EUR/USD has posted losses Friday, as the pair trades at 1.1130 in the European session. The euro posted sharp gains on Thursday, after the ECB announced it was lowering interest rates and expanding its bond-purchase program. On the release front, it’s a quiet end to the week, with no major releases on the schedule. German Final CPI gained 0.4%, matching the forecast. German WPI declined by 0.5%, well off expectations. In the US, today’s sole event is Import Prices.

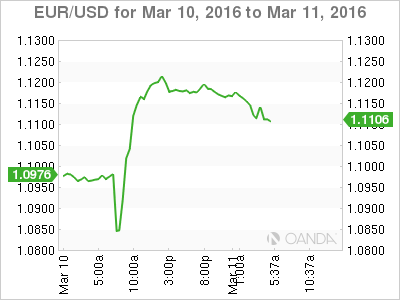

The euro went on a roller-coaster ride on Thursday, as the ECB surprised the markets with some bold monetary moves. The central bank applied the axe to interest rates, cutting the benchmark rate from 0.05 percent to zero percent, and further lowering deposit rates from -0.3% to -0.4%. The ECB also announced it would expand its bond-purchase program (QE), starting in April, from EUR 60 billion to 80 billion each month. These easing measures sent the euro downwards, but shortly afterwards the euro rebounded with a vengeance, after ECB head Mario Draghi stated in a press conference that the ECB was not planning any further rate cuts. Pressure had been building for months on the ECB to take action, as growth and inflation levels remain sluggish. In December, the ECB remained on the sidelines, so the markets were genuinely surprised at the robust moves announced by the ECB.

It’s been an uneventful week out of the US, with no major events on the calendar. That will change next week, with retail sales, inflation indicators and consumer confidence readings. As well, the FOMC will meet for a monetary policy meeting and make a rate announcement. The US economy has softened in early 2016, but overall the economy is on stable ground. The employment market is strong, (although wage growth remains a sore spot), there is growth and consumers are optimistic. Inflation levels are very low, however, exacerbated by the collapse in oil prices. Given this economic backdrop, will the Fed raise rates next week? Most experts say no, although there is some support in the markets for another such move. More likely, the cautious team of Yellen & Co. will wait until mid-2016, and seriously consider a hike if the US economy shows that it is gaining steam.

EUR/USD Fundamentals

Friday (March 11)

- 2:00 German Final CPI. Estimate 0.4%. Actual 0.4%

- 2:00 German WPI. Estimate +0.2%. Actual -0.5%

- 4:00 Italian Industrial Production. Estimate 0.9%. Actual 1.9%

- 8:30 US Import Prices. Estimate -0.7%

*Key events are in bold

*All release times are EST

EUR/USD for Friday, March 11, 2016

EUR/USD March 11 at 5:00 EST

Open: 1.1176 Low: 1.1103 High: 1.1210 Close: 1.1135

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0847 | 1.0941 | 1.1087 | 1.1172 | 1.1278 | 1.1387 |

- EUR/USD was flat in the Asian session. The pair has posted losses in European trade

- 1.1087 has switched to support following sharp gains by the pair on Thursday

- 1.1172 is a weak resistance line

Further levels in both directions:

- Below: 1.1087, 1.0941, 1.0847 and 1.0708

- Above: 1.1172 and 1.1278 and 1.1387

OANDA’s Open Positions Ratio

EUR/USD ratio is showing strong movement towards short positions, consistent with sharp gains by EUR/USD, which has resulted in the covering of long positions. Short positions have a strong majority (64%), indicative of strong trader bias towards EUR/USD continuing to head higher.