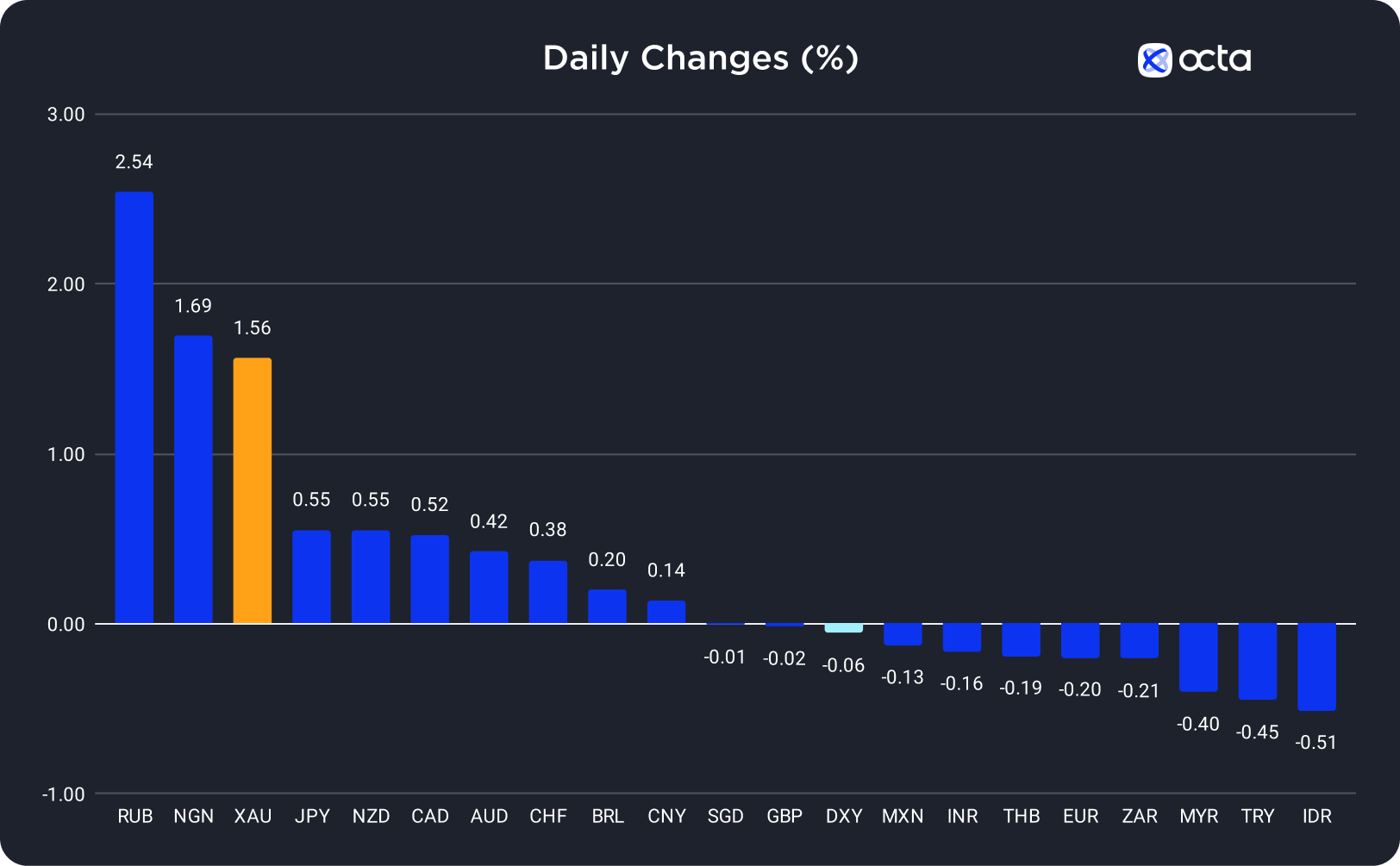

On Monday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Indonesian rupiah (IDR) showed the weakest results. The Japanese yen (JPY) was the leader among majors, while the euro (EUR) underperformed.

Gold Is Near a One-Week High Due to the Middle East Conflict's Escalation

Gold (XAU) surged by 1.56% on Monday after heavy buying by investors alarmed by the political turmoil in the Middle East.

Gold is considered a safe-haven asset, protecting the funds from depreciation amid political and economic turmoil. Thus, the gold price sharply gapped up after a GLOBEX platform opened on Monday.

'There are a lot of questions about what could happen next in the Middle East if the situation further escalates, then gold prices could move towards 1,900,' said Bob Haberkorn, the senior market strategist at RJO Futures.

Indeed, the ongoing conflict may increase market fluctuations, compounding the unpredictability in anticipation of U.S. inflation data later this week. The Producer Price Index (PPI) and Consumer Price Index (CPI) reports are critical to follow because they will largely determine the Federal Reserve's (Fed) monetary policy stance. Fundamentally, U.S. interest rates will play a more significant role in the gold market over the long term.

XAU/USD was declining slightly during the Asian and early European trading sessions after rising over 2% in the two previous trading sessions. Assumptions that the Fed might refrain from lifting the base rate in the November meeting have increased following dovish comments from several officials. Yesterday, the Fed Vice Chair Philip Jefferson emphasized a cautious approach due to the recent uptick in yields. Meanwhile, the Dallas Fed President Lorie Logan suggested no need to continue hiking interest rates if long-term rates stay high.

'We don't believe the FOMC will continue to hike rates into increased uncertainty, and the prospect for peak rates has suddenly moved closer despite the potential inflationary impact of higher oil prices,' wrote Ole Hansen, the head of commodity strategy at Saxo Bank.

Today, traders should pay attention to the news about Middle East tensions. The conflict escalation will push XAU/USD up while easing tensions will put downward pressure on the pair.

EUR/USD Recovers After a Sharp Fall on Monday

The euro (EUR) lost 0.20% on Monday as safe-haven flows went into the US dollar rose due to military clashes between Israel and Hamas forces.

It's a little bit of risk aversion, not a wholesale panic and not a huge amount of sell-off, but just a little bit of a move towards safety as markets wait to see how things develop,' said Brad Bechtel, the global head of FX at Jefferies in New York.

Geopolitical uncertainty usually increases the demand for safe-haven currencies, such as the US dollar. However, the conflict effect may not be long-lived, so the EUR/USD drop may be considered a short-term market reaction.

Indeed, EUR/USD was rising in the Asian and early European trading sessions. Any further developments in the Middle East may certainly impact the pair. Today's macroeconomic calendar is relatively light, but the European Central Bank President Christine Lagarde's speech may move the market as she might provide details about the eurozone rate-hike path. Also, traders should prepare for the release of critical U.S. inflation data. The Producer Price Index is due tomorrow, while the Consumer Price Index will come out on Thursday.