GBPUSD has moved upwards, influenced by touching SMA50, which acted as a support despite the negativity on RSI.

However, ADX remains positive along with stability above 1.5414. Moving above 1.5335 is essential to keep the bullish overview valid, targeting 1.5480 and 1.5520.

Stable move above 1.5520 and SMA50 will cancel out the negative sign on RSI.

Support: 1.5400 – 1.5380 – 1.5335

Resistance: 1.5450 – 1.5480 – 1.5525

Direction: Sideways

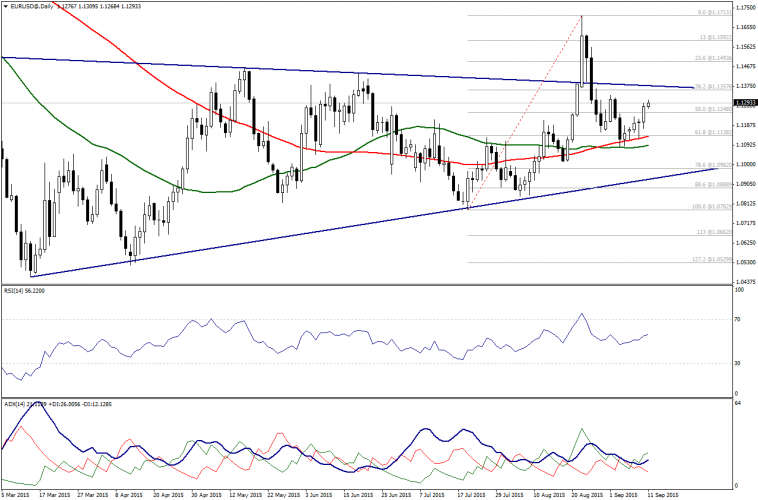

EURUSD inclines, supported by stability above 1.1250, which is a good signal for buyers and would bring further upside actions.

ADX reflects strength in the uptrend, while RSI14 moves above 50.00, reinforcing the bullish outlook.

Testing 1.1360 is available and a break of which will accelerate. On the downside, coning below 1.12 is negative sign.

Support: 1.1250 – 1.1200 – 1.1180

Resistance:1.1300 –1.1360 – 1.1495

Direction: Up

The USDCHF pair has failed to maintain levels above the key resistance of 0.9780 and is currently trading around 61.8% Fibonacci retracement as seen on the provided daily chart.

The current trading levels are very sensitive and therefore, we prefer to stand aside, but we will change this neutral outlook into bearish once the USDCHF pair succeeds in clearing 0.9685.

Being carried by moving averages didn’t prevent them from showing signs of trend exhaustion.

On the upside, coming above 0.9780 will be a sign of resuming the recovery started at 23.6% Fibonacci level.

Support: 0.9685-0.9620-0.9550

Resistance: 0.9780-0.9830-0.9880

Direction: Sideways

USDJPY is presently trading around SMA20 along with signs of indecision on technical indicators; however, failure to reach 121.90 resistance argues us to suggest potential debasement.

The USDJPY pair has formed two long upper shadows during the previous 2 days and that could assist bears to haul it lower.

Nevertheless, breaching through 120.20 is required to make us more comfortable with the bearishness.

Support: 120.00-119.30-118.85.

Resistance:120.60-121.00-121.75

Direction: Bearish