Equity REITs, which invest typically in commercial buildings, apartments and other properties, have been a hot asset class over the past 14 months. As a sector, REITs are up about 30% since January of last year, including dividends. That’s about double the S&P 500’s total return over that period.

After a run like that, are REITs still cheap enough to consider buying?

You bet they are.

As I wrote last week, mainstream U.S. stocks are very expensive at today’s prices, trading at a cyclically-adjusted price earnings ratio of 27. This is more expensive than they were in 1929 and 2007 — both before their respective meltdowns.

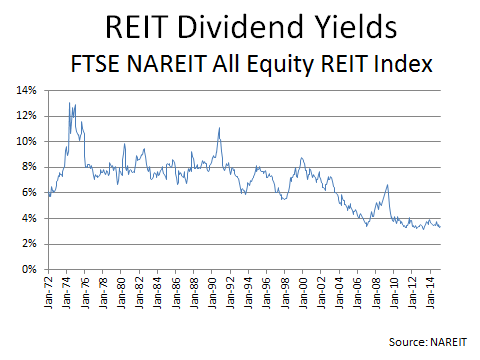

But looking at REIT dividend yields, we see a very different story. Apart from the brief spike in yields that happened during the 2008 meltdown — remember, falling prices mean rising yields — REIT dividend yields have barely budged over the past decade. Since 2006, they’ve essentially bounced around in a range of about 3.2% to 4.0%:

As you can see, that’s a far cry from the 8% yields that were the norm for the 1970s, ‘80s and even parts of the ‘90s. But remember, we’re in a very different world today, one in which bond yields scrape along at lows that few ever believed possible.

In 1980, CPI inflation was 13.9% and the 10-year Treasury yielded over 12%. That made the 8% dividends offered by REITs look terrible by comparison.

Today, REITs as an asset class may yield only 3.4%, but that looks pretty good in a world where CPI inflation and the 10-year Treasury yield are both below 2%.

If you believe — as I do — that this period of low inflation and low bond yields still has a few years left to run, then REIT dividends at today’s levels look like a very solid value.