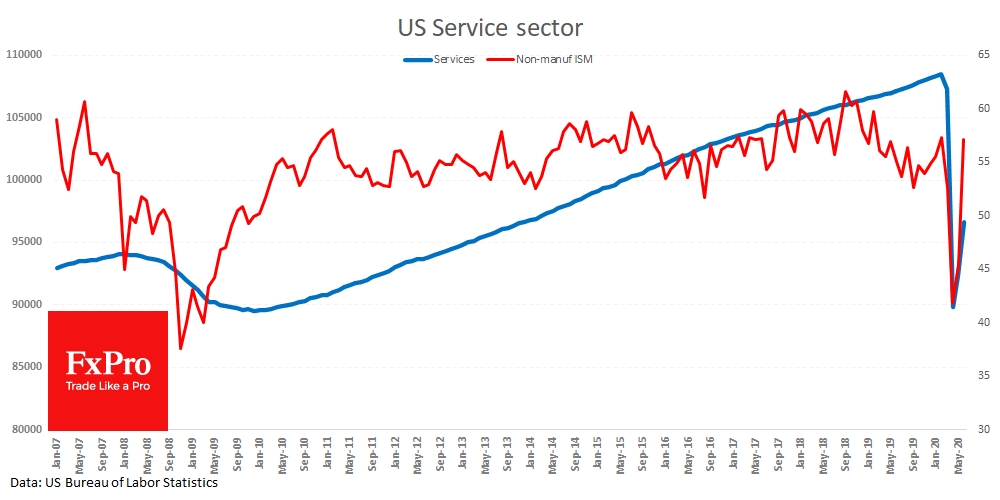

Economic indicators one after another are exceeding expectations, fuelling market growth after a series of strong macro reports from the United States on Monday. The ISM Non-Manufacturing Index rose to 57.1 in June, which is much stronger than the expected level of 50.0. A value significantly above 50 reflects higher business activity compared to the previous month, demonstrating the beginning of a recovery.

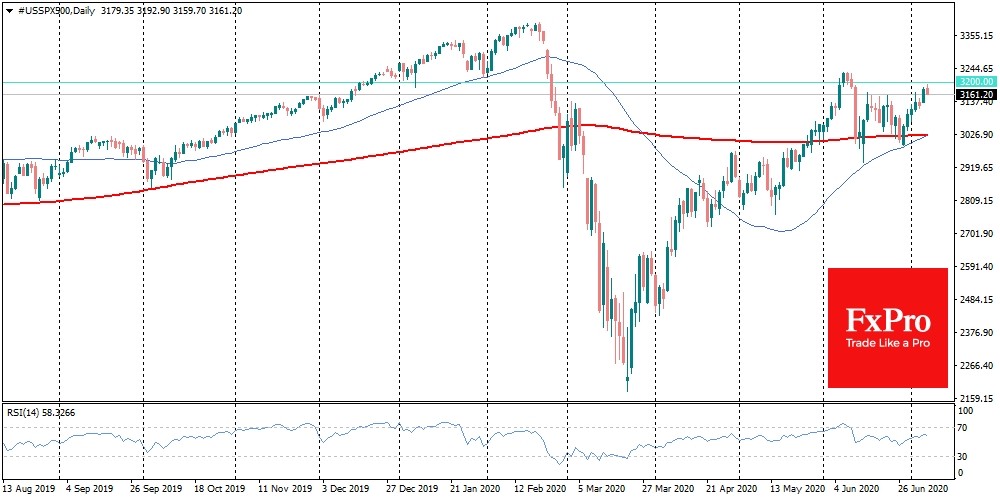

Against this backdrop, S&P 500 added 1.6% and Dow Jones added 1.8%. Chinese markets picked up the baton on Tuesday morning, another 1.8% to the 6.7% spike on China A50 yesterday.

The currency market dynamic also reflects the positive mood of traders, although it is important to note that they act with much more caution. EUR/USD trades close to 1.13000 in the morning, having added 0.6% yesterday. The dollar's decline is slightly more restrained against other major currencies, which often occurs in periods of strengthening investor sentiment against risk assets.

However, you should not dismiss the warning signs. Bear in mind that PMI indices reflect the relative dynamics of industries, so it is worth paying attention to employment data. The U.S. service sector still creates jobs (+4.63 mln in June), but this is 11% less than in February. This suggests that the initial V-shaped rebound may be followed by a long period of steep and uneven economic recovery, as the number of unemployed has jumped by more than 10%, affecting consumer sentiment.

Caution can also be heard among central bankers with the most recent example today from RBA. The Australian central bank noted an improvement in financial conditions but said it is ready to increase incentives for the economy further. This cautiousness caused market participants to slow down, and AUD/USD once again failed to overcome the 0.700 level. Also, the USD/CNH pair failed to take 7.0, which is also a sign of a fragile rally.

In such conditions, one should not be surprised by sudden index drops, similar to the one that occurred about a month ago, when the S&P500 lost more than 5.5% in one day, after an unsuccessful attempt to gain a foothold above 3200. This morning, another effort to get higher came across a fierce resistance of the bears.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Currency Market Calls On Caution

Published 07/07/2020, 05:07 AM

Updated 03/21/2024, 07:45 AM

Currency Market Calls On Caution

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.