The pair continues falling amid the publication of weak statistics in the eurozone. The GDP growth in Germany on a year-to-year basis came out at 1.3% while economists predicted a 1.6% growth. In addition, the German ZEW Survey – Economic Sentiment fell from 11.2 to 6.4 points, while for the eurozone it declined from 21.5 to 16.8 points. Both indices came out substantially worse than forecasts.

This week extra attention needs to be paid to data on the Durable Goods Orders and GDP in the US. Strong data could significantly strengthen the US dollar, as it would increase the chances of an interest rate hike in the nearest future.

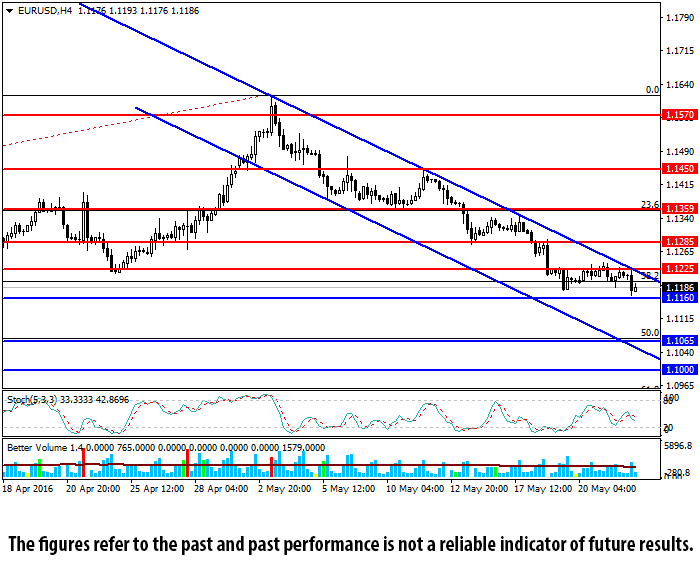

The pair bounced off the upper border of a descending channel and heading towards the support region of 1.1180-1.1160, a breakdown of which would open the way towards the level of 1.1065.

Support levels: 1.1160, 1.1065, 1.1000.

Resistance levels: 1.1225, 1.1285, 1.1359.