Yesterday, major indices across the globe ended their sessions in the red. Only a handful were able to stay slightly above zero. The only major index which managed to claw back some losses and end the trading session in the green was the Shanghai Composite, finishing with a 0.66% gain.

In the US, all top three indices were significantly in the red, with NASDAQ leading the way. It suffered the most significant drop, closing with a -2.88% loss. The driver behind that was a declining technology sector, which fell the most yesterday.

In the list of the worst-performing sectors, the runner-up was the communications service sector, followed by consumer cyclicals. There was only one sector in the US, which managed to stay in positive territory, and that’s consumer defensive.

Japanese Inflation Moves Lower

Today will be a relatively quiet day in terms of economic data releases. During the Asian morning, we have received the Japanese national core and headline CPI figures for January. There was no initial forecast available for the headline number, but the actual one came out at +0.5%, lower than the previous +0.8%.

The core CPI was forecasted to have fallen slightly, going from +0.5% to +0.3%. However, the actual reading showed up at +0.2%. The main contributing sectors to declining inflation were culture, recreation, and housing.

Let us remind our readers that the Bank of Japan aims for a 2% inflation target. Until then, no rate hikes are on the table. The Japanese yen did move much, as it remains more vulnerable to geopolitical tensions.

UK and Canada Retail Sales

In regards to the European economic data, Great Britain delivered its retail sales numbers for January, both core and headline on an MoM and YoY basis. The initial expectation for all figures was to see a sharp increase.

Three out of four readings came out even better than the initial high expectations. Only the YoY core retail sales failed to meet the forecast by seven-tenths of a percent, showing up at +7.2%. Nevertheless, the reading was still much better than the previous one, at -3.8%.

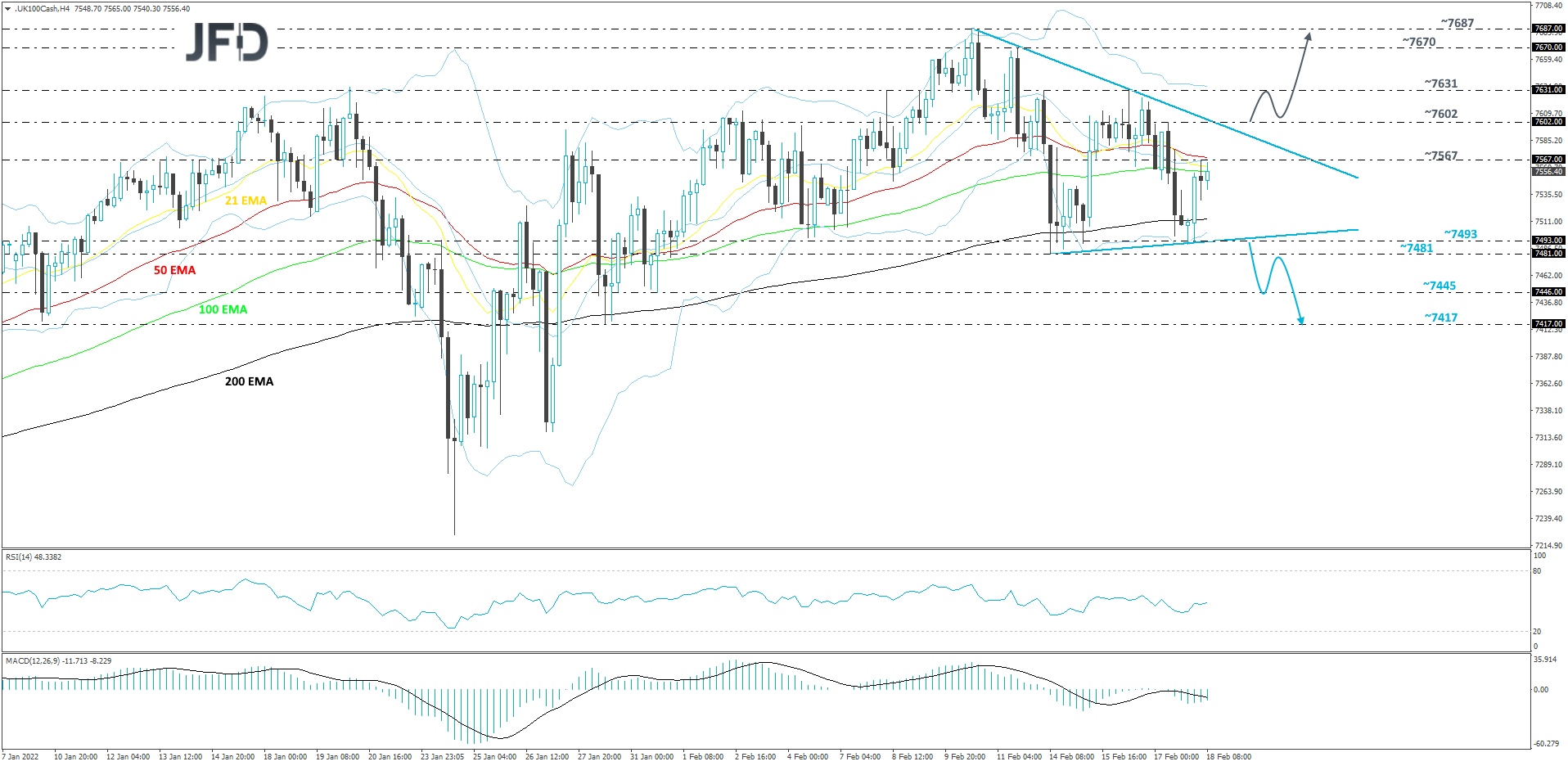

FTSE 100 – Technical Outlook

The FTSE 100 index is currently trading between two short-term tentative trendlines, an upside one taken from the low of Feb. 14 and a downside one drawn from the high of Feb. 10. As long as the price stays between the two lines, we will stay neutral. We need a violation of one of those lines before examining the next directional move.

If the UK index breaks the aforementioned upside line and then falls below a support area between the 7481 and 7493 levels, marked by the lows of Feb. 14 and 17, respectively, that would confirm a forthcoming lower low potentially clearing the way for further declines. That's when we will aim for the 7445 hurdle, which could set the stage for a move to the 7417 level if it fails to hold and breaks. That level marks the low of Jan. 28.

To start examining the upside, we would prefer to wait for a break of the previously discussed downside line first. In addition to that, if the price rises above the 7602 hurdle, marked by the high of Feb. 17, that could help attract more bulls into the field. The FTSE 100 might then drift to the 7631 obstacle, a break of which may lead to a test of the 7670 level, marked by the high of Feb. 11. Slightly above it lies the current highest point of February, at 7687, which could get tested as well.

Later on in the day, Canada will also deliver its retail sales numbers for December. The core MoM number is expected to go down, from +1.1% to -2.0%. The headline is also forecasted to fall from +0.7% to -2.1%. If that’s the case, this might keep the Bank of Canada from raising its rate for a while to keep boosting the economy.

During the last gathering at the end of January, the BoC kept the interest rate the same, at +0.25%. The rate has been at this level since the end of March 2020. However, the bank continues to monitor the country’s rising inflation, which has been on a gradual uprise from June 2021.

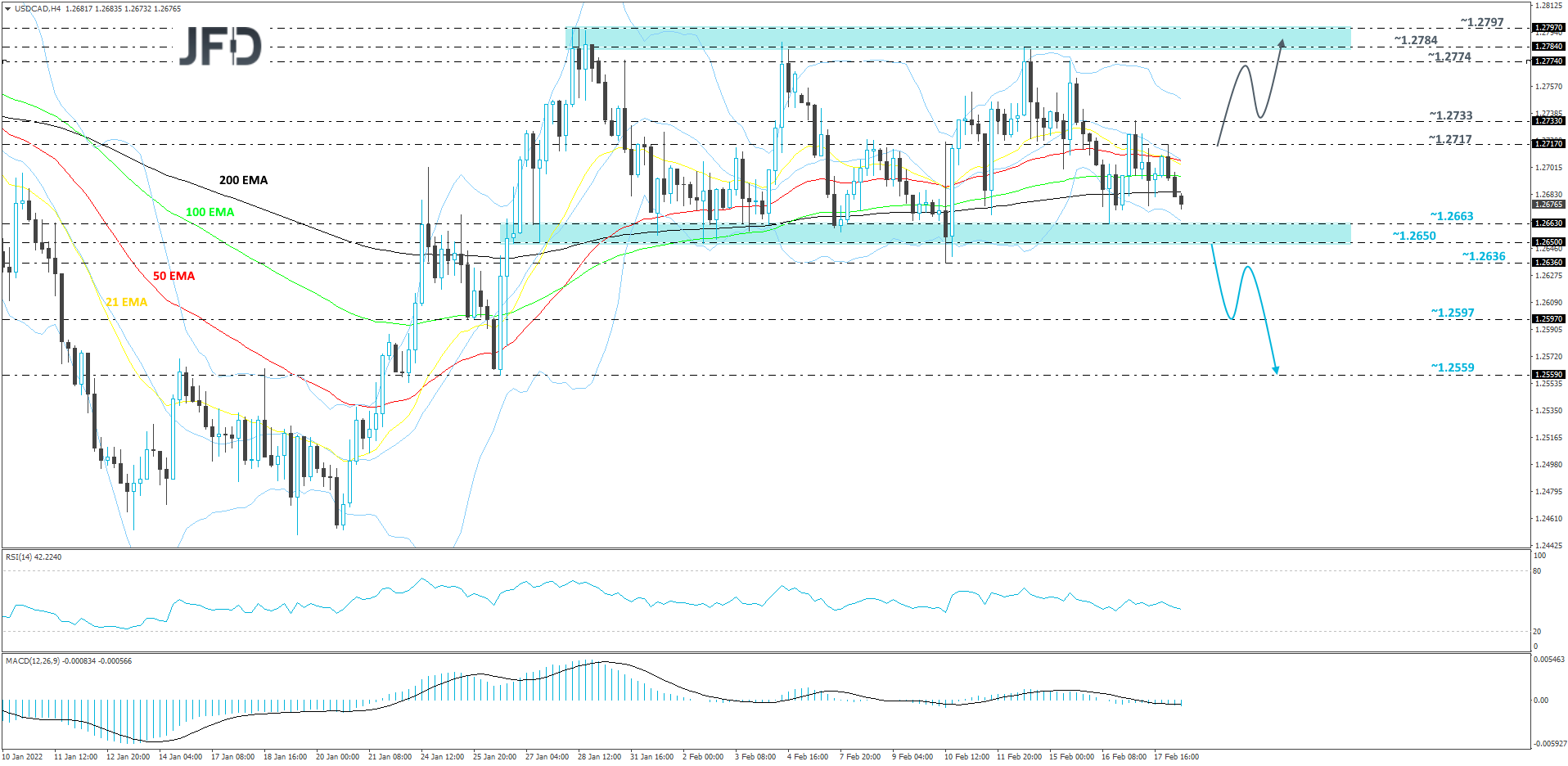

USD/CAD – Technical Outlook

Currently, USD/CAD continues to trade inside a short-term range, roughly between the 1.2650 and 1.2797 levels, which has been in play since around the end of January. Given that the rate is very close to the lower bound of that formation, there is a chance that a break may follow. Until that break happens, we will remain neutral and continue observing the price action.

If eventually, the pair breaks out through the lower side of the aforementioned range, this will confirm a forthcoming lower low, possibly clearing the way to some lower areas. USD/CAD could then drift to the 1.2636 hurdle, marked by the current lowest point of February, where a temporary hold-up might occur. However, if the sellers stay in control, they may easily drag the rate further south, aiming for the 1.2597 level, marked by the inside swing low of Jan. 25 and an intraday swing high of Jan. 26.

On the upside, a push back above the 1.2717 barrier, marked by the high of Feb. 18, might attract a few more buyers into the game, who might help lead the rate towards slightly higher areas within the previously discussed range. USD/CAD could then travel to the 1.2733 obstacle, a break of which might set the stage for a move to the 1.2774 level, marked by the high of Feb. 15.

Canada will also deliver its MoM new housing price index for January, which currently doesn’t have any forecast available. We know that the index has been on a somewhat of a decline since May of last year when the April figure peaked at +1.9%.

Last month’s reading was at +0.2%, but the actual number shows up below it, or even in negative territory, CAD might take a slight hit against its major counterparts.

As For The Rest Of Today’s Events

From the US, we will get the existing home sales numbers. The current expectation is for the existing homes sales to drop from 6.18mln to 6.10mln. Percentage rate-wise, the forecast estimates a number near -1.0%. On the positive side, this still might be seen as a positive, as the previous reading was at -4.6%.