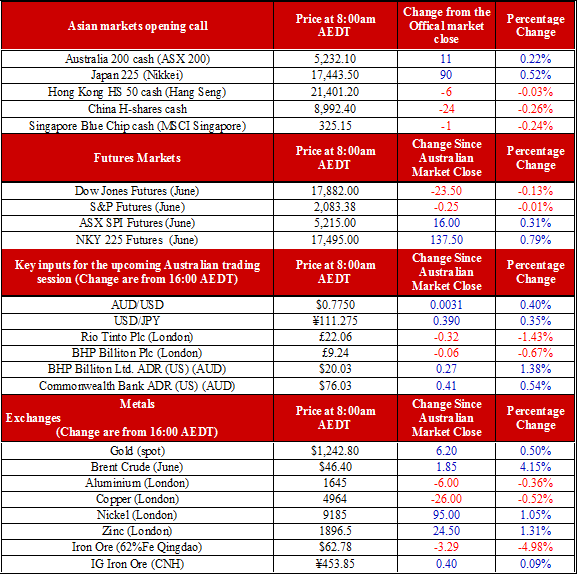

A mixed night in equity markets saw most US and European markets close in positive territory. Apple (NASDAQ:AAPL) saw its first earnings-per-share miss in 13 quarters and was down more than 5% in after-hours trade, while Twitter dropped over 9% after lowering its quarterly guidance. The private American Petroleum Institute (API) survey reported US oil inventories increased by 1.07 million barrels, indicating the inventories build may indeed be slowing. This saw WTI oil jump 3.3% to its highest US session close since 9 November. If we see a similarly small build in the Energy Information Administration (EIA) inventories this evening that could easily see WTI oil close above US$45.

The concern is that at US$45 a significant amount of oil plays become profitable again and we still have not seen a big enough decline in oil output to bring about the appropriate supply and demand rebalancing. Everyone in the market is concerned that we could see a repeat of 2015, where after a dramatic price decline, prices began to rise again and prompted a huge influx of oversupply and an even more severe selloff.

The notable increase in Chinese investment and credit growth seen so far in 2016 is likely to ease off in the coming months, removing the primary driver for the jump in industrial metals. There is a very real possibility that we may see a widespread second bottom across the commodities space in the coming months. The Fed may also begin to talk up rate hikes in the near future and that could also rally the USD, potentially providing the precipitating factor that could see commodities slide again.

The Aussie market is set to open about 0.3% higher, with the energy space set to recover much of yesterday’s losses. The Nikkei looks set to open 0.6% as speculation over the Bank of Japan easing at their meeting tomorrow continues to rally Japanese equity markets.

New Zealand trade data will be released today, and they may be a bit weaker than expected with the Kiwi dollar still trading around multi-month highs. Although it is unlikely to push the RBNZ to cut rates tomorrow, as most expect them to wait until June for the next cut.

Aussie CPI is likely to come in above market expectations for 1.7% as there was fairly strong inflation growth in January and February before the Aussie dollar rallied sharply in March and dimmed the effects of tradables inflation. The release is unlikely to have a major effect on the Aussie today.

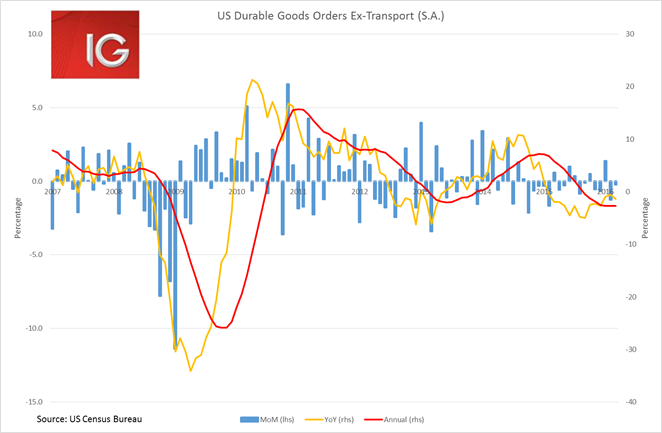

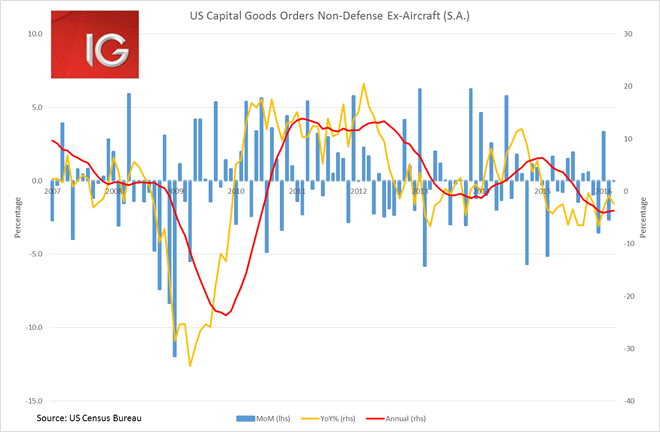

US data overnight have done little to indicate that the Fed may decide to start talking up the possibility of rate hikes in June at their meeting this evening. Both durable goods and capital goods orders missed market expectations and are still very weak. On the positive side, they increasingly look like they have bottomed at current levels and may start to steadily improve from here.