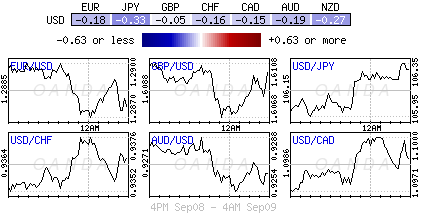

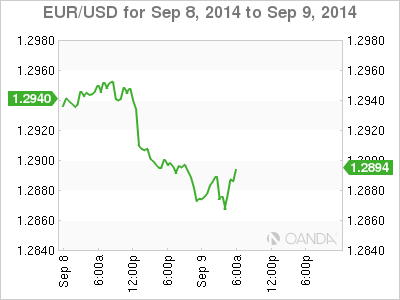

The mighty dollar is basking in glory right across the boards, egged on by investors speculating that the Fed would strike a "less" dovish tone in its next policy statement on September 17. Also aiding the buck cause is the uptick to risk-aversion trading sparked by uncertainty over Scotland's upcoming independence vote taking place the next day on September 18. The thought that the Fed may be about to adapt its communication ahead of an end to QE next month has given the USD its broad based strength. This has managed to push the EUR/USD to trade below the psychological €1.29 handle and USD/JPY above $106. Even fixed income traders are adapting, the USD's OIS (overnight indexed swaps) upward trend of higher-highs continues to persist.

Leverage market dynamics

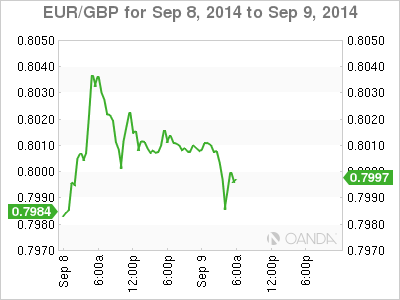

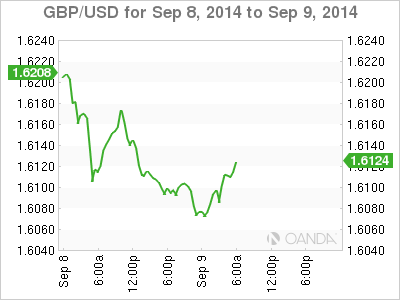

The dollar index (DXY: 84.38) is moving towards a break of last years high, aiming for its 2010 'total' dominance level. Over the past two-months the USD has managed to remain on the front foot for a couple of reasons. First, it was perhaps the 'peak' on BoE rate hike expectations - this initially managed to turn GBP around (£1.7130+), while today, the Scottish sovereignty issue is fueling the pounds decline (£1.6112). Second, the ECB actions favor "lower for longer." Rate divergence has been the key, and a growing view that Ms. Yellen is about to change the Fed's rhetoric is applying more pressure.

Investors should be looking at short-term yields to gauge whether there is to be further divergence between the Fed and ECB, as well as the Fed and BoE. The tightening and widening of spreads helps with interpreting the dollars direction. USD/GBP spread has aggressively narrowed in the last couple of weeks (from 74 to 22) and is likely to flatten given that Governor Carney could delay a BoE rate hike until after next year's May election, while the Fed keeps the hike door open in H1 2015. The market is anticipating that the Fed could use either next weeks meet or next month's gathering to make changes to its post meeting statement. Assuming that every other Central Banker remains 'dovish' on rates, it will only promote further dollar strength in the medium-term.

Traders fear missing the boat

The past few weeks have seen some extraordinary moves by the major currency pairs, which has frankly left many traders rather stunned on the 'breath and depth' of some of these price changes. The volatile situation has been magnified due to years of inactivity - dealing with well contained and tight trading ranges - which has left some traders/investors ill prepared for this "fast" emerging USD uptrend. Many, incorrectly, continue to focus on levels that have come and gone and that do not expect to be revisited any time soon. For dealers, they have had to overcome further regulatory measures - prop trading and excess risk taking has been made a "dirty" issue. Complicating and compounding matters is that many investors have not been able to identify a trending market. All of the above have added fuel to the dollars move higher. If nothing else, there is a genuine uptick in both volume and volatility that should give traders more opportunities and with the lack of return out there, a fast paced currency market becomes attractive looking.

It's no surprise to see the sterling remain under pressure again this morning. Outright, it has managed to print a new 10-month (£1.6067) as investors become a tad more nervous about next weeks Scottish sovereign vote. Ongoing polls continue to highlight that anything could go either way - a mirror image of Canada's 1995 Quebec sovereignty question. Investors should be anticipating a nervous market with erratic price action right up to the vote. Below are some facts and poll date releases that will have an influence GBP prices over the next week.

Scottish independence vote facts:

- Vote will take place on Sep 18. Polls will open from 0600GMT-2100GMT

- Voters will be faced with a single question: "Should Scotland be an independent country?" They will only be able to vote yes or no.

- Anyone who lives and is registered to vote in Scotland will be allowed to vote -- including those aged 16-17.

- A simple majority is needed to secure victory.

- Result will only be officially declared when counts from all Scotland's 32 local authorities have been provided to the chief counting officer (CCO) and she has accepted them as valid.

- Final result is expected to be announced on the morning of Sep 19.

- If Scotland votes yes: A constitutional settlement will need to be drawn up giving terms of independence. Alex Salmond has already stated plans to declare Independence Day in March 2016 and hold elections in May 2016.

- If Scotland votes no: Devo-Max - all parties have pledged to devolve more powers to Scotland.

Scotland never been so important:

He is a list of the Scottish polls timetable that remain.

- September 9: TNS / BMRB - Capi Poll

- September 11: Survation online poll for Daily Record

- September 14: YouGov for Sunday Times

- September 17: Final YouGov for the Sun and a Survation online poll via Scottish media outlet

If nothing else, the market should be expecting much price volatility around the above poll releases.