It’s no secret that the value of emerging market currencies is heavily driven by global liquidity, in particular in countries with large current account deficits that depend on external financing. Past worries about US monetary policy gave rise to phrases like “Taper Tantrum” and “Rate Hike Hissy Fit” to describe the sharp negative moves in EM currencies on concerns of an imminent tightening of monetary policy in the world’s largest economy. Now though, EM currencies could be signaling the opposite effect: The Fed’s-On-Hold Hootenanny.

As we noted on Friday, Fed funds traders (typically considered the “smartest” market) have completely priced out any chance of a Fed rate hike in June, September is only about a one-in-four chance, and there’s almost a 50% chance that we may not see the Fed raise rates at all this year, though it’s important to note that these probabilities can change rapidly based on incoming data. In comments yesterday, the influential president of the New York Fed, William Dudley, reflected this greater uncertainty surrounding Fed policy, noting that “There are a lot of wild cards in the [economic] outlook,” that he was “Not reasonably confident on inflation right now” and that he “Hopes that data supports rate lift off this year” (emphasis mine). In particularly, his “hope” that the Fed will be able to raise rates this year is a downgrade over previous central banker comments “expecting” hikes this year.

If Dudley’s hope is not fulfilled and the Fed remains on hold throughout this year, EM currencies could be the biggest beneficiaries. Mirroring the pause in the dollar index, the greenback’s rally has already lost steam against many of the most-traded EM currencies over the last few weeks, including the Mexican peso, Polish zloty, South African rand, and Singaporean dollar.

Pair in Play: USD/RUB

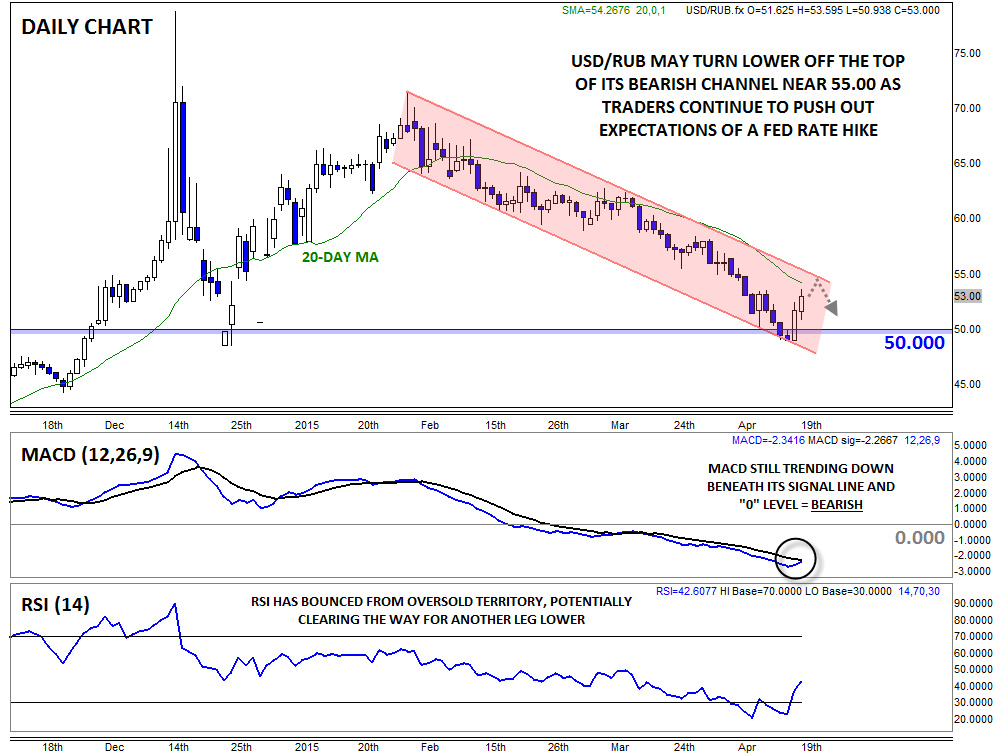

Of course, the biggest gainer in the EM FX space has been the Russian ruble, with USD/RUB dropping all the way to below 50 last week on the general weakness in the USD and strength in oil prices. In the short term, the pair is bouncing off the bottom of the bearish channel off its late-January peak at 71.50, but resistance looms near 55.00, just above current market rates. Meanwhile, the MACD indicator continues to trend lower, below both its signal line and the “0” level, signaling that bears are still in control, and the RSI has bounced out of oversold territory, potentially clearing the way for another leg lower.

As long as USD/RUB remains within its bearish channel and below 20-day MA resistance (currently near 55.00), the path of least resistance will remain to the downside. If we do see the near-term bounce stall out this week, a return back to key psychological support at 50.00 is certainly possible, especially if we see weak US data add more support to the “Fed’s-On-Hold Hootenanny” case.