USD/CHF Daily Outlook

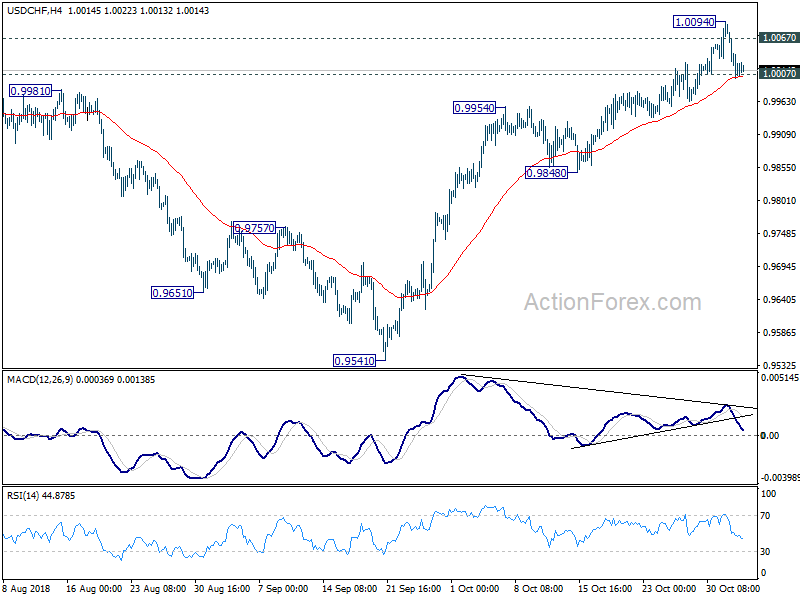

Daily Pivots: (S1) 0.9984; (P) 1.0038; (R1) 1.0076;

Intraday bias in USD/CHF remains neutral first. Considering bearish divergence condition in 4 hour MACD, break of 1.0007 minor support will suggests near term reversal. Intraday bias will be turned back to the downside for 0.9848/9954 support zone. On the upside, though, break of 1.0094 and sustained trading above 1.0067 will confirm resumption of larger rise from 0.9186 and should target 1.0342 key resistance next.

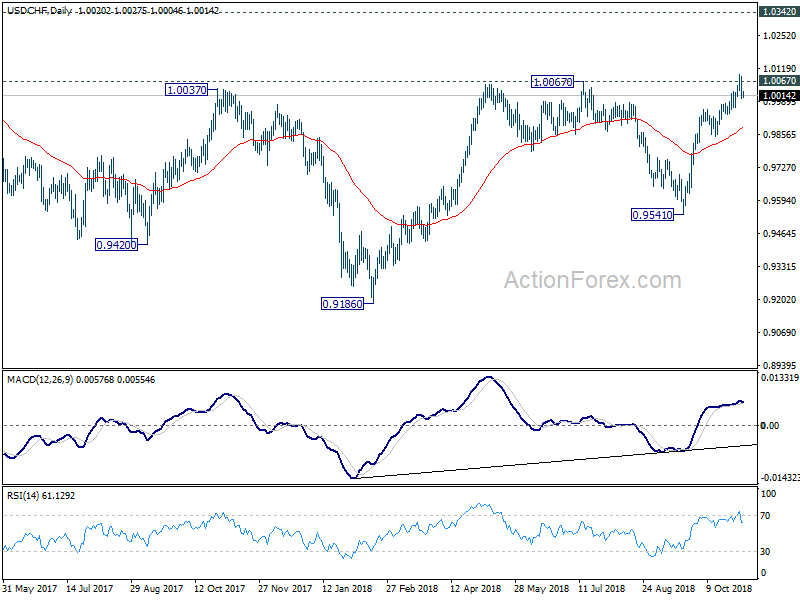

In the bigger picture, the pullback from 1.0067 has completed at 0.9541 already. And rise from 0.9186 is likely resuming. Firm break of 1.0067 will pave the way to retest 1.0342 key resistance. We’d be cautious on strong resistance from there to limit upside to bring another medium term fall to extend long term range trading.

EUR/USD Daily Outlook

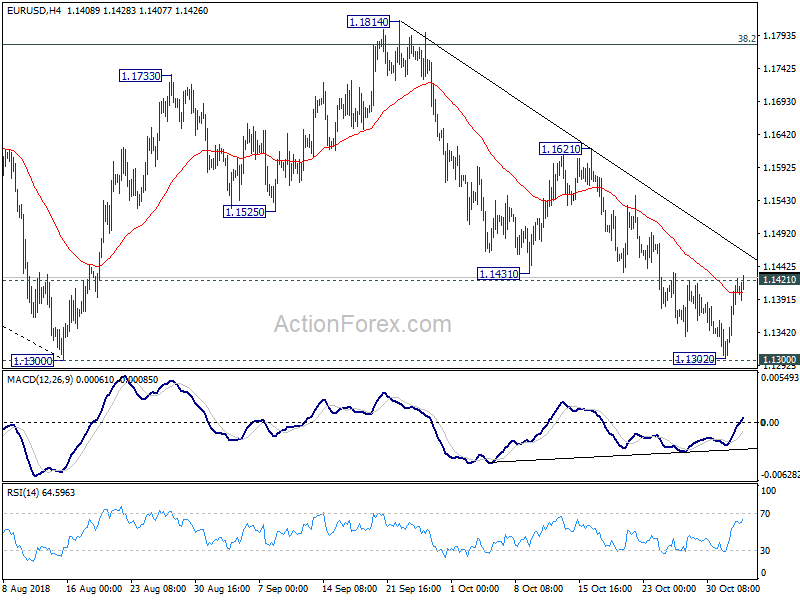

Daily Pivots: (S1) 1.1335; (P) 1.1379; (R1) 1.1455;

EUR/USD’s break of 1.1421 resistance argues that fall from 1.1814 has completed at 1.1302 already, ahead of 1.1300 key support, on bullish convergence condition in 4 hour MACD. Intraday bias is turned back to the upside for 1.1621 resistance and possibly above. For now, price actions from 1.1300 are seen as a consolidation pattern. Hence, upside should be limited by 1.1814 to bring down trend resumption eventually. On the downside, break of 1.300 will resume whole down trend from 1.2555 and target 1.1186 fibonacci level next.

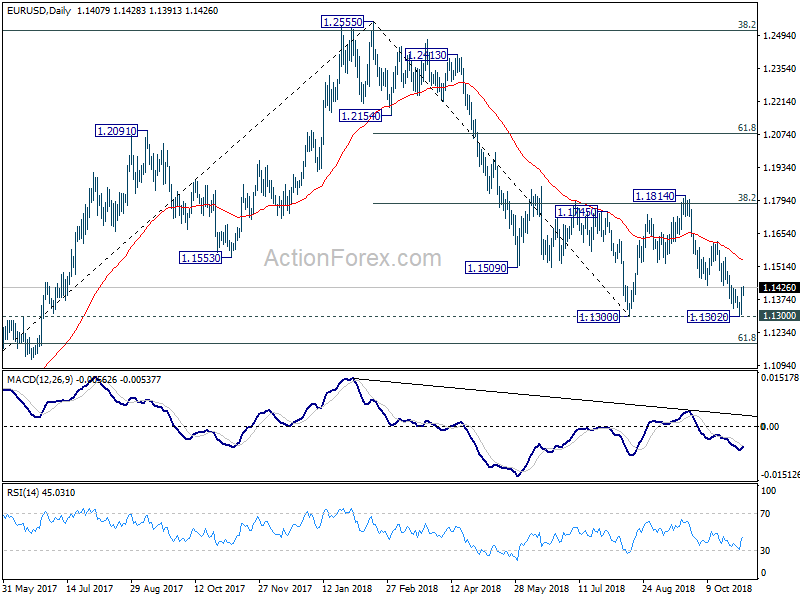

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.