We’ve been looking at massive H&S patterns in the last two reports I’ve posted so you can get a feel for the bigger picture which is so important to grasp. It’s always much easier to make money trading within the big trend. For instance if you’ve been trading the precious metals stocks over the last 3 years or so you have had a strong headwind blowing against your trades, making it very difficult to make a decent profit and then hold on to those profits.

If you’re a short term trader and can catch the little swings up and down you at least have a chance, but that too is very hard to do constantly. Knowing the direction of the big trend can bail an investor out if his timing is off. But, if you trade against the trend and your timing is off then you will pay dearly because the markets can be unforgiving.

As promised, today we’ll look at some massive H&S tops that are showing up on some of the major global currencies. When looking at some of the charts, keep in mind how they will affect the US dollar. These charts will have a direct impact on the long term direction for the US dollar regardless of why the dollar may crash and burn.

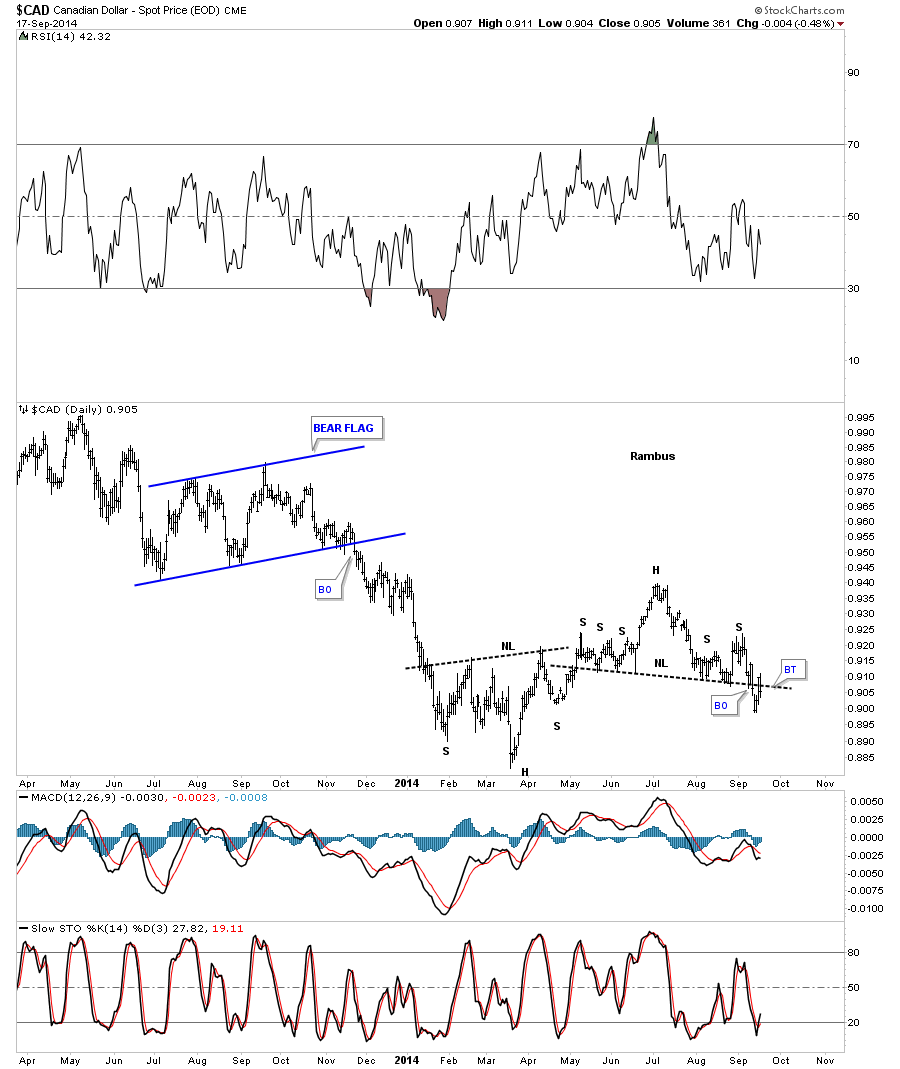

Let's start with the Canadian dollar which is showing a smaller H&S top on the daily chart.

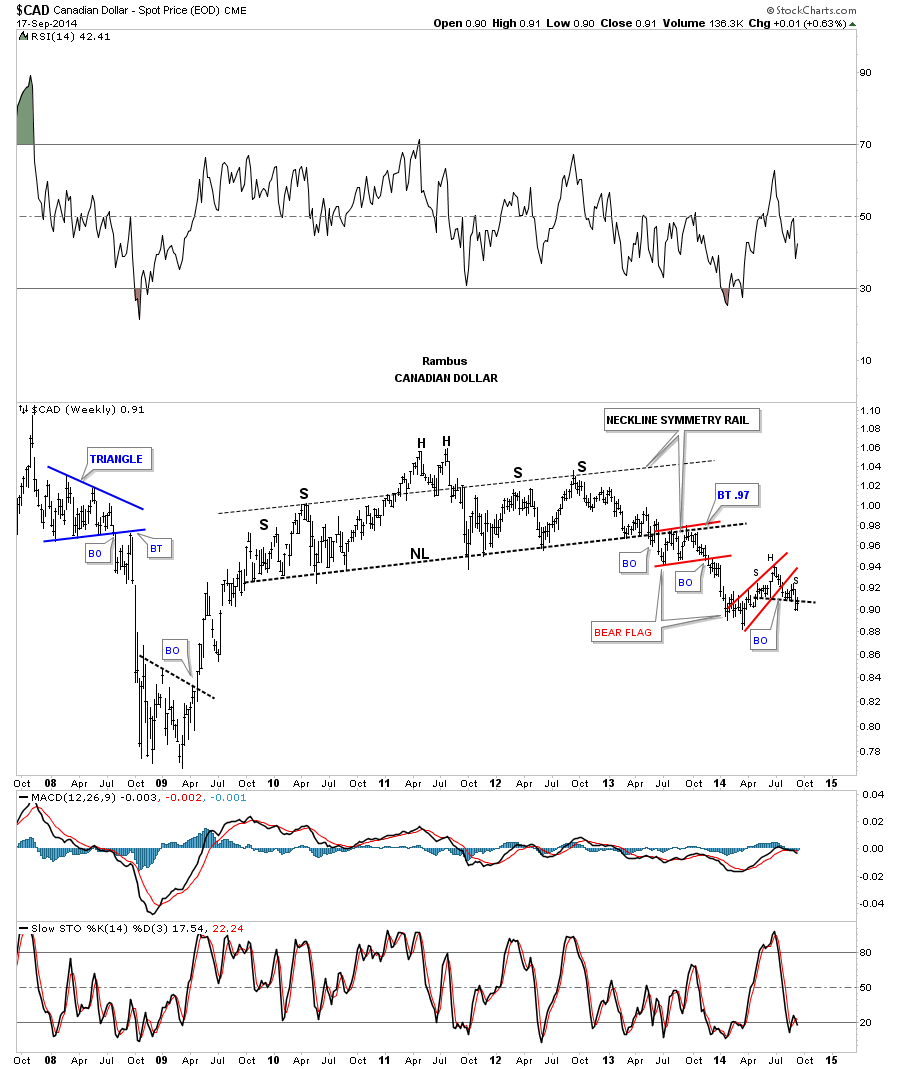

We’ve been following this long term weekly chart for the Canadian dollar since it broke below the massive H&S neckline in the middle of last year. The breakout took its sweet 'ole time forming a bear flag just below the neckline which was telling us the bearish setup was in place.

Since the breakout of that massive H&S top, the Canadian Dollar has formed its second red bear flag which broke out to the downside two months ago and is starting an impulse move lower. You can see the little H&S top that formed at the high of the lower red bear flag which I showed you on the chart above.

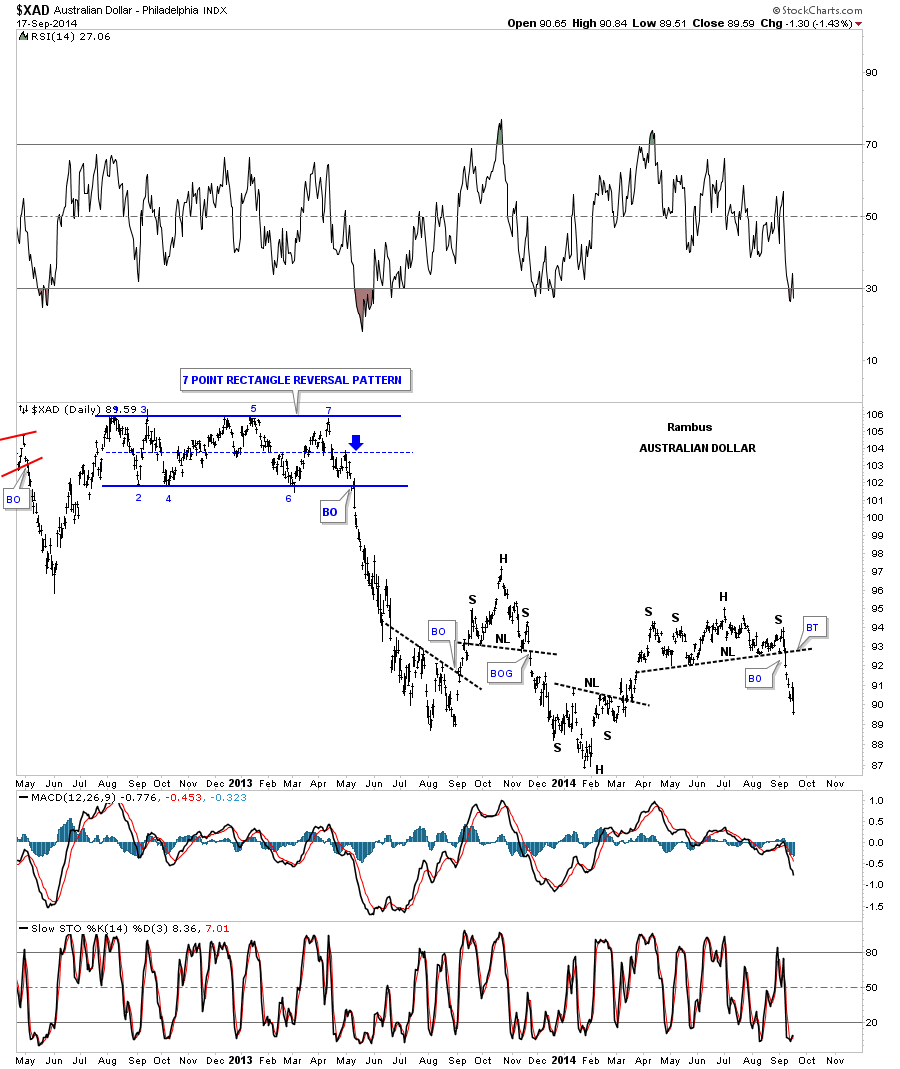

The Australian dollar looks an awful lot like the Canadian dollar on the daily and long term weekly charts. The daily chart shows XAD breaking down out of a H&S top last week.

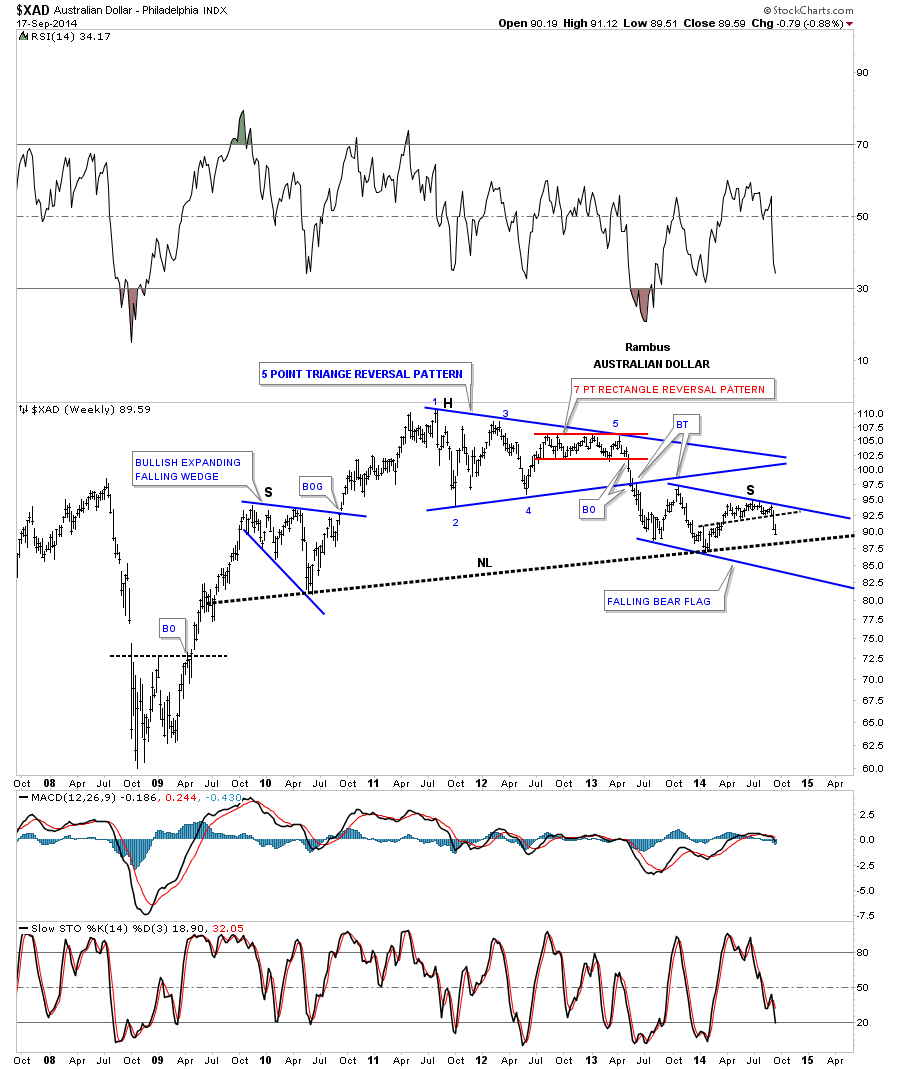

The long term weekly chart for XAD shows some really nice Chartology. The head portion was made up of the blue, five-point triangle reversal pattern that finished up with a seven point red rectangle. Remember, an odd number of reversal points equals a reversal pattern and an even number of reversal points equals a consolidation pattern.

The left shoulder was made up of the blue expanding falling wedge while the right shoulder is being made up of the blue falling flag. The neckline is still unbroken to the downside, yet but the price action is closing in on it. As I have mentioned before, these big patterns will take a long time to reverse the downtrend that is being put in place.

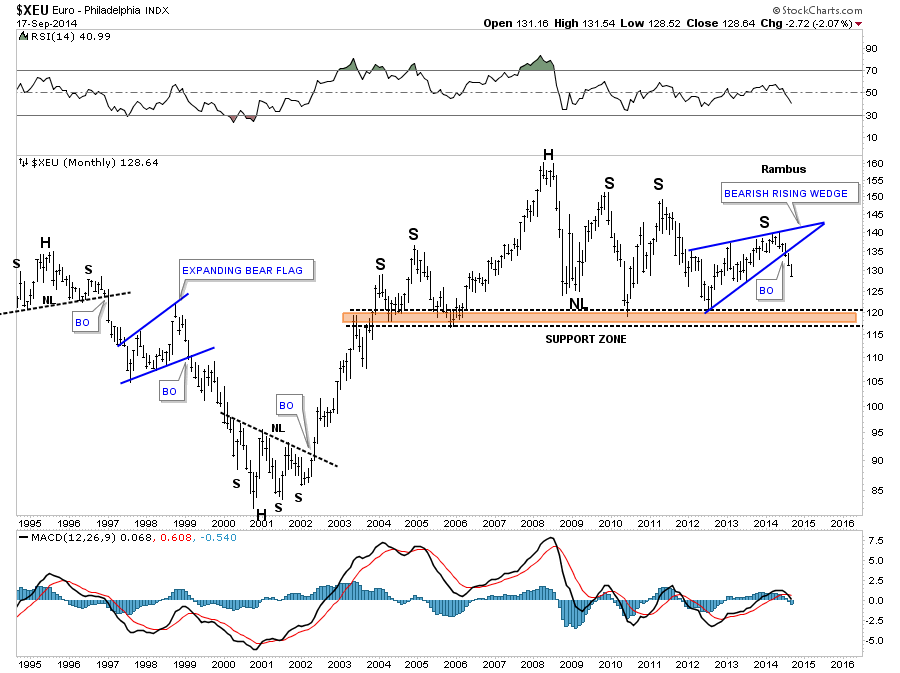

The long term monthly chart for the euro shows a massive H&S top forming. It’s not one of the prettiest H&S tops I’ve ever seen but all the pieces are in place, suggesting that at a minimum the breakout of the blue rising wedge, which is creating the right shoulder, should take the price down to the brown shade support and resistance zone. From that point we’ll have to see what develops.

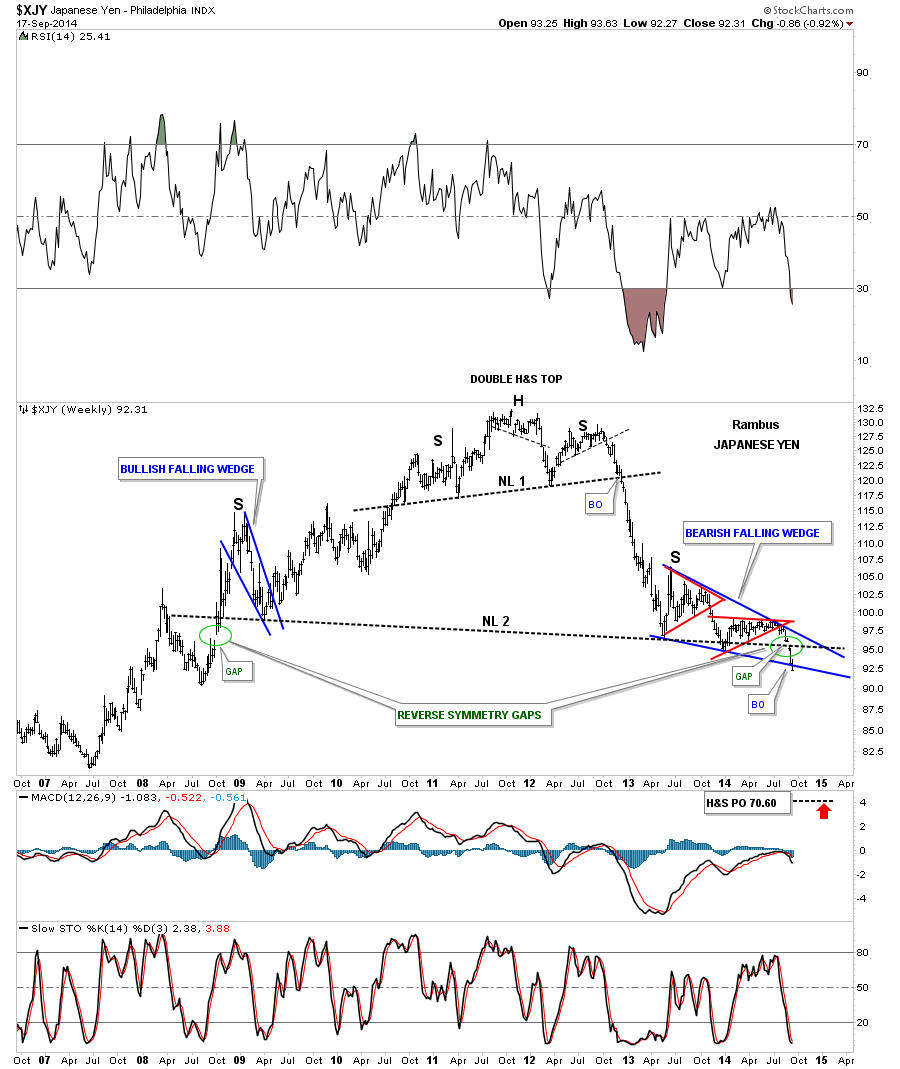

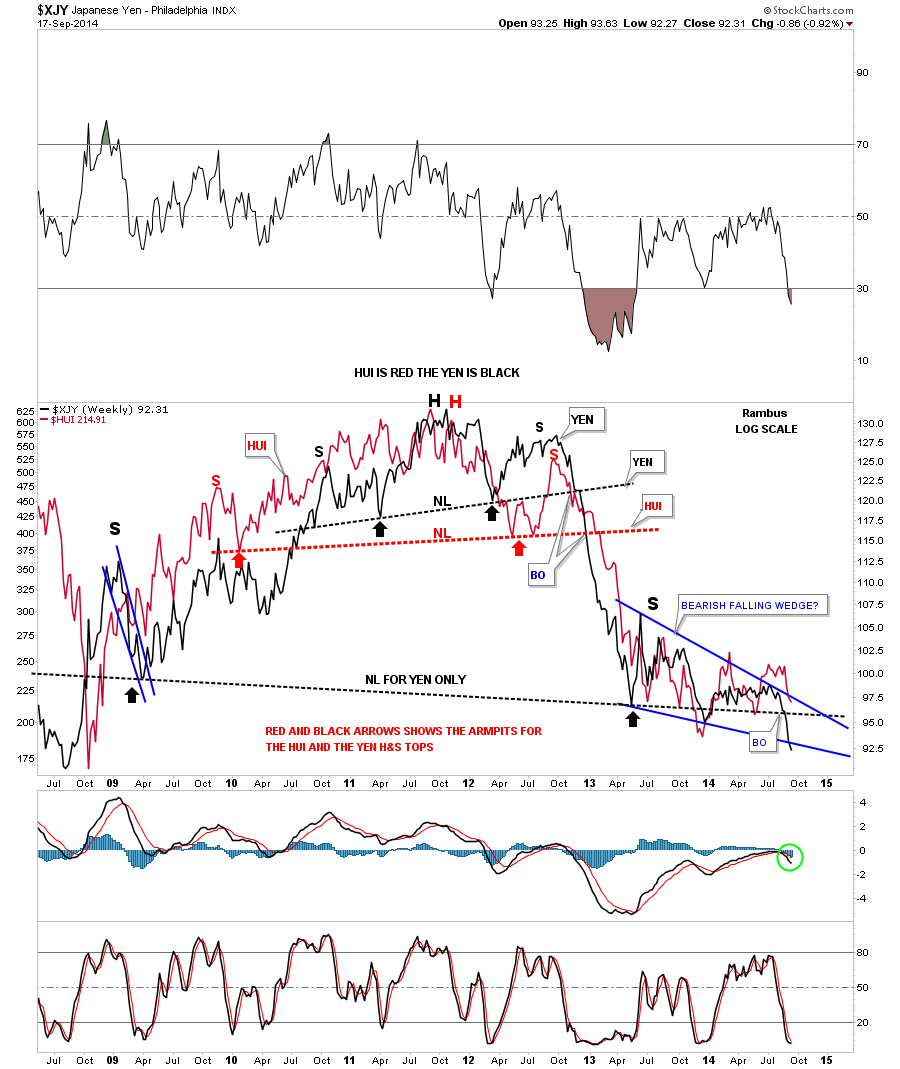

If you’re a goldbug, this next chart for the Japanese yen should make you stand up and take notice. There are a thousand fundamental reasons why gold should be going up, but the XJY is telling you the truth, which I’ll tell you in a minute.

I first posted this long term weekly chart for the yen when the much smaller H&S top, which is forming the head portion of the massive H&S top, broke out. Note the almost vertical decline once the energy was released to the downside.

The right shoulder is a nice piece of Chartology as it shows the two red triangles that are creating a much bigger, blue bearish falling wedge. Yesterday, the XJY broke below the bottom rail of the blue bearish falling wedge, signaling the impulse move is just beginning.

One last point on reverse symmetry: Note the green circle on the left hand side of the chart. It matches perfectly to the green circle on the right hand side of the chart that shows you the breakout of that massive H&S top neckline. It just doesn’t get an prettier.

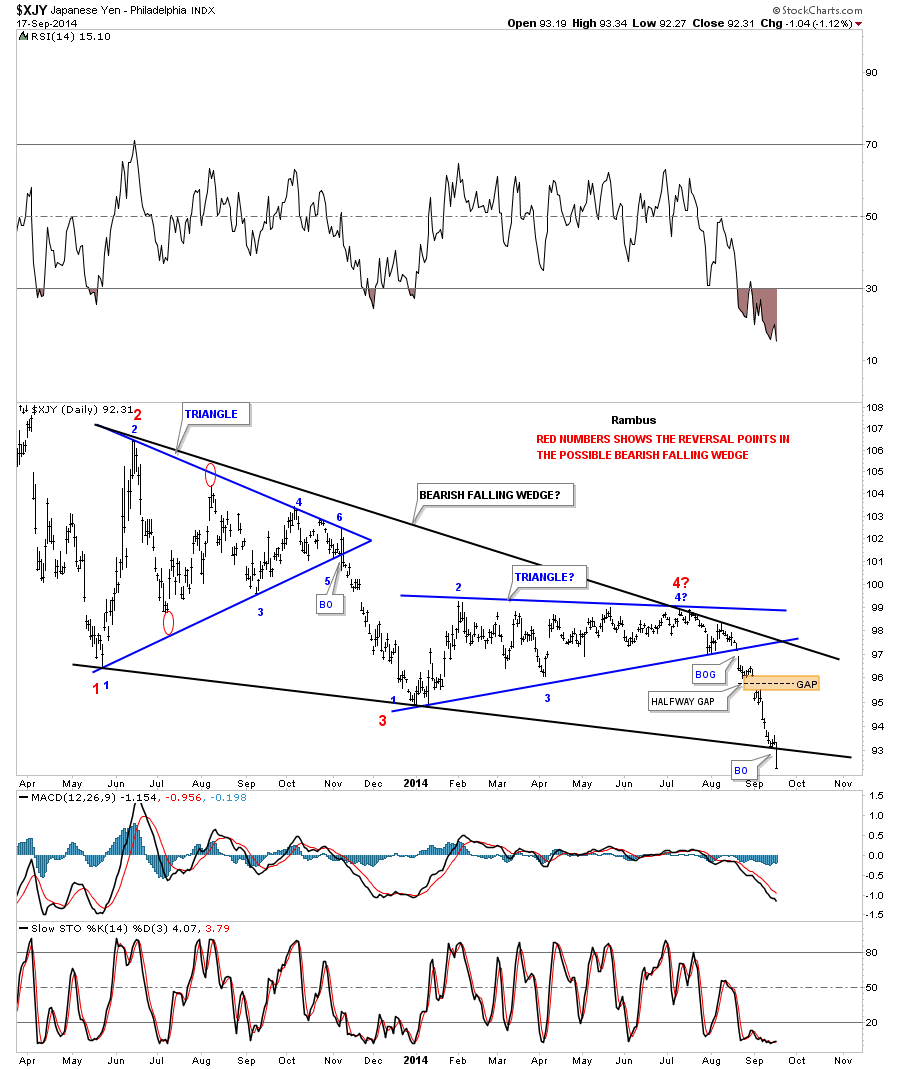

Below is a daily chart for the XJY that shows the bearish falling wedge in more detail, including yesterday’s break out.

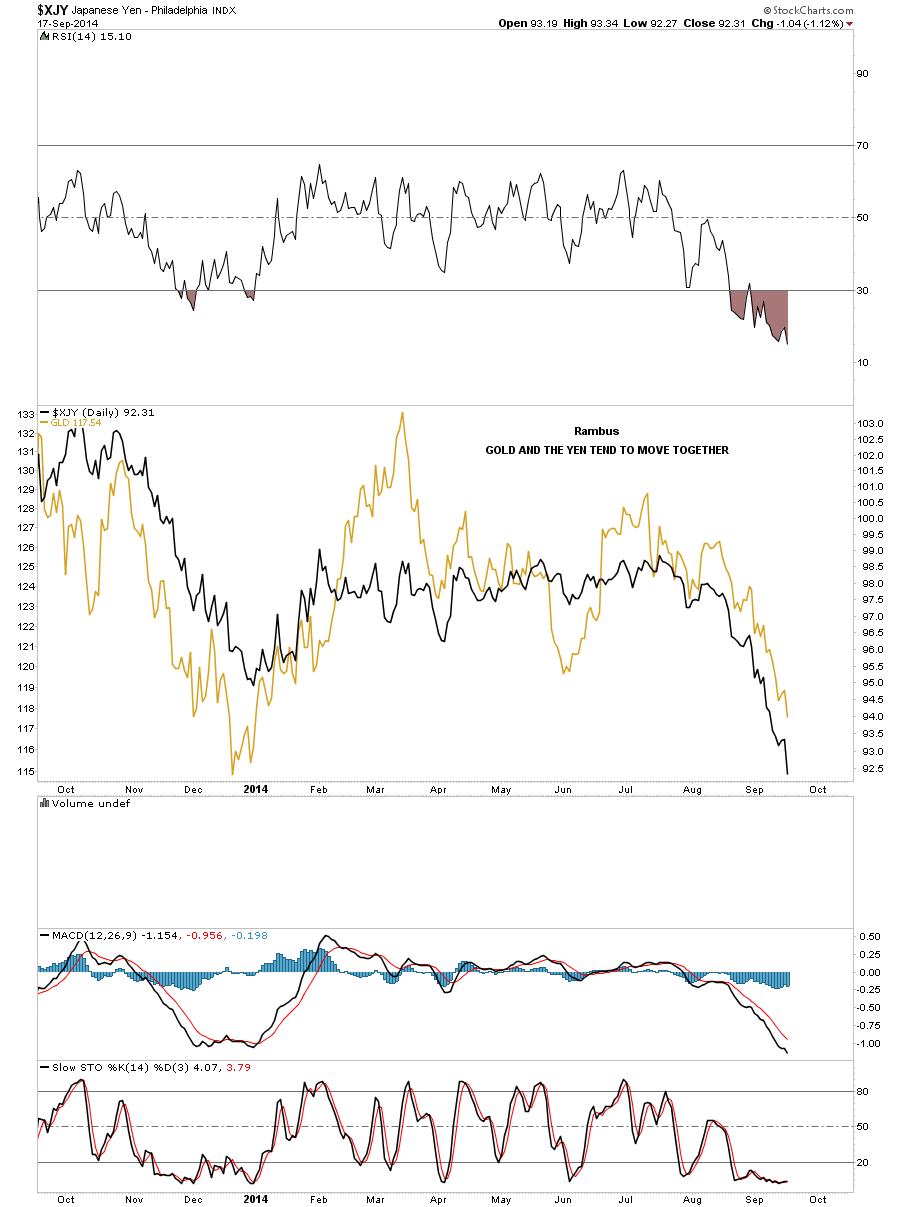

On this next daily chart for the yen, I’ve overlaid gold so you can see the near perfect correlation of the two. I’ll leave it up to the fundamentalists out there to come up with why this correlation is so strong. From a Chartology perspective I don’t need a reason. The point is simply that it is happening and that’s whats most important. Just follow the price action.

On this next chart I’ve overlaid the HUI on top of the XJY which shows a correlation similar to what gold has with the yen. You can see the massive H&S top that both the yen and the HUI made before they broke down below their respective necklines. The correlation is close enough that I wouldn’t want to bet against it.

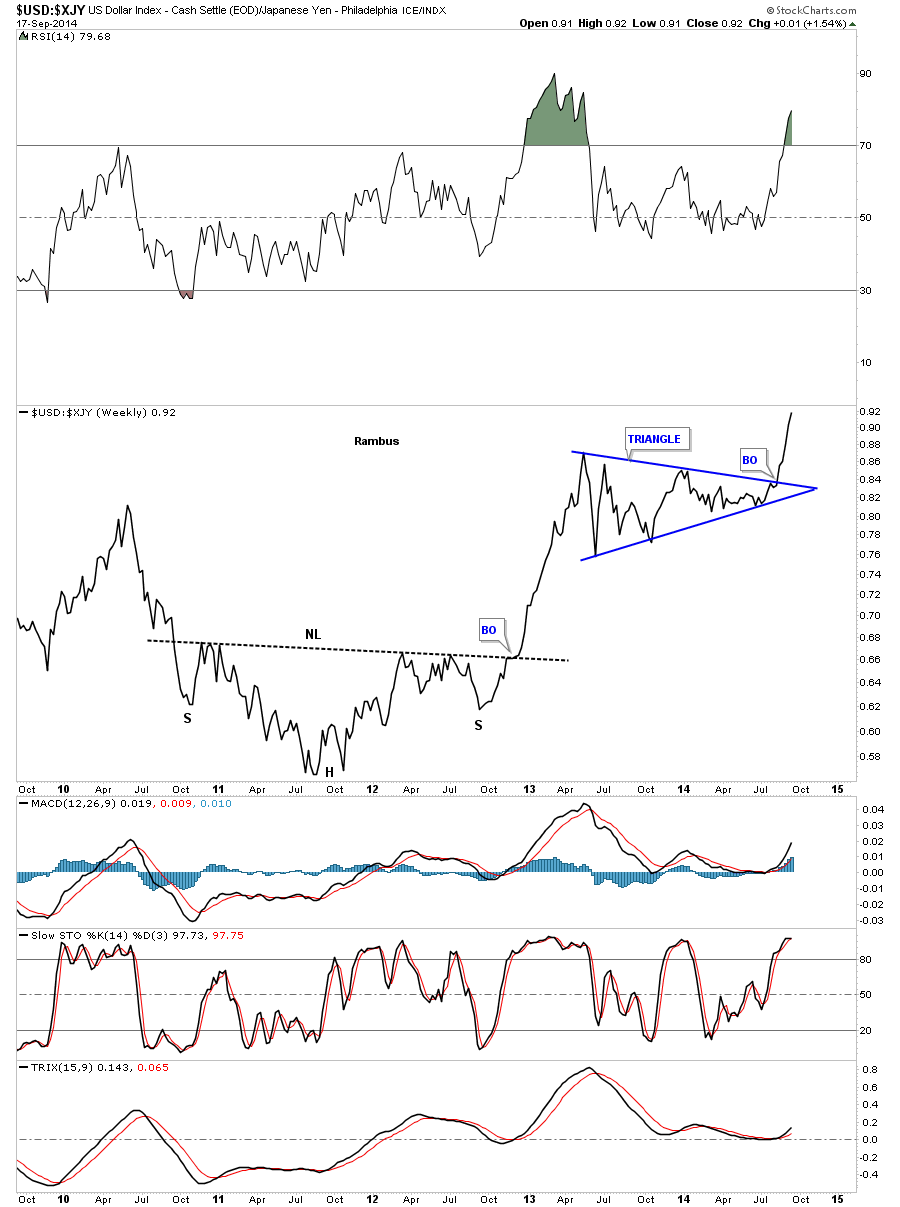

While we’re on the subject of the Japanese yen, I would like to show you a ratio chart that compares the US dollar to the yen. The chart below is a long term weekly look that shows a massive inverse H&S bottom with a near vertical move once the breakout occurred.

After a pause to refresh, blue triangle, this ratio chart is in another near-vertical move up, showing how much stronger the US dollar is compared to the yen. So we have gold and the HUI following the yen lower while the US dollar is going strongly in the opposite direction which isn’t a good sign for commodities or the precious metals complex.

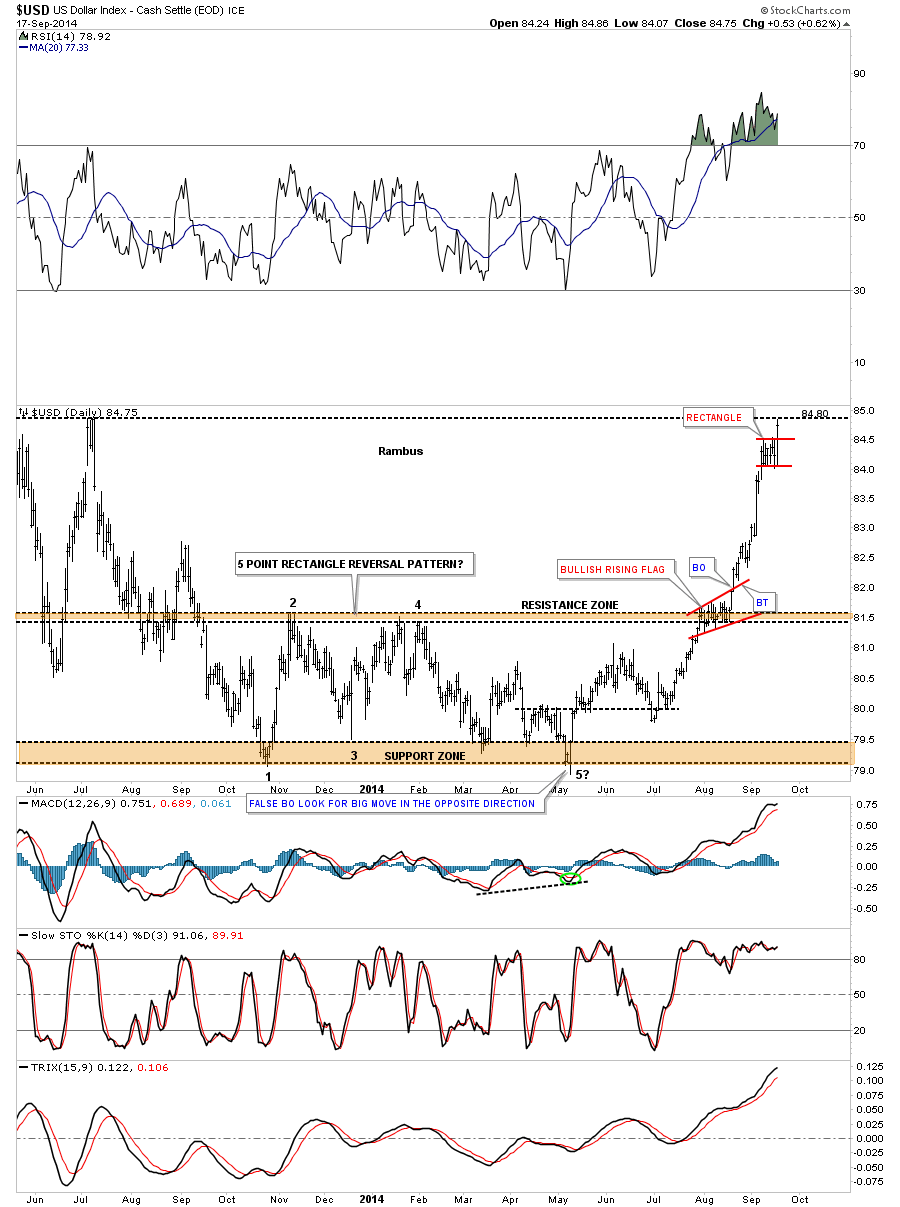

All the different currencies have a direct impact on the US dollar so let's see how the US dollar looks vs the different currencies. This first chart is a daily look which shows the beginning of the impulse move up for the the US dollar.

As you can see, the move started after the US dollar broke out of the five-point, rectangle reversal pattern and hasn’t looked back. There is no question that the US dollar is overbought and is trading back at its most recent highs.

In fast moving conditions such as where the US dollar finds itself right now, it can form a small flag-type consolidation, one after the other, until it’s time for a bigger correction. You can see the first little red consolidation pattern, the red bullish rising flag, which formed on the top rail of the five-point rectangle. Notice the vertical move out of that pattern which is called a flag pole.

Yesterday, the US dollar just broke out of a small rectangle which might very well be another halfway pattern to the upside with a vertical move to follow that is similar in nature to the one leading up into the red rectangle.

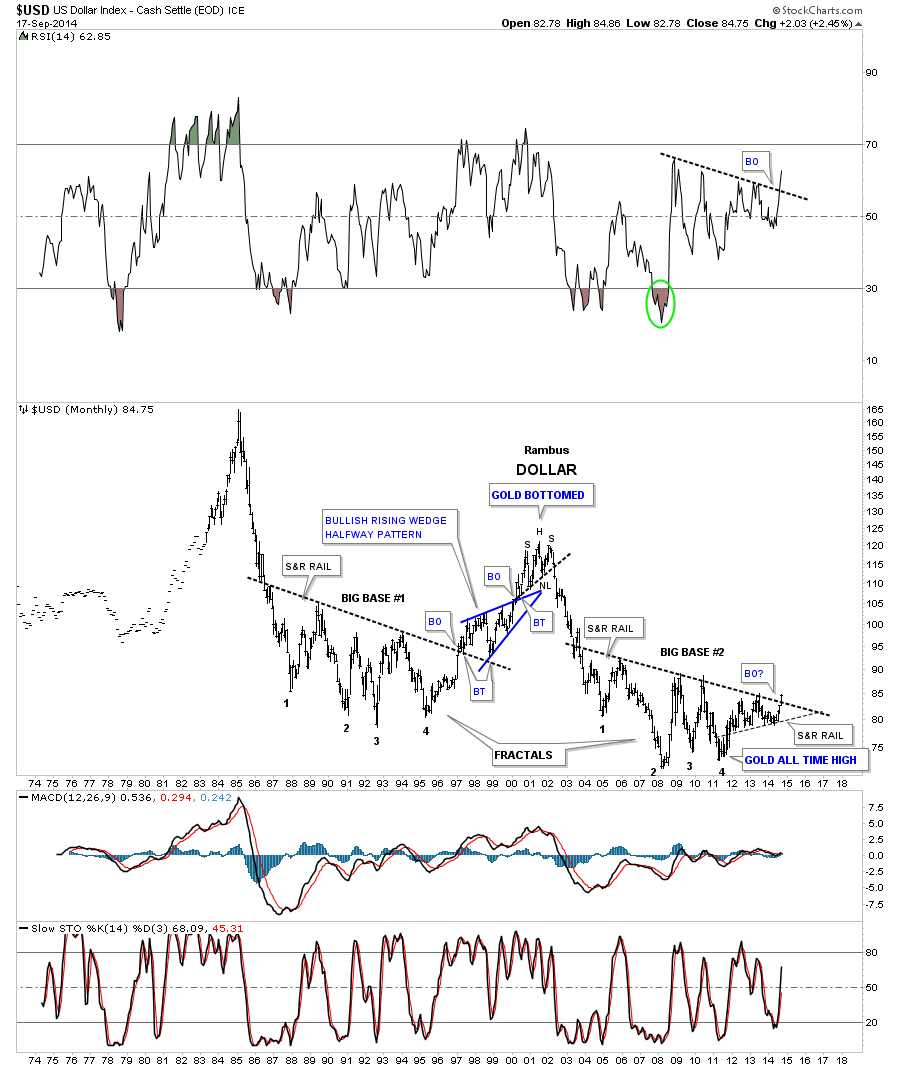

If many of the currencies I showed you on this post have massive H&S tops in place, it stands to reasons that the US dollar should also have a massive H&S base. Below is my epiphany chart which is when I first discovered the two fractals for the US dollar.

As you can see, at last, after a year and a half of waiting for big base #2 to breakout, it’s happening this month. I have to say it’s very rewarding to finally see something you've first saw a year and a half ago come to fruition. A lot of investors are wondering why the US dollar is so strong right now. The reason the US dollar is so strong right now is because it’s breaking out of that massive big base #2, it’s a breakout move.

I've believed for a very long time that the US dollar was going to take center stage at some point. With all the massive H&S tops in place on a lot of the most important currencies, this is telling me that things related to a strong US dollar are going to be under pressure for some time to come.

We’re not talking about a few days or weeks, or even months, but most likely years before those massive distribution patterns play themselves out. It’s just my interpretation of the Chartology that is leading me to this conclusion.

The fundamentals will show their hand further down the road, but it will be too late to take full advantage of what lies before us right now. The big picture is painted in full color for everyone to see if they choose to actually look. From the purely Chartology perspective, I like what I see.