London Forex Report

ECB kept both its benchmark rates and monthly asset purchases unchanged as expected, but maintained a dovish stance and left the door open for further easing when necessary. In the US, data flow remained relatively positive despite the gloomy global backdrop. US existing home sales rose to the highest level in nine years and continued to point to steady property market momentum amid job gains and record-low mortgage rates. However, two separate reports showed diverging business conditions in Chicago and Philadelphia, reinforcing patchy economic sentiments and weak investment spending that would continue to dampen growth prospects in the US. USD eased as risk appetite in the markets recovered post-ECB risk event. The USD Index slipped 0.21% to 97.00 amid recoveries in major components EUR, GBP and JPY

FX Majors: EUR: ECB kept both its benchmark rates and monthly asset purchases unchanged as expected, but maintained a dovish stance and left the door open for further easing when necessary. The accompanying statement said that ECB will continue to expect key rates “to remain at present or lower levels for an extended period of time” and “monthly asset purchases of 80 billion euros are intended to run until the end of March 2017, or beyond, if necessary”, signaling the bank’s stance of the wait and see approach at this juncture pending more details on growth and inflation as well as the upcoming economic projections in September. GBP: retail sales data out of the UK reiterated that growth was already losing steam prior to the EU referendum. UK retail sales snapped a 2-month gain to end the second quarter with a 0.9% MOM decline in June as households tightened their purse strings ahead of the EU referendum. Anticipated weakness in consumption has prompted BOE to prepare the market for another round of stimulus in August. JPY: After weak department store sales number, Japan’s all industry activity index indicated that industrial output and the services sector contracted in May, snapping two straight months of expansion. The index slipped 1.00% MOM in May (April: +0.80% MOM) and pointed to extended weakness in the Japanese economy, strengthening the case for additional fiscal and monetary stimulus to boost growth.

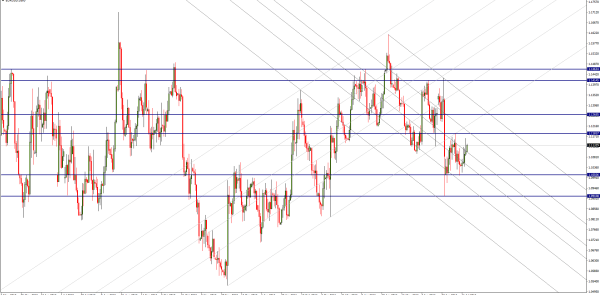

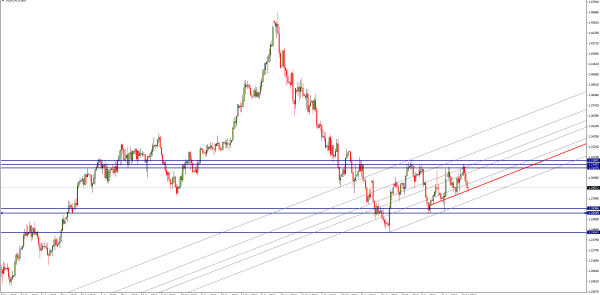

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Technical: Bids below 1.10 arrest range support test and delay a challenge of 1.09 post Brexit reaction lows. Intraday resistance is sited at 1.1070, while this area caps expect further downside.

Retail Sentiment: Neutral

Trading Take-away: Neutral

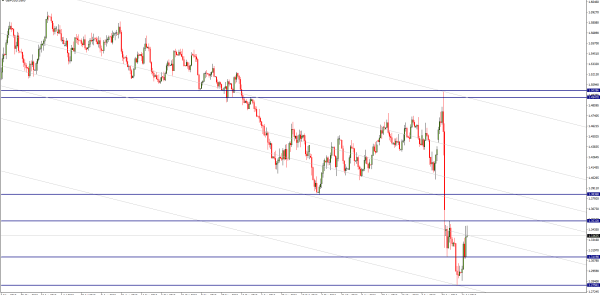

GBP/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Technical: 1.3260 represents symmetry resistance while this area caps expect a retest of 1.30 base. Over 1.3330 shifts attention back to 1.3550 symmetry swing objective.

Retail Sentiment: Neutral

Trading Take-away: Neutral

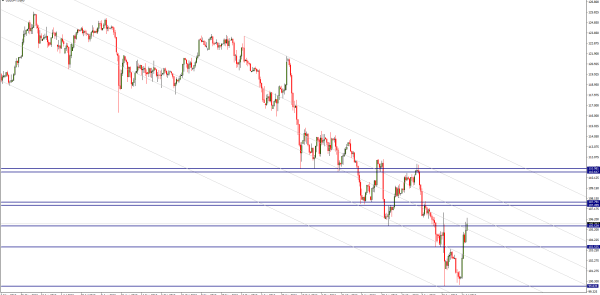

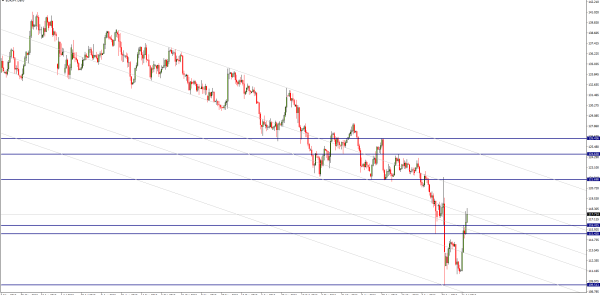

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: Only a close below pivotal 105.50 threatens near term bullish bias. While this area survives on a closing basis expect another test of 107.50 offers. Below 105 opens 103.50 as the next downside objective

Retail Sentiment: Bearish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: As 116.40 supports bulls target 119.30 as the next upside objective.Only below 115 threatens near term bullish bias.

Retail Sentiment: Bearish

Trading Take-away: Long

Commodities FX: Gold remained above a three-week low on Thursday, as the US dollar and European shares fell after the ECB left key interest rates unchanged, but better-than-expected US jobs data weighed, Crude Oil reversed gains from the previous session, after a rise in US gasoline inventories pushed supplies in the world’s top oil consumer to a record high, reinforcing worries of a global glut. AUD: A survey on Australia’s businesses conducted by National Australia Bank showed that outlook on the economy this quarter deteriorated to the lowest level in 3 quarters. The index slipped from 4 in 1Q to 2 in 2Q. CAD weakened against the USD as renewed worries about a global oil glut weighed, more than offsetting stronger-than expected domestic wholesale trade figures.

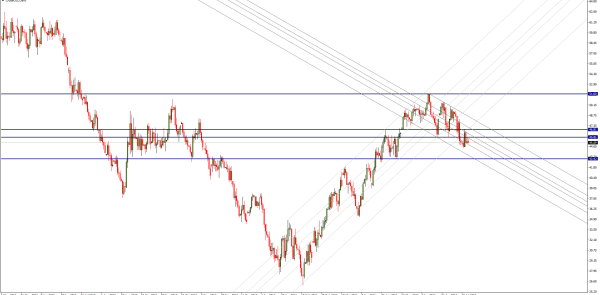

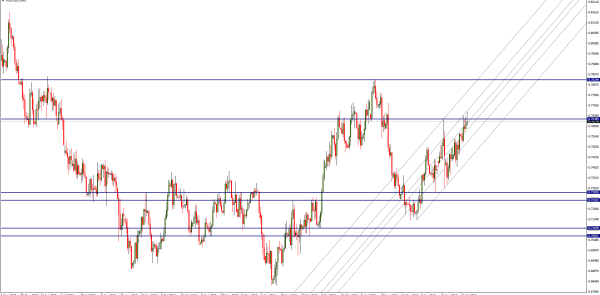

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: Attention shifts back to .7430 as we continue to rotate in a broader .7660/.7340 range, with .7330 representing symmetry swing support. Intraday resistance is sited at .7550

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: 1.2850 pivotal for carving out a potentially bullish base, with higher lows targeting a push higher to 1.32. Below 1.28 opens move back to range lows 1.2650.

Retail Sentiment: Neutral

Trading Take-away: Neutral

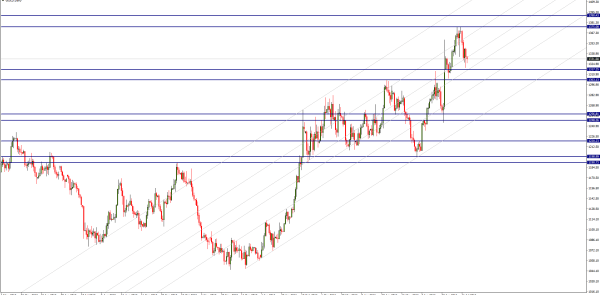

XAU/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Technical: Testing symmetry swing support sited at 1305, while this area attracts buyers will set a potential platform to challenge and breach 1360 highs en-route to 1391. Below 1300 opens 1270 as next downside objective

Retail Sentiment: Neutral

Trading Take-away: Neutral

US OIL

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: 44.50 continues to act as pivotal support while this level survives 48.30 become the upside objective. Below 44 opens 41.87 as the downside objective.

Retail Sentiment: Bullish

Trading Take-away: Short