Diamond Offshore Drilling Inc. (NYSE:DO) was upgraded by equities research analysts at Vetr from a "buy" rating to a "strong-buy" rating in a research note issued to investors on Wednesday, MarketBeat.com reports. The brokerage currently has a $19.33 price objective on the offshore drilling services provider's stock. Vetr's price target points to a potential upside of 16.45% from the company's previous close.

A number of other research analysts have also recently commented on DO. Zacks Investment Research cut shares of Diamond Offshore Drilling from a "buy" rating to a "hold" rating in a research report on Tuesday, July 19th. Jefferies Group reissued a "hold" rating and set a $22.00 target price on shares of Diamond Offshore Drilling in a research report on Monday, August 1st. Credit Suisse Group AG reissued a "hold" rating and set a $18.00 target price on shares of Diamond Offshore Drilling in a research report on Wednesday, August 3rd. Howard Weil began coverage on shares of Diamond Offshore Drilling in a research report on Wednesday, September 14th. They set a "sector perform" rating and a $17.00 target price on the stock. Finally, Bank of America Corp reissued a "buy" rating and set a $28.00 target price on shares of Diamond Offshore Drilling in a research report on Thursday, September 15th. Six research analysts have rated the stock with a sell rating, seventeen have issued a hold rating, five have given a buy rating and one has issued a strong buy rating to the company. The company presently has an average rating of "Hold" and a consensus target price of $20.54.

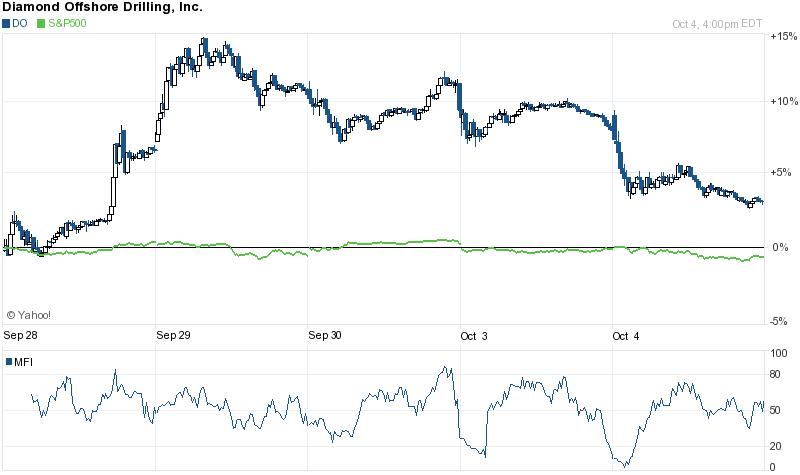

Shares of Diamond Offshore Drilling (NYSE:DO) opened at 16.60 on Wednesday, MarketBeat.com reports. Diamond Offshore Drilling has a 52 week low of $14.18 and a 52 week high of $26.72. The firm's market cap is $2.28 billion. The company's 50-day moving average is $17.21 and its 200-day moving average is $21.88.

Diamond Offshore Drilling (NYSE:DO) last posted its earnings results on Monday, August 1st. The offshore drilling services provider reported $0.16 EPS for the quarter, topping analysts' consensus estimates of $0.08 by $0.08. Diamond Offshore Drilling had a negative net margin of 30.20% and a positive return on equity of 9.12%. The business had revenue of $388.75 million for the quarter, compared to analysts' expectations of $374.17 million. During the same period in the previous year, the company posted $0.66 earnings per share. The business's revenue for the quarter was down 38.7% compared to the same quarter last year. Analysts forecast that Diamond Offshore Drilling will post $1.02 EPS for the current fiscal year.

Several institutional investors have recently modified their holdings of DO. TIAA CREF Investment Management LLC increased its position in shares of Diamond Offshore Drilling by 105.5% in the first quarter. TIAA CREF Investment Management LLC now owns 287,594 shares of the offshore drilling services provider's stock worth $6,249,000 after buying an additional 147,662 shares in the last quarter. JPMorgan Chase & Co increased its position in shares of Diamond Offshore Drilling by 290.6% in the first quarter. JPMorgan Chase & Co now owns 182,609 shares of the offshore drilling services provider's stock worth $3,968,000 after buying an additional 135,861 shares in the last quarter. Teachers Advisors Inc. increased its position in shares of Diamond Offshore Drilling by 73.6% in the first quarter. Teachers Advisors Inc. now owns 111,587 shares of the offshore drilling services provider's stock worth $2,425,000 after buying an additional 47,306 shares in the last quarter. Dimensional Fund Advisors LP increased its position in shares of Diamond Offshore Drilling by 39.2% in the second quarter. Dimensional Fund Advisors LP now owns 5,117,935 shares of the offshore drilling services provider's stock worth $124,520,000 after buying an additional 1,440,650 shares in the last quarter. Finally, Seven Eight Capital LLC acquired a new position in shares of Diamond Offshore Drilling during the first quarter worth $327,000. Institutional investors own 99.34% of the company's stock.

About Diamond Offshore Drilling

Diamond Offshore Drilling, Inc is engaged in offshore drilling and providing contract drilling services to the energy industry. The Company has a fleet of approximately 30 offshore drilling rigs, such as semisubmersibles, jack-ups and dynamically positioned (DP) drillships. Its fleet offers a range of services around the world in the floater market (ultra-deepwater, deepwater and mid-water).