Talking Points

- Iraq conflict stirs Crude Oil volatility

- Gold to resume gains on USD weakness

- Platinum vulnerable to strike deal

Crude oil may be in store for further volatility as ongoing unrest in the Middle East keeps traders on edge. Meanwhile, gold could resume its upward trajectory on a weaker greenback, if the reserve currency continues its slump alongside anemic levels of volatility. Also in the precious metals space; platinum and palladium may be vulnerable as newswires report a resolution to the South African mining workers strike is near.

Iraqi Conflict Stirs Crude Oil Volatility

WTI and Brent Oil both reversed earlier gains in yesterday’s trading session as investors weighed the prospect of supply disruptions stemming from turmoil in Iraq. Newswires have reported that fighting between the Iraqi army and militant insurgents continues, yet has not extended to the country’s south, which accounts for the bulk of crude oil production.

As noted in recent commodities reports, an escalation of the conflict could raise fears over a crimp to the commodity’s production in Iraq, which accounts for 11 percent of OPEC supply, and in turn could offer a source of short-term support to crude. However, if the attacks remain contained to the north, the impact on oil supplies would likely be limited, leaving traders to quickly unwind fear-driven positioning and putting pressure on WTI. Both scenarios offer the potential for a spike in volatility for the commodity. Indeed, the 20 day Average True Range for WTI hit its highest level in more than a month yesterday.

US Dollar Slump Leaves Gold Room To Recover

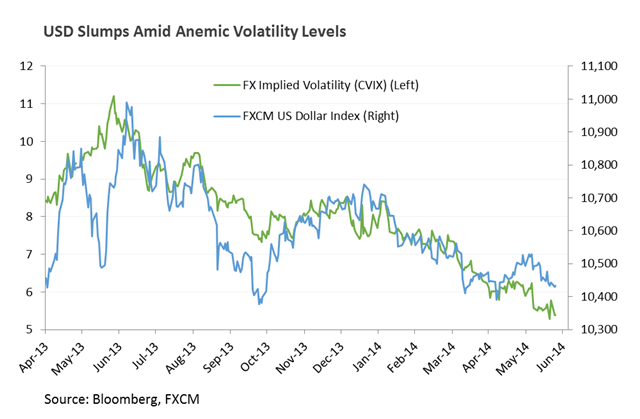

The US Dollar Index extended recent losses in yesterday’s session, despite positive US data and a slight lift in 10 year yields. This creates some doubt over how much potential is offered by upcoming Consumer Confidence data to inspire a recovery for the greenback. While the gauge of consumer sentiment is tipped to rise to 83.5 (versus a prior reading of 83.0) it would likely take a significant upside surprise to revive the reserve currency. A lackluster response from the US Dollar could afford gold a push higher.

The US Dollar’s woes may be partly explained by a dovish posturing by Fed officials alongside a persistent slump in implied volatility for major currencies. While both of the these forces continue to put pressure on the greenback, gold and silver may be given further room to recover.

Platinum and Palladium Vulnerable On Strike Deal

An agreement to end the five-month long South African mining workers strike is set to be signed by union representatives and the country’s largest miners today. The deal would see the 70,000 striking miners return to work in the country’s platinum mining belt as soon as Wednesday according to newswires. The latest developments may alleviate fears over further supply disruptions to South African platinum production, which accounts for approximately 70 percent of global supply, and could in turn leave the precious metal exposed to a pullback. Speculation over a deal has likely been a factor behind a plunge in the price of palladium (which is mined together with platinum), the metal has dropped by 4.21 percent after hitting a high of $861 per ounce earlier in the month.

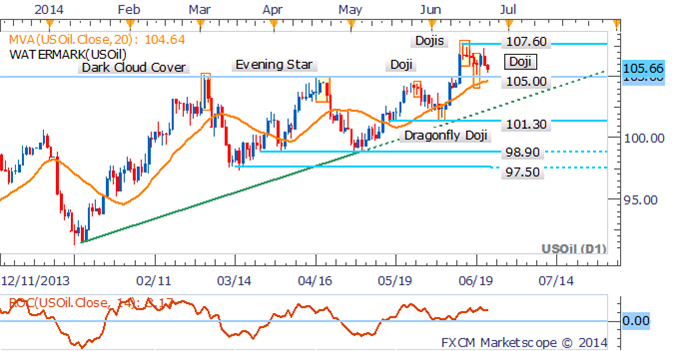

CRUDE OIL TECHNICAL ANALYSIS

Crude oil’s retreat to support at 105.00 offers a new opportunity for longs, given the uptrend for the commodity remains intact. A target is offered by the 2014 high near 107.60, while a daily close below 105.00 would invalidate a bullish bias.

Crude Oil: Pullback Offers New Long Entry Opportunities

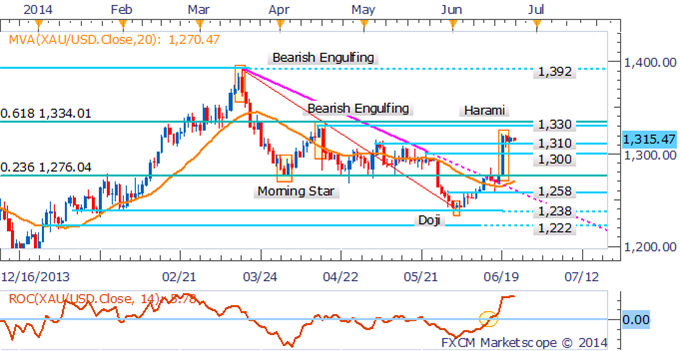

GOLD TECHNICAL ANALYSIS

Gold may be primed for a push higher given signs of an uptrend have emerged on the daily chart. A break above several resistance levels and spike in volatility also suggests the potential for further gains. The slight pullback to support at 1,310 is seen as an opportunity for new long entries, with a target offered by the April high near 1,330.

The DailyFX Speculative Sentiment Index suggests a bullish bias for gold based on trader positioning.

Gold: Breakout Affords Bullish Bias

SILVER TECHNICAL ANALYSIS

Silver’s ascent has stalled at the 61.8% Fib Retracement Level with a Doji pattern suggesting signs of hesitation amongst traders. While this could prompt a slight retreat to support at 20.40, with the uptrend intact a correction would be seen as an opportunity to enter new long positions. A more convincing daily close above 20.80 could open up a run on 21.66.

Silver: Sellers Emerge At Key Fib Level

COPPER TECHNICAL ANALYSIS

The trend appears to have shifted for Copper following a push above a key resistance level at 3.10. However, skepticism over further gains may be warranted given the base metal has not seen this many consecutive up-days since December 2013, which were shortly followed by a slight retreat. Sellers will likely look to keep the base metal contained below the 3.19 mark.

Copper: Consecutive Bars Pushes Extremes

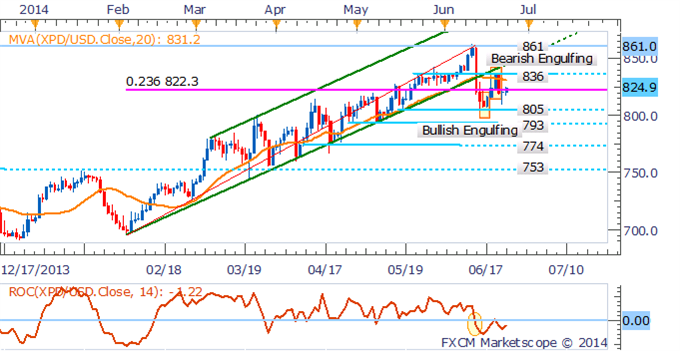

PALLADIUM TECHNICAL ANALYSIS

Palladium may be primed to push lower after the precious metal failed to breach resistance at 836, resulting in a Bearish Engulfing candlestick pattern. Further falls are likely to find support at 805.

Palladium: Reversal Pattern Suggests Further Falls Ahead

PLATINUM TECHNICAL ANALYSIS

Platinum’s consolidation continues following the bounce off its range-bottom at 1,424. While a Hammer candlestick hinted at a push towards 1,489, the emergence of a Dark Cloud Cover pattern suggests the bears may look to lead a retreat back to 1,424.

Platinum: Bears Return Following Dark Cloud Cover Pattern