EUR/USD

The pair extends correction from fresh high at 1.1390, posted yesterday and attempts below 1.1200, round figure support and 1.1189, Fibonacci 61.8% of 1.1064/1.1390 upleg. Broken daily 100SMA at 1.1237, is seen as key, with daily close below here, to confirm near-term bearish stance and trigger further easing. Daily Tenkan-sen offers next support at 1.1124, ahead of breakpoint at 1.1065, 05 May trough / daily cloud top / near Fibonacci 38.2% of 1.0519/1.1390. Extended reversal should find ground here, to keep overall bulls intact, as larger uptrend from 1.0519 higher low is looking for final push towards 1.1450 target, lower platform of mid-February. Today’s US jobs data are eyed.

Res: 1.1227; 1.1255; 1.1289; 1.1324

Sup: 1.1173; 1.1154; 1.1116; 1.1065

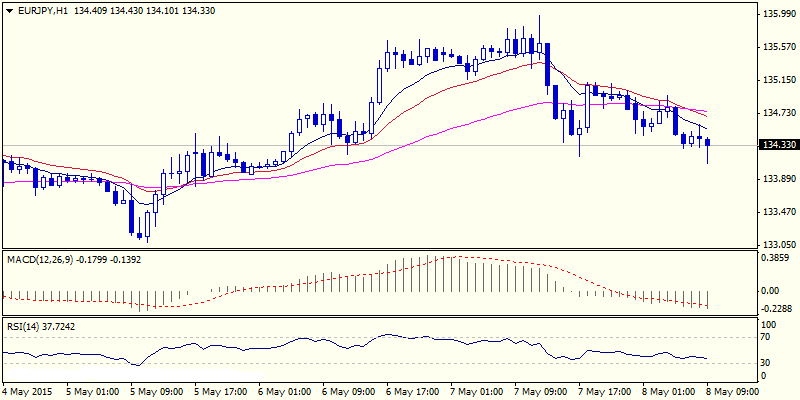

EUR/JPY

The cross came under pressure and accelerated lower, following upside rejection on approach to psychological 136 barrier. Subsequent reversal ended yesterday’s trade in red, with today’s fresh weakness extending below Fibonacci 61.8% of 133.09/135.98 upleg, at 134.19. Near-term studies weakened, with increased downside risk seen on close below daily 100SMA, currently at 134.09 that would expose key near-term support at 133.09, 05 May trough. On the other side, underlying bulls remain intact, with current pullback seen as correction on overbought conditions. Dips should be ideally contained above 133.09 higher low, reinforced by daily 10SMA, to avoid risk of deeper pullback towards 132.20, Fibonacci 38.2% of 126.08/135.98 rally, on loss of 133.09 handle.

Res: 134.59; 134.96; 135.26; 135.68

Sup: 134.09; 133.95; 133.70; 133.09

GBP/USD

Sterling rallied sharply on elections result, with overnight’s strong acceleration from 1.5235 low, probing above psychological 1.55 barrier. Strong bullish acceleration that completed 1.5496/1.5086 correction phase, is now looking for final attack at pivotal 1.5551/67 resistance zone , peak of 26 Feb / Fibonacci 38.2% of multi-month 1.7190/1.4564, to resume recovery on extension above. The notion is supported by strong bullish tone on daily studies, with correction on overbought near-term conditions under way. Dips were so far contained at initial Fibonacci 38.2% support at 1.5410, with extended easing required to find ground above 1.5343, Fibonacci 61.8% of overnight’s rally, to keep near-term bulls in play.

Res: 1.5520; 1.5551; 1.5567; 1.5600

Sup: 1.5410; 1.5370; 1.5343; 1.5300

USD/JPY

The pair rallies back into short-term range, after reversing from 119.04, where higher low was formed yesterday. Fresh strength above daily cloud top cracks psychological 120 barrier, improving near-term structure for sustained break higher and attempt pivotal 120.49 barrier, lower top of 05 May. Return to these levels is needed to open range’s top and breakpoint at 120.83. However, overall neutral tone, favors prolonged range trading expected while the price remains entrenched between118.50/ 120.83 range limits. Daily cloud’s top marks initial support at 119.75, while extension below daily 20SMA at 119.44, would shift near-term focus lower.

Res: 120.27; 120.49; 120.83; 121.00

Sup: 119.81; 119.58; 119.44; 119.04

AUD/USD

The pair extended pullback from 0.8028, 06 May peak, commencing fresh leg lower from yesterday’s rejection at 0.80 barrier, ending day in red. Today’s fresh easing was so far contained above daily 100SMA, averting immediate risk of further easing. On the other side, break lower to confirm bearish stance and expose daily 20SMA, currently at 0.7820, loss of which to open way for full reversal of 0.7780/0.8028 rally. However, overall picture remains bullish and favors fresh upside attempts, with ideal reversal point seen on current lows, above daily 100SMA. Regain of initial 0.8000/28 barriers is required to confirm reversal and focus key barrier at 0.8073, 29 Apr high.

Res: 0.7925; 0.7971; 0.8003; 0.8028

Sup: 0.7861; 0.7820; 0.7800; 0.7780

AUD/NZD

The cross trades in extended consolidative phase off fresh recovery peak at 1.0683, posted on 05 May, with yesterday’s long-legged Doji confirming near-term indecision. Overextended daily studies suggest further hesitation ahead of key med-term barrier at 1.0792, 28 Jan peak. However, no reversal signal has been generated on daily chart so far, suggesting further sideways trade, as mixed near-term studies show no clear direction. Initial support lies at psychological 1.06 level, ahead of 1.0562, consolidation floor, below which to signal further easing. Overall strong bull-trend remains intact and favors further upside, as the pair is poised for repeated strong weekly close.

Res: 1.0650; 1.0681; 1.0715; 1.0734

Sup: 1.0600; 1.0562; 1.0516; 1.0465

XAU/USD

Spot Gold consolidates above 1178, fresh low posted on descend from upside rejection at 1200. Near-term studies are weak, keeping the downside in focus for possible retest of pivotal 1170 support and short-term range floor. Break here is needed to signal fresh direction, as the price action remains entrenched in short-term range, with daily studies in neutral mode. On the upside, daily Tenkan-sen / 20SMA mark initial barrier at 1193, close above which is required to ease immediate downside pressure and re-focus next pivots at 1197, daily Kijun-sen and psychological 1200 barrier.

Res: 1193; 1197; 1200; 1207

Sup: 1181; 1178; 1170; 1163