Nobody can tell you when a 10% stock market pullback is imminent. That has not stopped many from issuing erroneous prognostications over the last 31 months. By the same token, no individual can predict when a correction will morph into a 20% bearish sell-off. Yet Marc Faber (”Dr. Doom”) has routinely served up enormously frightful comments in a perpetually compliant media.

While it may be impossible to forecast with certainty, it is possible to increase one’s chances of success. One can always avoid a big loss by taking a big gain, small gain or small loss. Another might employ fundamental analysis to buy traditionally undervalued assets and/or to sell traditionally overvalued assets. Still others might simply let long-standing moving averages (a.k.a. “trendlines”) dictate when to participate and when to stand down.

I use a wide variety of data (e.g., economic, historical, contrarian, geopolitical, fundamental, technical, etc.) when making asset purchase decisions for money management clients. In the end, though, when the markets decide that I am wrong about a particular selection, I cut bait so that I may successfully fish another day.

Looking at stocks at this moment in time, the evidence suggests an extraordinary disconnect. Vanguard MSCI Europe (ARCA:VGK), SPDR Dow Jones Industrials (ARCA:DIA) and SPDR High Yield Bond (ARCA:JNK) all hit fresh 52-week highs on Thursday (5/8/2014). The breadth of riskier assets that are forging ahead might suggest to participants that a “risk-on” attitude will continue to be quite profitable.

In the same vein, however, iShares Investment Grade Bond (ARCA:LQD), SPDR S&P Dividend (NYSE:SDY) as well as PowerShares Low Volatility (NYSE:SPLV) are also hitting new 52-week peaks. Moreover, U.S. 10-Year Treasury bond yields are near their lows of 2014 (2.60%) after falling from 3.03% at the end of 2013.

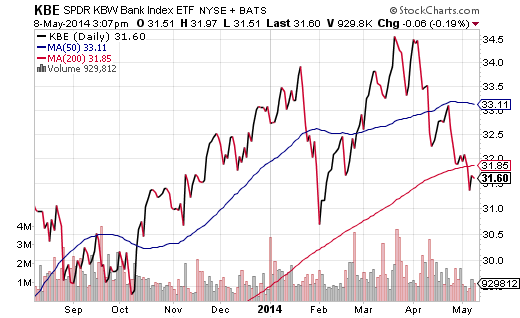

Some signals make the waters even murkier. Leading trouble-makers of the 2007-2009 financial collapse have dropped below long-term trendlines, including SPDR KBW Bank (NYSE:KBE) and SPDR S&P Homebuilders (NYSE:XHB).

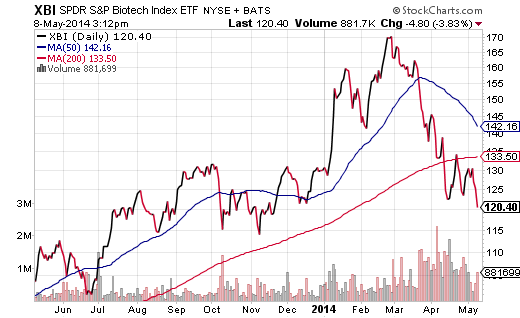

Do potentially harmful new downtrends end at the doorsteps of a few financial sub-sectors? Hardly. We also see a breakdown in the high-flying sub-segments from the 2000-2002 bear. Internet stocks via First Trust Internet (NYSE:FDN) as well as biotech biggies via SPDR S&P Biotech (NYSE:XBI) have also crossed below respective 200-day trendlines.

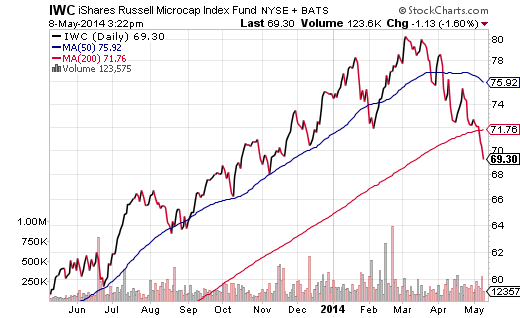

Unfortunately, the depreciation is not restricted to stock areas that we might associate with previous bear markets. The small-cap and micro-cap classes are signaling their own downtrends on extreme levels of fundamental overvaluation. Both iShares Russell 2000 (ARCA:IWM) as well as iShares MicroCap (NYSE:IWC) have dipped beneath their long-term moving averages. Not to be outgunned, SPDR Retail (NYSE:XRT) is struggling with a downtrend of its own; fears that wage growth has been too anemic to support lofty consumption expectations may be at work.

Technical analysts have to note that quite a few areas of the market are “rolling over.” Fundamentally, the Dow has seen three consecutive quarters of earnings declines, while the trailing 12-month P/E for the Russell 2000 is 100. That’s right… 100! And one-half the companies that have reported their earnings missed analyst sales projections. Does this sound like a near-term recipe for a dramatic leg up in the U.S. bull market? If the Federal Reserve intended to initiate additional stimulus, perhaps investors could take the action as a reason to bid stock prices higher. Alas, the continuation of tapering has created uncertainty about whether or not rates will remain low enough to support higher stock valuations.

It is true that stocks may still be attractive in a yield-deprived world. Nevertheless, even in an environment with historically low interest rates, home sales have been declining since August of 2013 and home prices have been declining since September of 2013. The influential real estate segment may not be able to contribute all that much to the gross domestic output of the U.S.

Indeed, there are scores of conflicting data points that have kept the U.S. market range-bound. Mix in unfavorable seasonality patterns (May-October) as well as the potential for the November elections to place Congress in the hands of a single party, and climbing the proverbial wall of worry seems even more arduous.

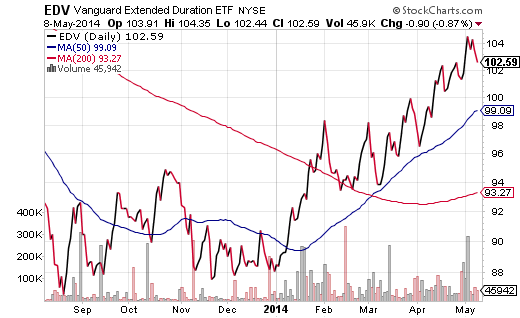

My suggestion is to tread where the trends are favorable and the value is more identifiable. For example, European equities with attractive valuations still exist in the large-cap space. Consider iShares MSCI Value (NYSE:EFV). Maintain allegiance to the homefront, yet do so through less price volatility in iShares USA Minimum Volatility (NYSE:USMV). Don’t be afraid to consider extremely out of favor investments with remarkably attractive fundamental characteristics. Both Market Vectors Russia Small Cap (NYSE:RSXJ) and Market Vectors Brazil (NYSE:BRF) might fit the bill. Lastly, when the entire economic community tells you that rates are going higher or that yields are too low to consider bonds, let the price movement determine your allocation. Few ETF investments have been as profitable as Vanguard Extended Duration Treasury Bond (NYSE:EDV) in 2014.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.