- Markets are on edge ahead of the Federal Reserve’s latest policy meeting.

- I believe the Fed will lean hawkish with its messaging as inflation fears return.

- Contrary to the consensus view, there is a growing risk that the Fed will hold off on cutting rates altogether this year.

- Looking for a helping hand in the market? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

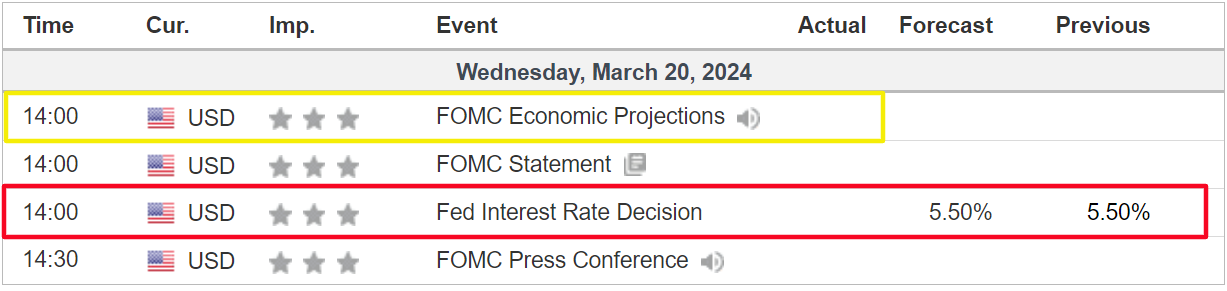

The Federal Reserve will announce its latest policy decision at its second meeting of the year today, and the stakes are high.

No action by the U.S. central bank on the rates front is seen as the most likely outcome. However, updated projections for interest rates and fresh commentary from Fed Chairman Jerome Powell may be a wild card, potentially signaling fewer rate cuts and a later start to policy easing than previously anticipated.

As such, there will be a lot on the line when the U.S. central bank delivers its monetary policy decision and updated economic projections at 2:00 PM ET on Wednesday afternoon.

If you are looking to diversify your risk exposure ahead of the event's volatile trading, you should check out our game-changing AI-powered stock-picking tool. For less than $9 a month, our predictive AI helps you find the best companies in the market on a monthly basis for sustained market outperformance.

Subscribe now and never miss another bull market again by not knowing which stocks to buy!

What to Expect From Today's Rates Decision:

The Fed is all but certain to keep the benchmark Fed funds target range between 5.25% and 5.50%, where it has been since last July.

Source: Investing.com

FOMC policymakers will also release their new forecasts for interest rates and economic growth, known as the "dot plot", which will reveal greater signs of the Fed's likely rate trajectory through the rest of 2024 and beyond.

In December, the "dot plot" showed Fed officials anticipate three interest rate cuts this year and an additional easing of 100 basis points in 2025.

All eyes will then turn to Fed Chair Powell, who will hold what will be a closely watched press conference, as investors look for fresh insight into his views on the economy and inflation and how that can affect monetary policy in the months ahead.

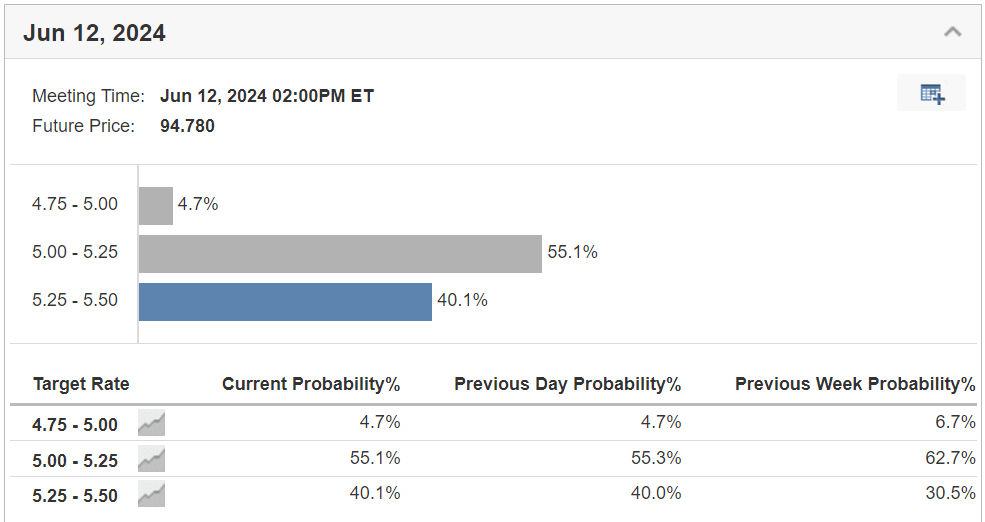

Despite market expectations for multiple rate cuts this year, traders have begun to adjust their forecasts following a recent batch of hot inflation data, signaling a potential shift in sentiment towards a more cautious approach to monetary policy.

After starting the year predicting as many as seven rate cuts, investors now expect just three, with the timing of the first move pushed back from March to June.

With that being said, even the odds of a June cut have been falling in recent weeks. At one point Monday, swap contracts that predict decisions by the U.S. central bank showed a less than 50% likelihood that policymakers will deliver their first interest rate cut in June.

Source: Investing.com

As of Wednesday morning, the Investing.com Fed Monitor Tool pegs the chances of a 25-bps rate cut in June at around 60%, down from over 90% just a few weeks ago.

Prediction: Hawkish Fed Is Back

I believe there is a substantial risk the Fed could strike a more hawkish tone than expected as inflation remains well above the central bank’s 2% target, the economy holds up better than expected, and the labor market remains strong.

In addition, the recent pickup in the rate of inflation will prompt Fed officials to downwardly revise their projections to imply two rate cuts this year, from three cuts previously.

As such, Powell will attempt to push back against market expectations for an imminent rate cut and reiterate that he only sees cuts happening when the Fed is confident inflation is sustainably moving back to its 2% goal.

Bottom line is this is not an environment conducive to cutting interest rates.

Contrary to the consensus view, I am of the opinion the Fed could hold off altogether on lowering rates this year as inflation takes longer to return to the Fed's target than many had hoped.

After June, the Fed only has four more meetings in 2024: in July, September, November, and December.

Taking that into account, it is looking increasing likely that the upcoming U.S. presidential election cycle could interfere with the start of the Fed’s easing cycle, as the central bank would prefer not to shift to a rate cutting cycle at the last FOMC meeting before the election.

That being the case, the Fed could keep rates higher for longer than markets currently anticipate.

What to Do Now:

Any indications or shifts in the Fed's tone during the meeting could trigger significant market movements and investor sentiments. Taking that into consideration, market participants are advised to remain vigilant, exercise caution, and diversify portfolios to hedge against potential market fluctuations.

Given markets have moved higher on the prospect of the Fed cutting rates this year, a shift to fewer rate cuts could be considered a threat to the market rally.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.