The euro is calm on Friday, as EUR/USD trades quietly in the high-1.33 range in the European session. There are no economic releases out of the Eurozone or US today. The markets will be closely monitoring the symposium in Jackson Hole, Wyoming, with Federal Reserve Chair Janet Jackson and ECB President Mario Draghi scheduled to speak on Friday.

Financial leaders and central bankers from around the world have gathered in picturesque Jackson Hole, Wyoming. This is Janet Yellen's first appearance as Fed chair at the conference, and she will deliver a keynote speech on Friday. Mario Draghi is scheduled to speak about labor market dynamics, but the markets will be hoping to hear some ideas about how the ECB plans to tackle the lack of inflation and growth in the Eurozone. There is speculation that Jackson Hole could be a currency event, which would be a marked departure from the conference's usual focus on the US labor market and monetary policy. If this is the case, we could see a sharp reaction from the currency markets. Traders should therefore be prepared for some movement from EUR/USD during the day.

US releases wrapped up the week on a high note. Unemployment Claims improved to 298 thousand, lower than the estimate of 302 thousand. The key indicator has now beaten the estimate in six of the past seven readings. Thursday's other key event, the Philly Fed Manufacturing Index, shot higher in July, rising to 28.0 points. The markets had expected the indicator to slip to 19.7 points. There was more good news on the housing front, as Existing Home Sales improved to 5.15 million, well above the estimate of 5.01 million. This marked the highest level we've since September 2013. What is particularly encouraging is that the data stems from a wide range of sectors, which points to balanced economic growth.

The Federal Reserve released its policy meeting minutes on Wednesday. The minutes were hawkish in tone, with the Fed saying that an interest rate hike could come sooner rather than later if employment numbers continue to improve. The Fed said that the economy continues to improve, but the QE program, which is scheduled to wind up in October, will not be accelerated. Once the asset purchase scheme is terminated, the guessing game regarding the timing of a rate hike will only intensify. Will Janet Yellen provide some clues when she speaks in Jackson Hole?

On Thursday, the Eurozone released Services and Manufacturing PMIs, and the results were mixed. French Manufacturing PMI came in at 46.5 points, the fourth straight reading below 50, which separates between contraction and expansion. French Flash Services PMI came in at 51.1, above the estimate. In Germany, the Service and Manufacturing PMIs both softened in July but beat the estimates. Eurozone Manufacturing and Services PMIs also weakened in July. There is cause for concern as most of the PMI readings were weaker compared to a month earlier, pointing to weaker growth in the Eurozone.

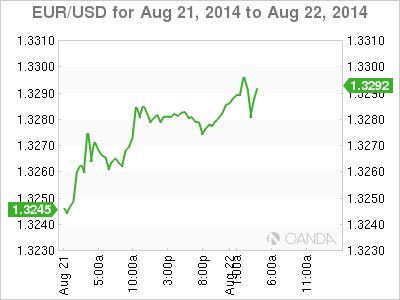

EUR/USD August 22 at 8:45 GMT

- EUR/USD 1.3291 H: 1.3297 L: 1.3274

EUR/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2984 | 1.3104 | 1.3175 | 1.3295 | 1.3346 | 1.3487 |

- EUR/USD has shown little movement in the Asian or European sessions.

- 1.3175 continues to provide strong support.

- 1.3295 is under strong pressure. Will the pair break above this barrier? 1.3346 is next.

- Current range: 1.3175 to 1.3295

Further levels in both directions:

- Below: 1.3175, 1.3104, 1.2984 and 1.2904

- Above: 1.3295, 1.3346, 1.3487 and 1.3585

OANDA's Open Positions Ratio

EUR/USD ratio is pointing to gains in short positions in Friday trade. This is not consistent with the movement of the pair, as the euro has made small gains. The ratio has a majority of long positions, indicative of trader bias towards the euro heading to higher ground.

EUR/USD Fundamentals

- Day 2 - Jackson Hole Symposium.

- 14:00 US Federal Reserve Chair Janet Yellen Speaks at Jackson Hole.

- 18:30 ECB President Mario Draghi Speaks at Jackson Hole.