The British pound is sharply lower today. In the European session, GBP/USD is trading at 1.179, down 1.83%. It has been a dreadful week for the pound, which has declined by 3.7%.

Bank Of England Delivers 75 Bp Hike

The Bank of England delivered as advertised, raising rates by a super-size 75 basis points today in a 7-2 vote. This was the sharpest rate hike since 1989 and brings the cash rate to 3.0%.

The jumbo rate hike comes at a delicate time, with the BoE warning that the UK is in a “prolonged recession”. The BoE is projecting inflation will hit 11% before the end of the year and estimates that the recession could last two years. The Bank said that further rate hikes would be needed, but the terminal rate would be lower than what the markets have priced in, which is 5.2%.

The BoE has not only witnessed a tumultuous period since the last meeting in September, but had to make its rate decision and forecasts without knowing government policy. A budget was supposed to be released last week but has been delayed until November 17th. Former Prime Minister Liz Truss’ ill-fated mini-budget led to a near financial crisis and forced the BoE to buy massive amounts of bonds. Thankfully, stability has returned and the BoE began selling bonds earlier this week.

The BoE’s message to lower expectations about future rate hikes runs contrary to what Fed Chair Powell said at the Fed meeting on Wednesday. Powell warned that there were no signs that inflation had peaked and said that rates will peak at a higher level than previously expected. This hawkish message sent equity markets sharply lower and boosted the US dollar against all the major currencies. The double-barreled punch of a hawkish Fed and grim warnings from the BoE have sent the pound reeling close to 2% today.

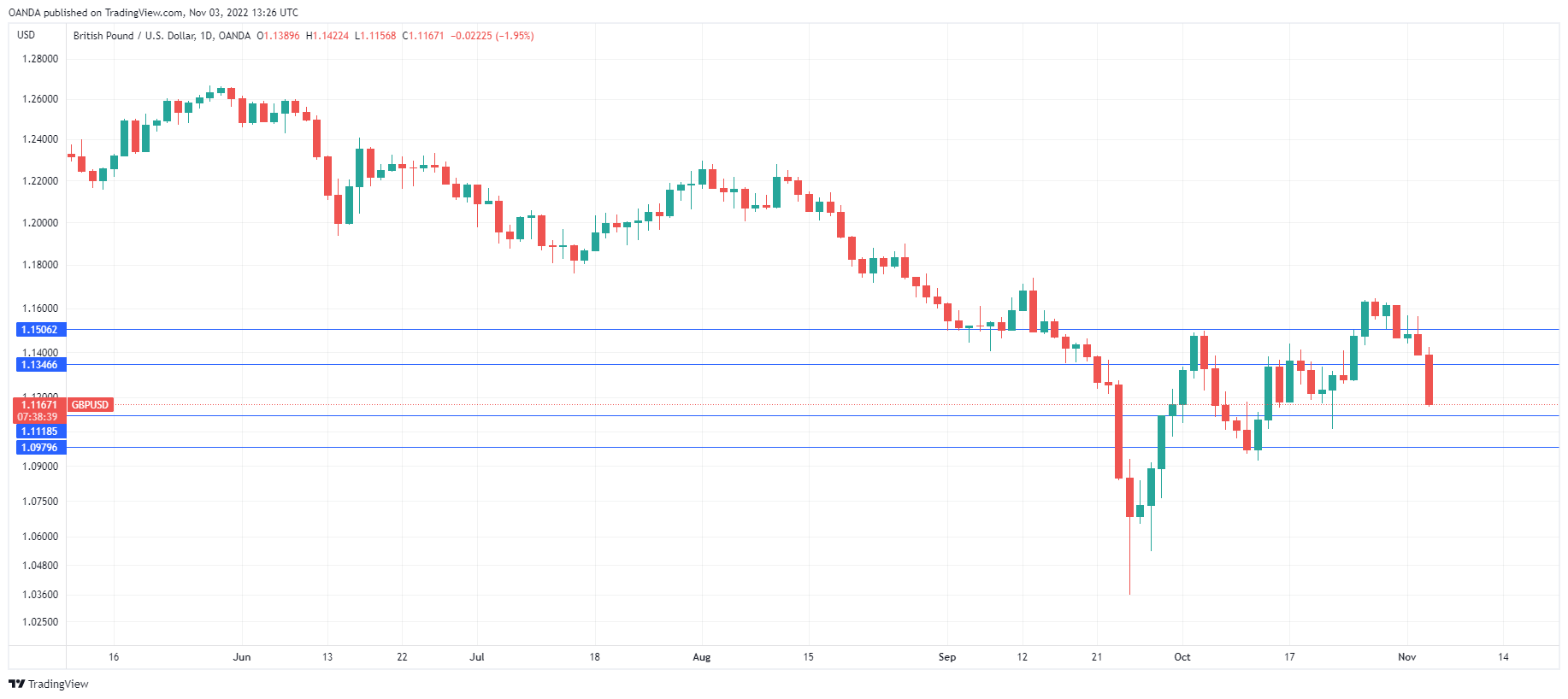

GBP/USD Technical

- There is resistance at 1.1658 and 1.1755

- GBP/USD is testing support at 1.1506. Below, there is support at 1.1367