Talking Points

- Crude Oil Stabilizes Ahead of Volatility-Inspiring Economic Data Next Week

- Gold and Silver Remain Vulnerable As Traders Look Past Geopolitical Tensions

- Bearish Technical Signals Emerge For Silver Following 2.5 Percent Plunge

Crude oil has regained its footing in Asian trading today and may be set to consolidate ahead of a string of key US data prints next week. Meanwhile, gold remains in a vulnerable position as ebbing concerns over Ukrainian tensions sap safe-haven demand for the precious metals. Finally Natural Gas is at a crossroads after the latest storage figures threaten to tip the scales in the bulls favor.

Crude Traders Awaiting Stream Of Top-Tier US Data

After plunging by more than 1 percent on Thursday crude traders may be hesitant to push the commodity lower ahead of potentially volatility-inspiring US economic data next week. Leading the procession of top-tier economic releases will be the second quarter GDP print for the world’s largest economy. The eagerly-awaited release is tipped to reveal a rebound to 2.9 percent, which would mark a robust recovery from a winter-chilled Q1 print. A healthy growth story in the world’s largest consumer of the crude is essential for drawing in the WTI bulls, and hence a strong reading next week could offer a source of support to the commodity.

Gold Left Vulnerable As Traders Look Past Geopolitical Tensions

The premium priced into gold based on fears of escalating regional conflicts may have further to unwind, leaving the precious metal in a precarious position. Its sibling silver is also at risk of a continued correction following yesterday’s sell-off which saw it plunge by more than 2.5 percent – its single largest daily decline since February. However with significant event risk on the US Dollar side of the equation next week, there may be some hesitation amongst the gold and silver bears to strike again leading into the weekend.

Turning Point For Natural Gas Or Corrective Bounce?

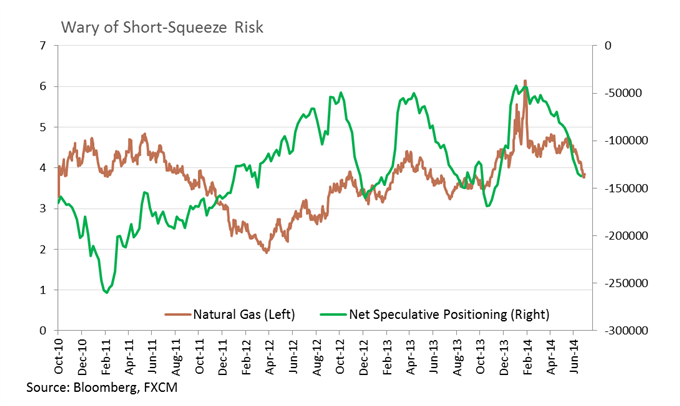

A higher-than-anticipated build in storage figures from the EIA on Thursday led a dramatic rebound for natural gas (2.26 percent for the session). Given the magnitude of the declines over the past month the commodity was likely left overly-sensitive to an upside surprise. However, it remains to be seen whether natural gas prices have turned a corner.

Although supplies have been building at a rate higher than the seasonal average, total stocks remain well-below prior year’s readings. If incoming supply figures continue their robust pace traders may look to renew selling pressure on the commodity. Positioning amongst speculative traders shown below suggests a short-squeeze may be an eventual risk.

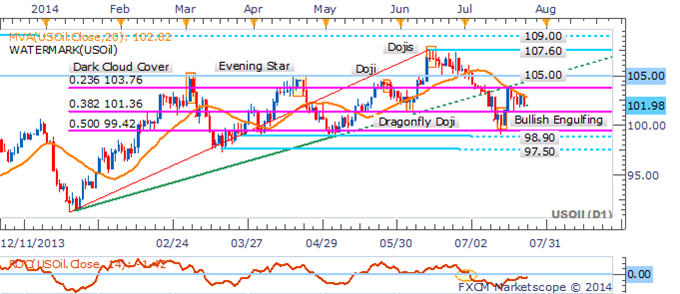

CRUDE OIL TECHNICAL ANALYSIS

Crude’s bounce back to noteworthy resistance at 103.76 offered a fresh opportunity to look at shorts. The failure to breach the 23.6% Fib Level alongside an intact downtrend suggests further weakness ahead. However, given the close proximity to nearby support at 101.36 new positions may be best served on a downside break, which would put the spotlight on 98.90.

Crude Oil: Awaiting Downside Break With Bearish Signals Intact

GOLD TECHNICAL ANALYSIS

The emergence of a short-term downtrend for gold casts the immediate risk to the downside with a break of 1,292 (50% Fib) to open 1,280. An absence of candlestick reversal signals casts doubt on a potential recovery at this point.

The DailyFX SpeculativeSentimentIndex suggests a bearish bias for gold based on trader positioning.

Gold: Risk Shifts Lower Following Break Of Fib Levels

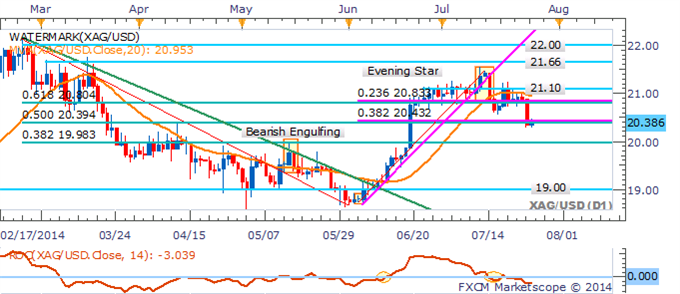

SILVER TECHNICAL ANALYSIS

Silver has regained its footing at the 20.43 mark (38.2% Fib Level) after crashing through former support-turned resistance at 20.83. The risk remains for a turn lower given a downtrend has emerged for the precious metal (signaled by the 20 SMA). Buyers are likely to emerge near the psychologically-significant 20.00 handle.

Silver: At Risk Of Further Falls, $20.00 Handle In Focus

Copper TECHNICAL ANALYSIS

Copper’s break above the 3.23 mark shifts the short-term technical outlook for the commodity to the upside, putting the focus on the recent highs near 3.29. The rate of change indicator looks to be shifting into positive territory, alongside a push above the 20 SMA. Taken together the re-emergence of an uptrend appears to be on the cards.

Copper: Threatens Shift In The Short-Term Trend

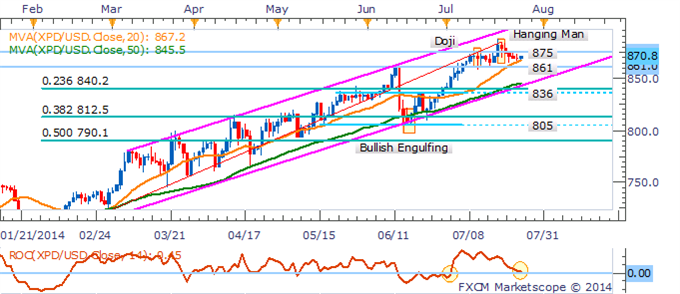

Palladium TECHNICAL ANALYSIS

Playing palladium’s uptrend remains preferred with the prospect of a run on the psychologically-significant 900 handle over the near-term still looking likely. A retest of 861 or push back above former support-turned-resistance at 875 would offer a fresh buying opportunity. However, a Hanging Man formation and decline for the ROC indicator offer warnings signs of a correction, which will be closely monitored.

Palladium: Looking For Longs With Uptrend Intact

Platinum TECHNICAL ANALYSIS

While platinum has maintained a slight upward trajectory over recent months, more recent price action has been relatively rough, which leaves a mixed technical bias for the commodity. The push below 1,470 may see a test of the ascending trend channel.

Platinum: Reversal Signals Absent With Trend Channel Bottom In Focus