting started.

Fx Trade Maker

As both the Yen and Euro weaken the U.S. dollar seems to strengthen. Meanwhile the Commercials, the smartest money in any market, are hugely short the U.S. dollar.

Conclusion

When you want to see the real reason why the U.S. dollar seems weak or strong, check out the underlying components of its index. Want to know where the smart money thinks the value of the dollar is going? Check out the weekly COT’s for the Commercial Traders net short/long positions and changes. As of Friday, November 21st Commercials were long 8,292 contracts and short 59,031.

GoldSeek.com

Are watching the numbers, following the money, the smart money, and golden gains on your radar screen?

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.