- Equity markets struggle to get back on their feet after hawkish Bostic and RBA

- Dollar holds near one-month highs, aussie jumps as RBA flags more rate hikes

- Yen perks up on wage data, gold firmer ahead of Biden’s State of the Union speech

Stocks make limited headway as Powell looms large

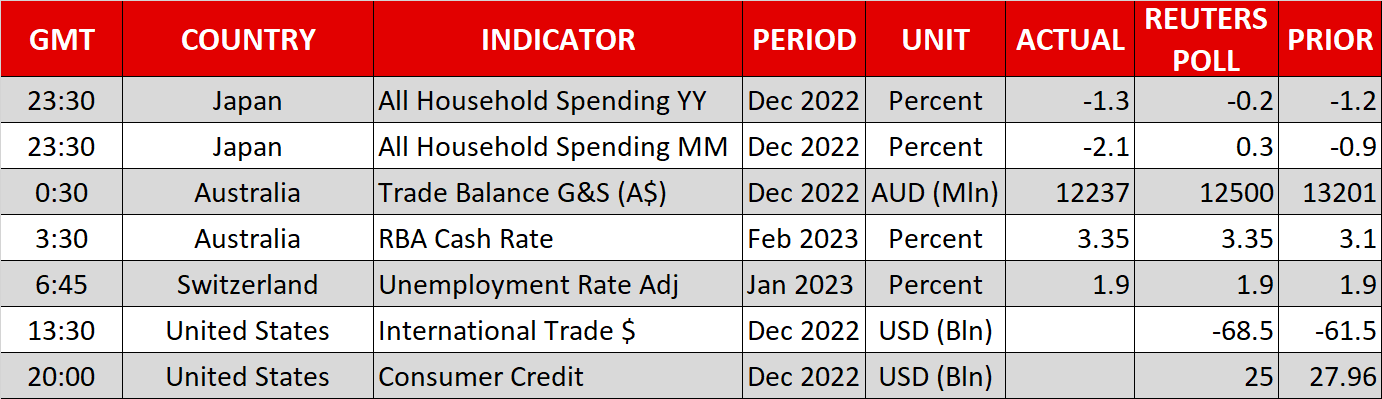

Trading got off on a somewhat steadier note on Tuesday, with some equity markets turning positive, while the US dollar’s rebound appeared to run out of steam. But the post-NFP selloff continued to torment bond markets as yields kept rising globally, with the exception of US Treasuries. The 10-year Treasury yield hit a one-month high of 3.6550% on Monday following the robust jobs report and ISM services print but has slipped slightly today.

The data dashed expectations that the Fed would hit the pause button soon and this was reinforced by comments from Atlanta Fed President Raphael Bostic yesterday, making the pullback in US yields all the more puzzling. This could just be a natural correction given the scale of the bond selloff since Friday and potentially bodes well for demand as the Treasury is set to auction $96 billion of notes and bonds this week, starting with $40 billion in three-year notes today.

But if Bostic’s remarks are anything to go by, Powell’s appearance at the Economic Club of Washington, D.C. later today could spark more selling. Bostic opened the door to a higher terminal rate than that projected in the latest dot plot and a return to rate hikes of 50-basis-point increments.

Wall Street’s benchmark S&P 500 index closed lower for a second straight day on Monday, with the tech-heavy Nasdaq underperforming again. But the reaction was nevertheless muted as in the past, suggestions from Fed officials of a further hawkish pivot would have sparked panic.

After Powell surprised many last week by not pushing back as hard against market bets of the tightening cycle nearing its end, investors are possibly anticipating the same tone from the Fed chief today. And with the earnings frenzy going down a notch this week, there is an even bigger spotlight on Powell to set the market tone.

Dollar firm but off highs, aussie surges as RBA turns more hawkish

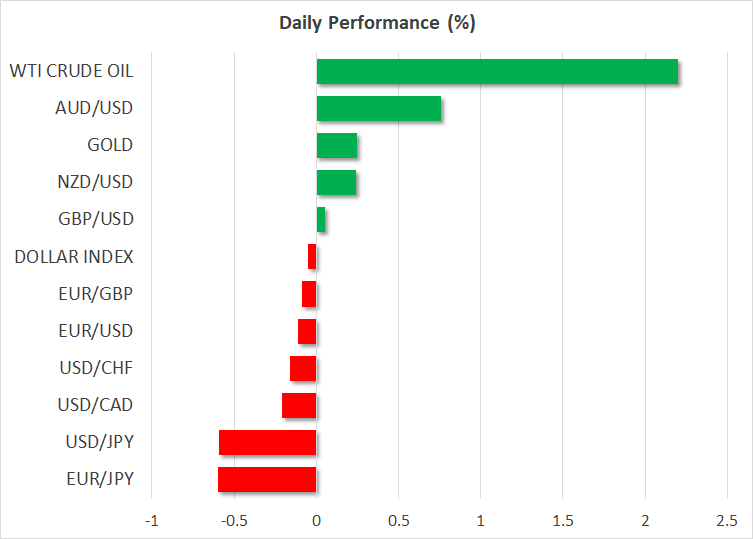

In the currency markets, the dollar index advanced to a fresh one-month high in Asian trading but has since eased off, giving the battered euro and pound some much-needed breathing space. But they are still lacking positive momentum and it is the commodity-linked currencies leading the charge.

In particular, the Australian dollar is surging today, reclaiming the $0.69 level, after the Reserve Bank of Australia raised interest rates for the ninth consecutive time on Tuesday. The RBA lifted the cash rate by 25 bps as expected, but it also signalled that further increases will be needed in the coming months, while abandoning previous language that kept the option of a pause on the table.

Although this does not signify a complete U-turn for the RBA, it is nonetheless a setback for the central bank, which may have become too optimistic with its inflation forecasts, only to discover that there is still a long battle ahead.

Investors may be thinking that the Bank of Canada might also regret its recent pause, as the loonie is climbing today even as rate differentials look set to disfavour the Canadian currency this year.

Yen boosted by wage pickup

The yen is shaping up to be today’s second best performer, strengthening past 132 to the dollar to pare some of yesterday’s losses when it came under pressure on reports that the Bank of Japan’s dovish deputy head, Masayoshi Amamiya, has been approached by the Japanese government to head the Bank when Kuroda steps down in April.

However, how dovish the new governor turns out to be may not be so relevant if the data is moving in the right direction and that could finally be happening. Overall wages in Japan grew the fastest since 1997 in December according to today’s figures, hitting 4.8% y/y.

The acceleration in pay growth comes even before the spring wage negotiations have taken place, boosting the odds of the BoJ announcing an exit from stimulus in April or soon after.

Gold eyes Powell and Biden addresses

In commodities, gold was clawing higher despite the dollar standing firm and the easing of tensions between China and the US. Following the downing of a suspected Chinese spy balloon flying over US airspace, President Biden has downplayed concerns that this has damaged relations between Beijing and Washington.

Biden is likely to bring up China again when he gives his State of the Union speech later in the day, with Russia getting a mention as well. But as far as the precious metal is concerned, Powell’s comments could carry more weight.