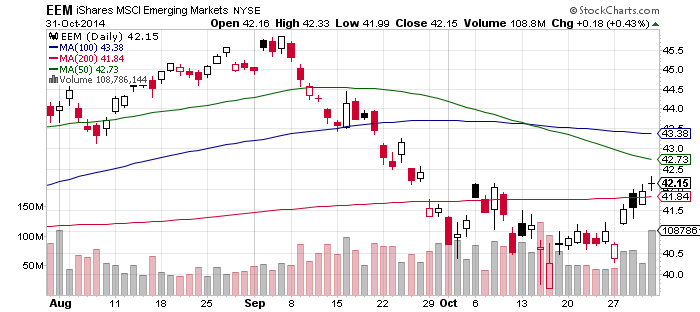

The Emerging Markets ETF (iShares MSCI Emerging Markets (ARCA:EEM)) had a second upweek in a row after a long time, getting above its 200-day MA again, which is very positive. A close above 43,50 may signal the start of the market reversal.

EEM ETF, daily chart

Among individual emerging market indices, China’s Shanghai Composite and India’s CNX-100 have a nice technical picture, while Russia’s RTSI and Brazil’s Bovespa lag, but rebounded nicely in the last few days.

China SHANGHAI COMPOSITE Index, daily chart:

India CNX-100 Index, daily chart:

Russia RTSI Index, daily chart:

Brazil BOVESPA Index, daily chart: