Industrial sand and metal 3D printer company The ExOne Company (NASDAQ:XONE) has reversed its tumultuous downtrend after peaking at a high of $66.48 on Feb. 9, 2021 to collapse to a low of $15.31 on July 27, 2021. The Company released improved earnings and then agreed to be acquired by Desktop Metal (NYSE:DM) around roughly $25.50 per share in a cash and stock deal. The 3D printing trend is continuing to flourish as the industrial, automotive, and aerospace sectors continue to adopt the technology. The combined entity will be a strong player in the additive manufacturing (AM) segment of 3D printing with its cutting-edge technology. Desktop Metal is poised to roll out one of the fastest 3D printers in the market. They plan to execute their AM 2.0 strategy for mass production providing unrivaled customer choice and product portfolio in casting. ExOne provides full digital casting workflows to Desktop Metal’s sand printing solutions. The combined distributions include over 200 channel partners in over 65 countries. Prudent investors seeking exposure in next-gen 3D printing technology can watch for pullbacks in shares of ExOne.

Q2 FY 2021 Earnings Release

On Aug. 11, 2021, ExOne released its second-quarter fiscal 2021 earnings report for the period ended in June 2021. The Company reported a loss of (-$0.25) per share versus consensus analyst estimates for a loss of (-$0.27) per share, a $0.02 per share beat. Revenues grew 69% year-over-year (YoY) to $18.78 million, beating consensus estimates by $3.67 million. The Company had record backlog of $48.7 million, up 27% YoY. The quarter also had all-time highs for quarterly recurring revenues at $8.3 million, up 34% YoY thanks to material sales. ExOne CEO John Hartner commented, “The ExOne Team is proud to deliver a record second quarter revenue result, driven by market momentum we continue to see for our portfolio of products, which we believe is the strongest in the company’s history and also in the binder jet marketplace, as well as an all-time high in both quarterly recurring revenue and backlog. We’re also benefiting from secular trends that we believe will continue to lift ExOne long into the future, such as a desire to lightweight cars and aircraft for sustainability benefits. While COVID-19 continues to cast uncertainty over the markets we serve, we also see early signs of an economic restart, led by the U.S. market, and a shift in manufacturing approach as a direct result of the pandemic that also benefits ExOne. We’re talking to an increasing number of manufacturers who are looking to de-risk and shorten supply chains in a way that supports increased interest in additive manufacturing technologies such as binder jetting for more localized production.”

Acquisition By Desktop Metal

On Aug 11, 2021, ExOne entered into a definitive agreement to be acquired by Desktop Metal for $25.50 in cash and stock equating to a $550 million deal. The deal is comprised of $8.50 in cash and $17.00 in shares of Desktop Metal for each common share of ExOne, implying a $47.6% premium. Desktop Metal CEO Ric Folup stated:

“We are thrilled to bring ExOne into the DM family to create the leading additive manufacturing portfolio for mass production. We believe this acquisition will provide customers with more choice as we leverage our complementary technologies and go-to-market efforts to drive continued growth. This transaction is a big step in delivering on our vision of accelerating the adoption of additive manufacturing 2.0.”

Upon closing of the transaction, Desktop Metal shareholders will own 85% to 88% and ExOne shareholders will own between 12% and 15% of the combined entity. The transaction is expected to close in Q4 2021.

XONE Opportunistic Price Levels

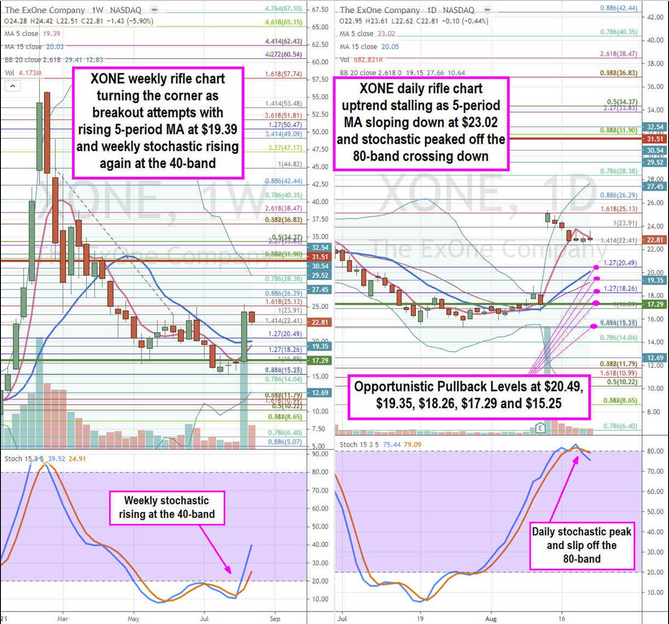

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for XONE stock. While the Company is being acquired by Desktop Metal, shares are still experiencing some reversions that investors can capitalize on. The weekly rifle chart reversed its downtrend as it attempts a breakout on the rising 5-period moving average (MA) at $19.39 to crossover the 15-period MA at $20.03. The initial spike on Q2 2021 earnings results peaked near the $25.13 Fibonacci (fib) level. The weekly formed a market structure high (MSH) sell trigger when shares fell under $31.51. However, the weekly market structure low (MSL) buy triggered above the $17.29 price level. The daily rifle chart shows a make-or-break situation as the 5-period MA slopes down at $23.02 attempt to channel tighten towards its 15-period MA rising at $20.05. The daily stochastic peaked and fell back under the 80-band.

Prudent investors can look for opportunistic pullback levels at the $20.49 fib, $19.35, $18.26 fib, $17.29 weekly MSL trigger, and the $15.25 fib.