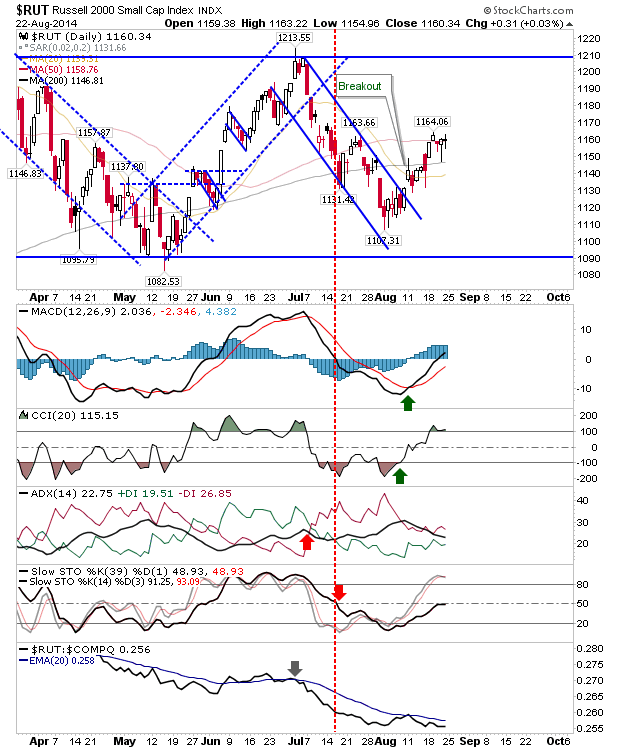

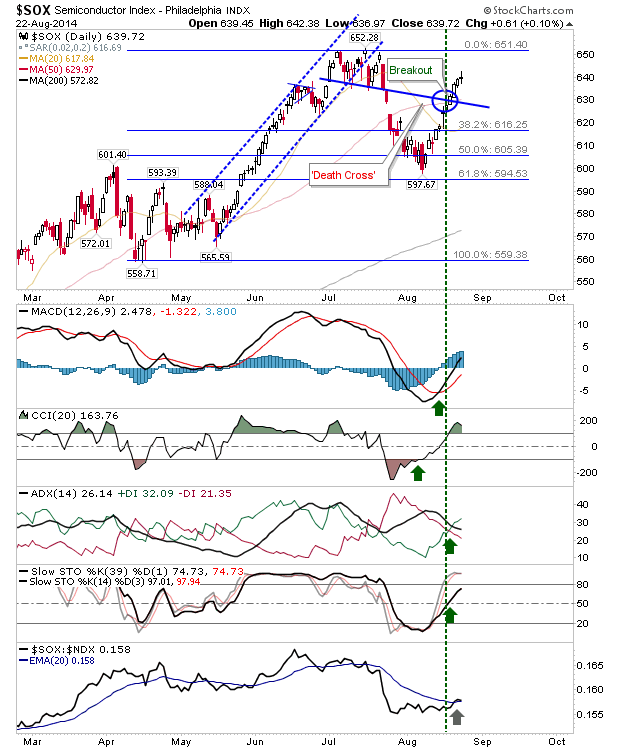

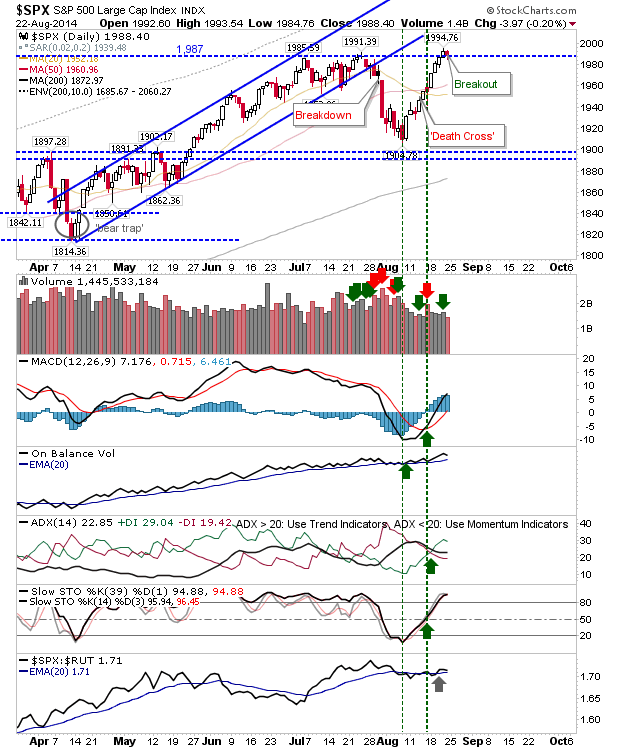

Friday's action marked a balance between bulls and bears. Tech and Small Cap indices finished with indecisive doji, marking a swing trade opportunity; buy/sell break of Friday's high/low with a stop on the flip side. The S&P 500 and Dow closed lower, but not enough to suggest bears finished the day in control.

The losses in the S&P weren't enough to trigger a 'bull trap', so the long-side play is still favoured. Selling volume was also down on Thursday's buying, another reason to suggest bulls have control. Technicals remain net bullish.

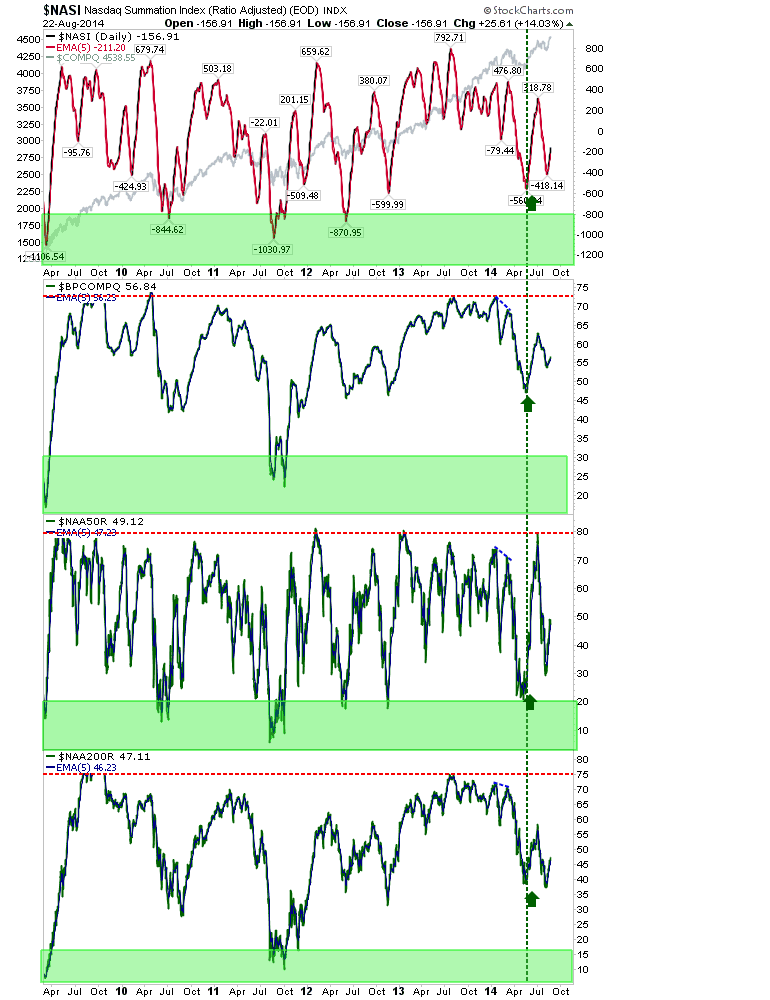

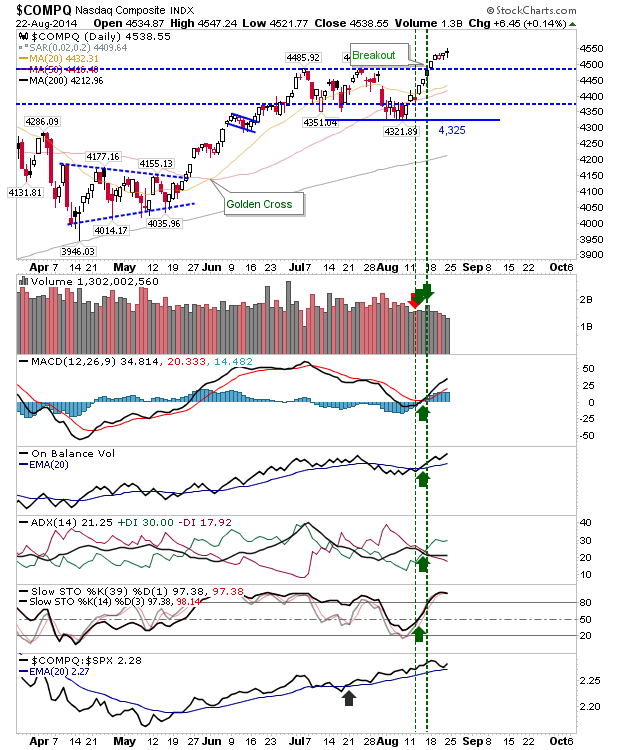

The NASDAQ did try and push above its tight 3-day range, but was unable to garner much in the way of bullish momentum. However, the broader trend is still bullish, with the August rally well established. A 'bull flag' or other consolidation would be welcome, but Friday's action doesn't necessarily suggest this will happen now.

The Russell 2000 is best positioned to gain. The last four days has shaped a small handle with buyer support at the 200-day MA. Given the July sell off, it remains best placed to challenge June's high. Longs can add with confidence on a close above 1,164 with a stop on a close below 200-day MA.