The U.S. economy is showing signs of life with good economic numbers after the ECRI (Economic Cycle Research Institute) declared on 30 Sep. that the U.S. has already or is about to dip into recession.

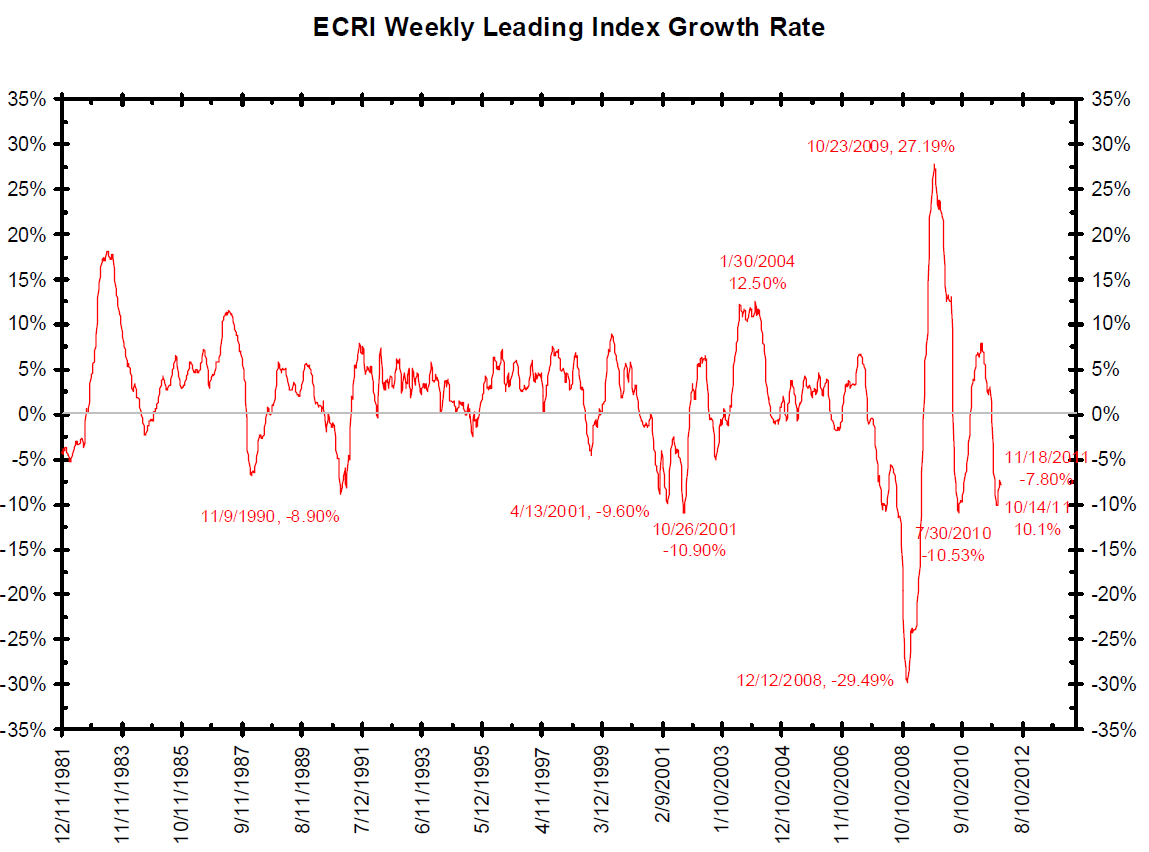

WSJ Market Beat noted that even ECRI’s own weekly leading index (WLI) came in at 122.5 with the latest reading, the highest since early September. However, ECRI said it relies on the longer-term WLI (See Chart Below) when it made the dreaded 'R' call over two months ago. (The long-term WLI is available only to ECRI's paying clients, but the chart below was posted at The Big Picture via Jim Bianco on 9 Dec.)

The bottom line is that ECRI says its recession call still stands. Lakshman Achuthan, co-founder of ECRI said in a Bloomberg TV interview (Clip Below) on 8 Dec. that

“This one [downturn] is persisting. Give us a year, and you'll see if we are right on our recession call."

Wall Street obviously has an entirely different view from the ECRI.

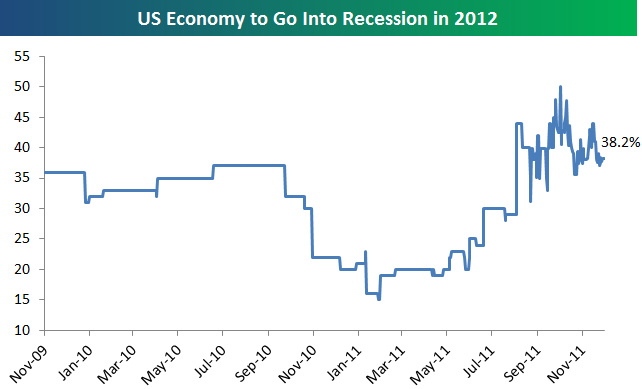

The chart below from the Bespoke Group shows the Intrade contract betting on whether the US will go into a recession in 2012. For the contract to pay out, US real GDP would need to be negative for two consecutive quarters. Right now, the odds of a recession in 2012 are at 38.2% based on actual monetary bets, down from a high near 50% in early October as U.S. economic data have gotten much better since.

For now, we'd agree with Achuthan when he remarked, “You’re not going to know whether or not we’re wrong until a year from now.” Only time will tell if ECRI or Wall Street has the brighter crystal ball.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECRI Renews U.S. Recession Call Clashing with Wall Street

ByEconmatters

AuthorEconMatters

Published 12/12/2011, 08:23 AM

Updated 05/14/2017, 06:45 AM

ECRI Renews U.S. Recession Call Clashing with Wall Street

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.