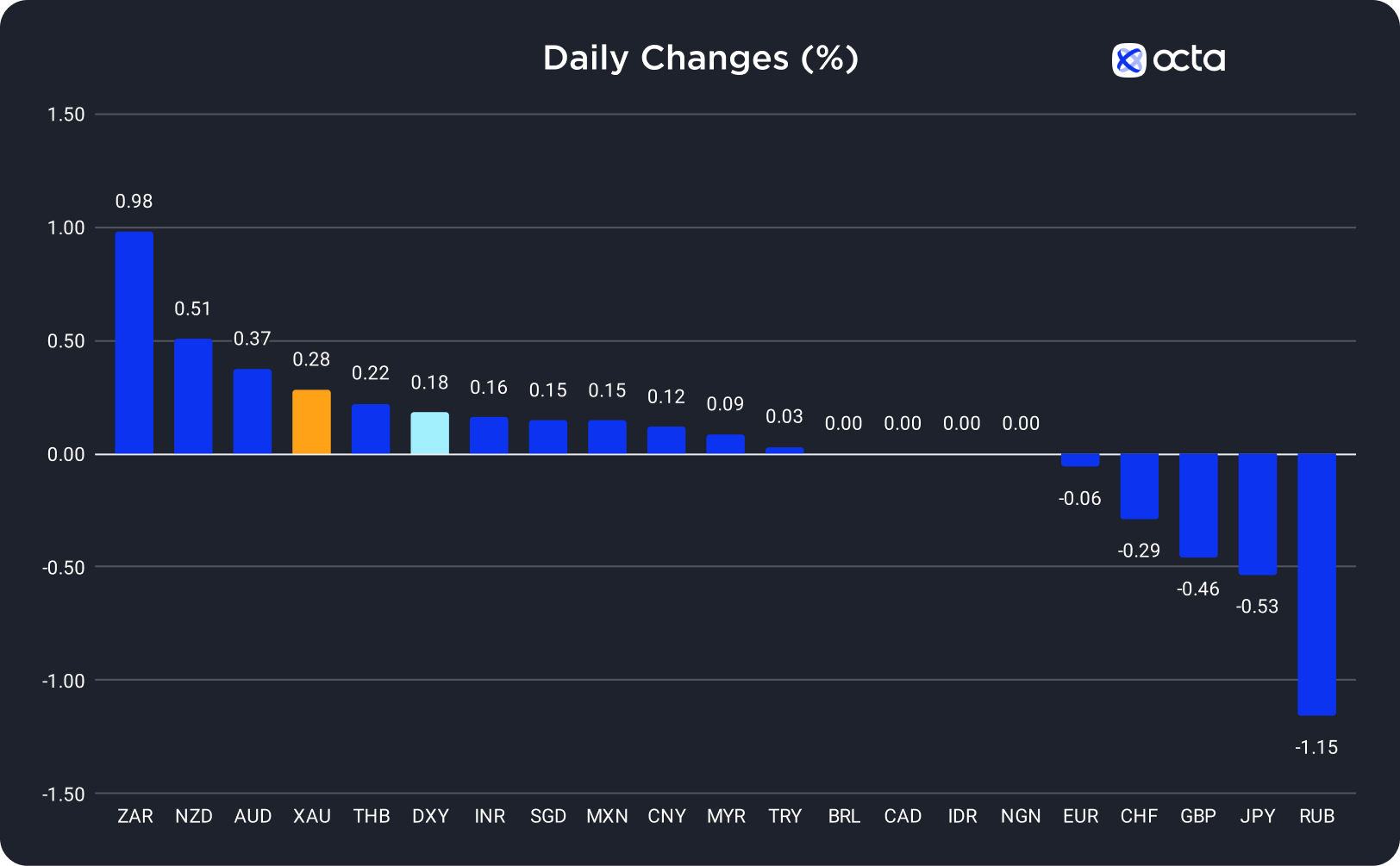

On Friday, the South African rand (ZAR) was the best-performing currency among the 20 global currencies we track, while the Russian rouble (RUB) showed the weakest results. The Australian dollar (AUD) was the leader among majors, while the Japanese yen (JPY) underperformed.

Weak PMI Data Pushed the Gold Price Up

The gold price rose by 0.28% on Friday as the Purchasing Managers' Indices from the U.S. and Europe were interpreted by the market as ‘dovish’ for the global monetary policy.

XAU/USD has been trading below the 1,950 level for several months. Meanwhile, the US dollar and Treasury yields rose, exerting downward pressure on gold, as the market believed the Federal Reserve (Fed) would maintain its hawkish monetary policy. Although the recent PMI figures didn't reveal the booming U.S. economy, consumer spending remains strong, preventing inflation from slowing faster. Neel Kashkari, the Minneapolis Fed President, said he was surprised that the base rate of 5.5% hasn't ‘slammed the brakes on consumer spending.’ Overall, the environment for XAU/USD is bearish because the Fed is prepared to continue hiking the rates. However, the sentiment is predominantly bullish due to investors' worries over a possible U.S. government shutdown and worldwide financial instability.

XAU/USD was virtually unchanged in the Asian session. The US Dollar Index (DXY) continues to trade near six-month highs, making gold expensive for holders of other currencies. Today's macroeconomic calendar is light, so a confident upward break in DXY is unlikely. Thus, XAU/USD may move higher for the next few days until the pair meets a solid resistance near 1,950.

Hawkish Comments From Fed Officials Brought the Euro Down

The euro decreased to a three-month low of 1.06160 on Friday as the market digested the hawkish message from the Federal Reserve (Fed), while French and German Purchasing Managers Indices (PMIs) disappointed investors.

The euro has depreciated by 6% over the past three months as investors generally believed the European Central Bank (ECB) finished the rate-hiking cycle. Christine Lagarde, the ECB President, will deliver several speeches this week that may provide some forward guidance on the eurozone monetary policy. Overall, the eurozone economy is more vulnerable than the U.S. economy. That is why expecting the ECB to turn hawkish seems unreasonable. Moreover, today's Germany's Ifo Index of Business Climate came out relatively weak, pulling EUR/USD lower.

EUR/USD fell during the Asian session, but a strong psychological level of 1.06000 will likely provide some support in the near future. Today, traders should pay attention to Lagarde's speech at 1:00 p.m. UTC. Overall, the economic calendar is relatively light, so the euro may rebound slightly and attempt to retest 1.06500.