Following the OPEC led gains in the oil markets which saw the commodity linked currencies gaining ground, price action yesterday saw the currencies give up most of the gains as the US dollar edged higher on the day.

The Australian dollar was the weakest, closing the day 0.73% lower. US final GDP for the second quarter was revised higher than expected. Today's economic calendar will see the UK final GDP revision while in the US session, personal spending and PCE data will be released.

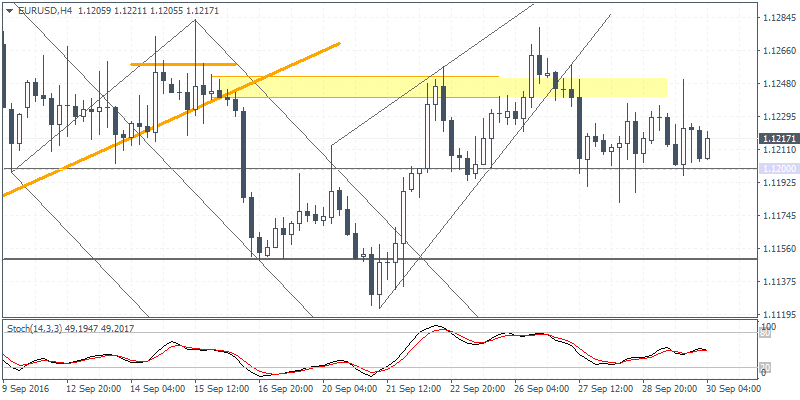

EUR/USD Daily Analysis

EUR/USD (1.1217) continues to post a strong consolidation with prices support above 1.1200 level and 1.1250 resistance. Following the breakout from the rising wedge pattern, EUR/USD has stalled, but this sideways range could soon give way to strong gains or declines depending on the support or resistance level that will give way. To the downside, support at 1.1100 could be challenged, while a breakout above 1.1250 resistance could see EUR/USD retest 1.1300 yet again. Overall, price action in EUR/USD remains flat for the moment.

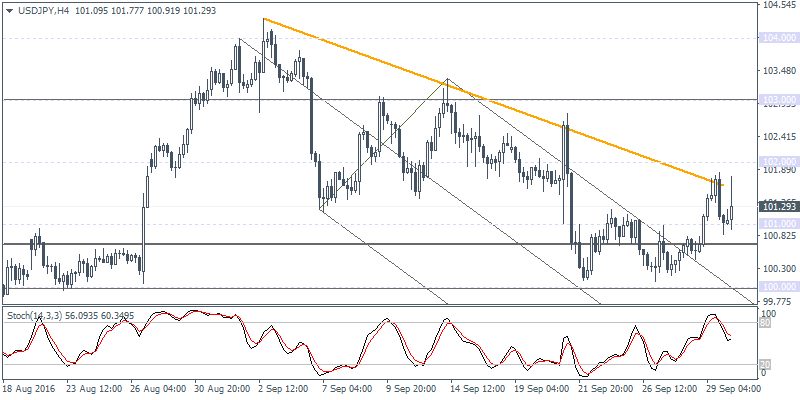

USD/JPY Daily Analysis

USD/JPY (101.29) was seen testing the falling trend line on the 4-hour chart marking the top of the descending triangle pattern. Prices quickly reversed following the trend line test which could now see the potential for the support at 100.00 - 100.50 being re-tested again. As long as USD/JPY posts a higher low above the support, the bias remains to the upside, subject to breaking the trend line. Further gains can be seen with 103.00 resistance likely to be tested. Alternately, watch for price action near the support, as a breakout below the support could see USD/JPY turning bearish.

EUR/GBP Daily Analysis

EUR/GBP (0.8649): Continuing to keep an eye on EUR/GBP, price action was bullish yesterday following the doji pattern formed on Wednesday. However, the upside momentum looks to be stalling after prices retraced 0.8671 - 0.8650 resistance zone as pointed out over the past few days. A reversal from here, following the doji candlestick pattern on the 4-hour session, could indicate further declines in store. Initial support at 0.8600 remains key to the downside, and a break down below this support could see EUR/GBP extend the declines towards 0.8495 - 0.8480 support. Alternately, watch for any potential gains above 0.8671 - 0.8650, which could invalidate the bearish bias and put EUR/GBP on thepath for more gains.