On December 16, 2014, U.S. zero-interest-rate policy (ZIRP) entered its seventh year. Happy belated birthday, ZIRP!

And on Wednesday, the Federal Reserve noted that it can be “patient in beginning to normalize the stance of monetary policy.” Thankfully, after six long years of this emergency measure, the Fed is going to remain “patient.”

A slight tweak in language within the latest monetary policy statement was cheered by traders and investors, as the S&P 500 proceeded to skyrocket 4.5%, the largest two-day rise since November 2011. The markets clearly have an unhealthy obsession with the pronouncements of central bankers.

But let’s not forget that the Fed has a horrific track record in forecasting economic variables and has appeared blind to obvious asset bubbles in the past.

I’m actually not sure which is more terrifying: a clueless Fed in charge of the short-term cost of money as well as banking system supervision, or a Fed that perpetually provides a dishonest assessment of the situation.

Either way, here’s my own evaluation of where the economy is headed in 2015.

Waiting for Godot

The current U.S. economic expansion is now 66 months old, compared to an average post-war expansion length of 58 months.

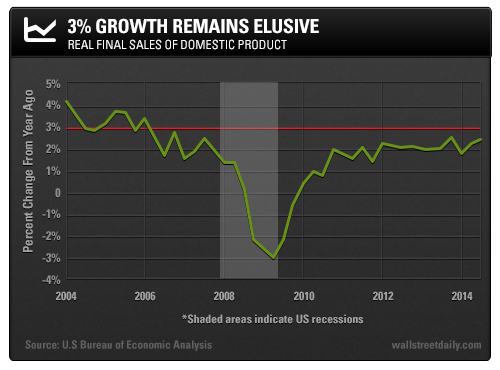

The chart below shows real final sales of domestic product, a measure that is similar to the popular GDP but excludes the effects of inventory builds and drawdowns.

I’m showing growth for each quarter relative to the quarter one year prior.

As measured on this basis, the U.S. economy grew at a 2.5% annual rate in the third quarter of 2014.

The Fed’s central tendency for 2015 growth is 2.6% to 3%. Meanwhile, the median economist estimate is currently 3%.

So the Fed and Wall Street economists are forecasting that this aging economic expansion will accelerate to a rate it hasn’t reached in the past nine years.

Not only that, but this swift rate of expansion – which we haven’t seen in nearly a decade – will sustain itself for an extended period of time.

These economic forecasts are simply unrealistic, as they’ve been for almost the entire post-recession period.

It also shows a staunch unwillingness to accept the reality of a slow-growth environment. Trust me, more and more people will agree with the secular stagnation thesis.

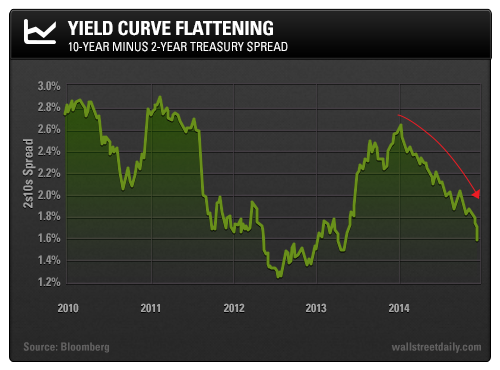

The Treasury market, for example, seems to grasp the dynamics at play.

The following chart shows the spread between 10-Year Treasuries and 2-Year Treasuries (the 2s10s spread).

The yield curve is flattening, and the downward trajectory of this spread indicates the bond market’s declining growth expectations. The market has also been in the process of ratcheting down inflation expectations.

Transitory Disinflation?

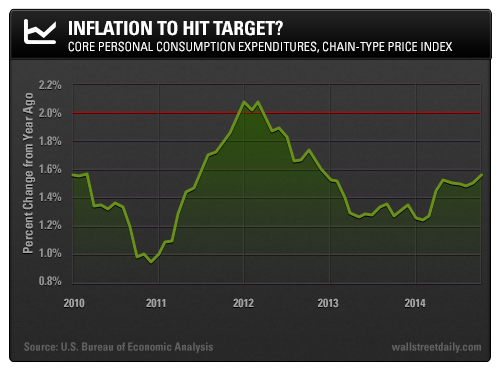

The chart below shows the year-over-year change for the core personal consumption expenditures (PCE) price index, one of the Fed’s preferred ways to measure inflation.

As you can see, inflation has been below the Fed’s 2% target for much of the past five years.The Fed expects inflation to “rise gradually toward 2% as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.”

But I have doubts as to just how transitory this decline in the price of oil will be.

Additionally, though the core PCE figure excludes food and energy, there will still be profound secondary effects from the decline in the price of oil on inflation, as well as growth.

Risk to Capex

According to Standard & Poor’s 2014 Global Capex Survey, the energy and materials sectors have accounted for 42% of global corporate capital expenditures in the latest year.

Capex by businesses – unlike central bank stimulus – is extremely stimulative of the real economy.

However, we’re already seeing energy capex budgets being slashed. So no, the decline in oil prices isn’t “unambiguously good” for the U.S. economy, as many analysts have asserted. This shallow analysis is a classic example of wishful thinking. After all, economists have to hope for something to boost the economy to their 3% targets. In reality, the issues in the commodity complex are broader and deeper than many realize, and will have global contagion effects.

Remember, former Fed Chair Ben Bernanke famously proclaimed that subprime was “contained” in early 2007, when the problems in the subprime mortgage market were anything but. As we’ll all see in 2015, the commodities rout isn’t contained either.

Unlike the Fed, I don’t believe the risks to economic growth are “balanced.”

Instead, I believe there’s significant downside risk. I foresee the U.S. and global economies falling short of not only the unrealistic economic projections for 2015, but also 2014’s tepid growth figures.