As much as I’d love to pretend things are just hunky-dory, they’re not. This market has (for me, at least) really been a nightmare lately. The big picture bear tops aren’t broken (yet!) but after last Thursday, the bulls have been gaining power and momentum.

Looking at the Dow Jones Composite, the descending channel is still completely intact, and all the up and down action over the past couple of months may ultimately turn out to be nothing more than just another pattern-within-a-pattern in the context of a generally descending market.

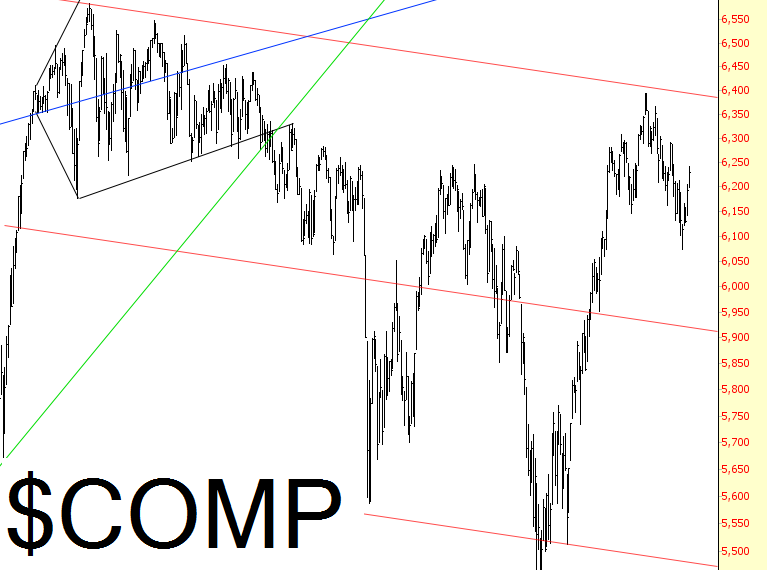

The NASDAQ Composite is a more horizontal configuration, and we’re approaching a gap (indicated by the red horizontal lower line).

If we look close at a more specific Dow index – – the 30 industrials – – we can see that the series of lower highs is intact, but barely (yellow tints). In just a few trading days, we’ve rocketed about 600 points off the Thursday lows.

The Russell 2000 is a more complex pattern, and its own lower horizontal line is likewise an important area of resistance. I’ve got to say, I’ve been surprised at the strength of the market overall (and energy stocks/financial stocks in particular), so these “important” levels of resistance are being swept aside.

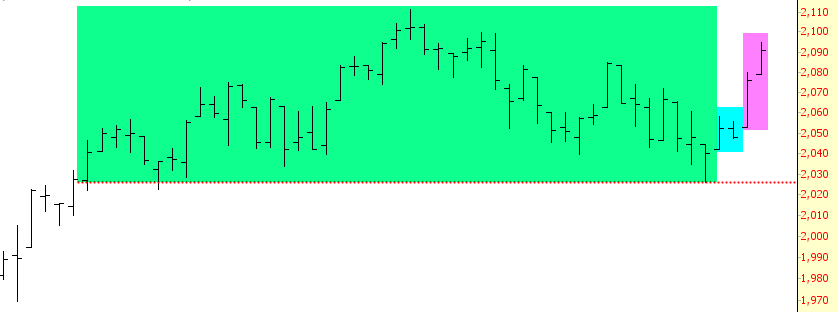

If I can chart my disappointment in a single graph, it would be the S&P 500, shown below. The green tinted area was the picture perfect topping pattern. Last Thursday, it started breaking down, and the birds were singing and the lion was lying with the lamb.

Then……….things started going wrong (cyan tint), although it wasn’t a house-wrecker yet. Then Tuesday and Wednesday loaded a paper bag full of dog crap, lit it on fire, dropped it on my porch, and rang the doorbell. My portfolio looks a lot like the bottoms of my shoes right now.

So I’ve gone from a perfect portfolio (73 shorts on Thursday, 100% of which were profitable) to a far lighter portfolio of 54 shorts with, ummm, not 100% profitability. I’ll continue to retreat with my embattled troops if the market keeps ascending. At this point, I’m just taking it one day at a time. Hardly a pithy way to close this post, but………honest.