Talking Points

- Gold and silver look to upcoming Yellen testimony for guidance

- Crude oil sell off slows to a trickle as Middle East supply fears fade

- Precious metals testing critical support following recent collapse

The commodities space is witnessing a fairly flat session in Asia thus far as traders await guidance from upcoming US data and testimony from Fed Chair Janet Yellen. A relief rally for gold following yesterday’s collapse in prices likely hinges on dovish comments from the central banker and disappointing economic prints from the world’s largest economy. Meanwhile, crude oil’s selloff appears to be lacking drive with the risk premium built on the back of Middle East supply disruption concerns having likely been unwound.

Gold And Silver Hang Hopes On Dovish Yellen Testimony

After plunging by more than 2 percent during yesterday’s session gold and silver have managed to recover their footing in Asian trading today. Clear catalysts behind the collapse are somewhat absent with newswires citing ebbing geopolitical tensions and fading Portuguese debt contagion concerns as possible reasons.

During the session ahead the precious metals may take some guidance from their pricing currency - the US Dollar. With an end to QE likely already priced in at this point, a recovery for the greenback hinges on firmer expectations for a rate hike from the US Federal Reserve. Upcoming testimony from Fed Chief Janet Yellen and US Advance Retail Sales data could prove noteworthy in that respect. If the Chairwoman fails to deliver hawkish verbiage and a more definitive timeline for an eventual rate rise, the USD may remain unimpressed, which in turn could afford gold and silver some breathing room.

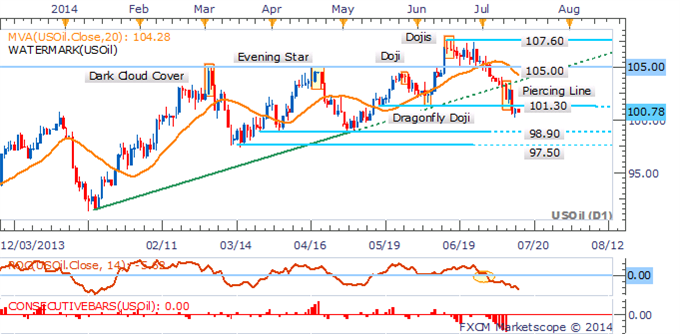

WTI Sell-off Lacking Fuel

The wave of selling pressure that hit crude oil last week seems to have weakened with WTI relatively flat (-0.18 percent) in early European trading. With the premium attributable to Middle East supply disruption fears likely having evaporated, the commodity may turn its gaze back to the US for guidance. This puts the upcoming US Advance Retail Sales data in focus. A better-than-anticipated reading could feed expectations for a strong US economic recovery, and healthy demand for crude oil from the world’s largest consumer of the commodity. Times and expectations for events available on the economic calendar.

CRUDE OIL TECHNICAL ANALYSIS

The downside remains preferred for crude oil following the break below 101.30 coupled with a short-term downtrend on the daily. The next definitive support rests at 98.90, however expect some buyers to slow the descent at the psychologically-significant 100.00 handle.

Crude Oil: Downside Remains Preferred, Sellers Targeting 98.90

GOLD TECHNICAL ANALYSIS

Gold’s sharp correction has negated a bullish technical bias for the precious metal with signs that the short-term trend is shifting. A break below buying support at 1,300/1305 (38.2% Fib Retracement Level) would pave the way for a drop to 1,258.

Gold: Cause For Concern As Trend Starts To Shift

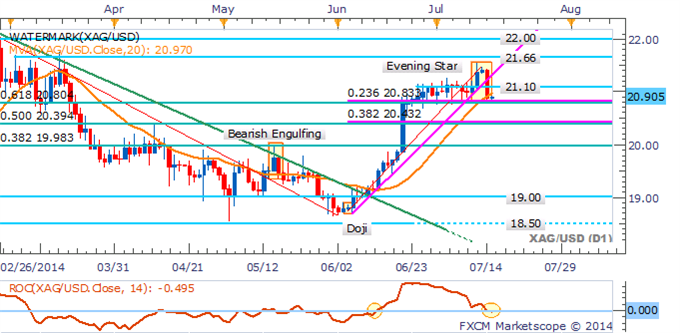

SILVER TECHNICAL ANALYSIS

In a similar fashion to its bigger brother gold, silver’s collapse warns of further weakness to come. However, at this stage the critical 20.80 support level appears to be holding. A break lower would confirm the Evening Star formation on the daily and a shift to a short-term downtrend.

Silver: Make-Or-Break Moment On Test Of Key Support

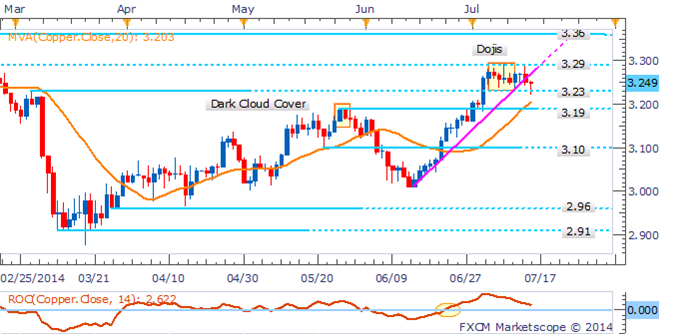

COPPER TECHNICAL ANALYSIS

Copper has breached its ascending trendline on the daily leaving the bulls hopes to hang on respect of support at 3.23. At this stage there are few indications of a more pronounced reversal for the base metal.

Copper: Bulls Hang Hopes On Respect Of 3.23

PALLADIUM TECHNICAL ANALYSIS

With an uptrend still in force for palladium, longs remain preferred. However, with such close proximity to resistance at 875 a pullback to support at 861 may offer more favorable entries.

Palladium: Pullback To Offer New Entry Opportunities

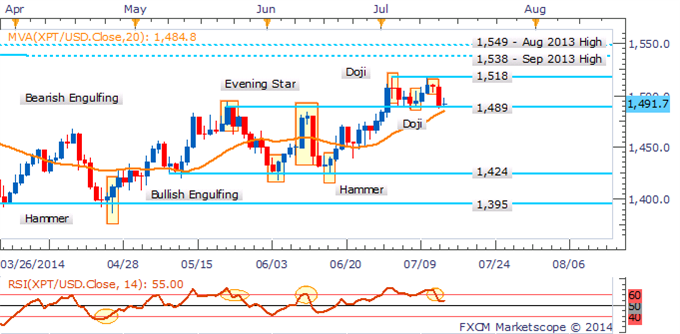

PLATINUM TECHNICAL ANALYSIS

Sellers remain prepared to cap gains for platinum at the 1,518, mark which suggests new entries for longs may be better served on a breakout or retreat to 1,489. A daily close below support would negate a bullish bias and suggest a drop to the former range-bottom at 1,424.

Platinum: Sellers Keep Gains Capped Below 1,518