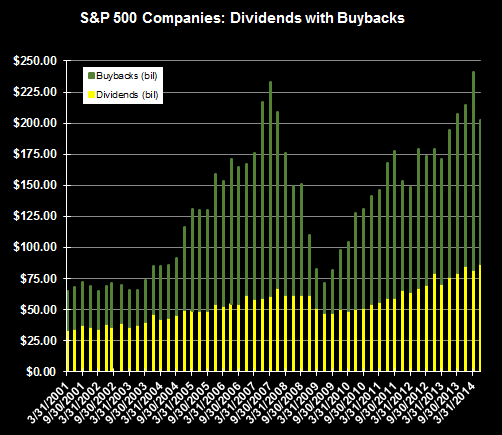

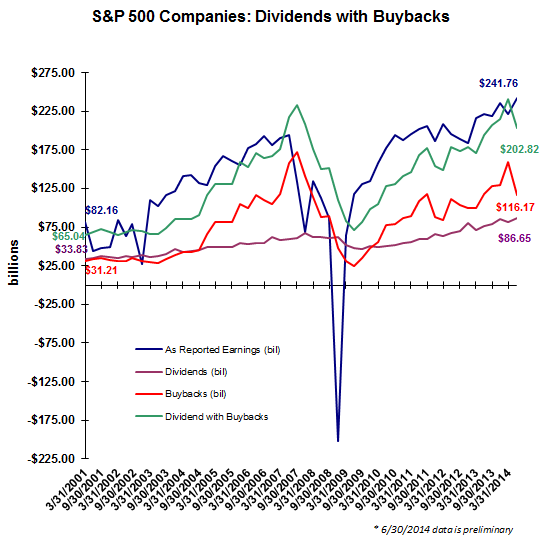

Earlier this week S&P Dow Jones Indices released their buyback report for the S&P 500 Index. Of note was the 27% decline in buyback value in the second quarter versus the first quarter of 2014. Even on a year over year basis (Q2 2014 versus Q2 2013) buybacks declined 1.6%. Some important highlights from the buyback report:

- "For the 12 months ending June 2014, S&P 500 issues increased their buyback expenditures by 26.6% to $533.0 billion from the $420.9 billion posted during the corresponding twelve month period in 2013."

- "Companies on aggregate...issued fewer shares, with the net change resulting in a lower share count and higher earnings-per-share (EPS)."

- "By reducing their share count, more companies are adding tailwinds to their EPS," says Silverblatt. "During the second quarter, 23% of S&P 500 issuers reduced their year-over-year share count enough to push up their earnings per share significantly versus just shy of 20% during Q1 and 12% during the second quarter of 2013."

In the report Howard Silverblatt also comments on the continued need for companies to spend more on buybacks going forward in order to prevent share dilution from employee options that are in the money. These employee options have gained in value as the equity market continues to move higher. This potential increase in buybacks would provide support for a respective company's share price.

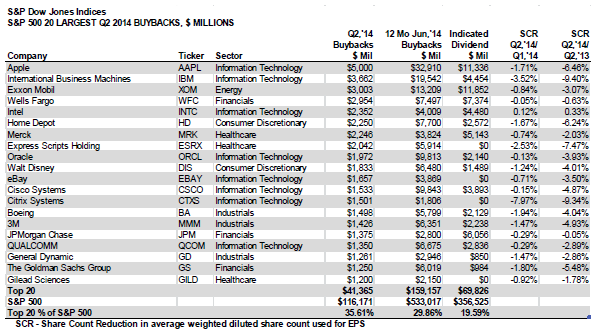

The report contains a number of useful tables with dividend and buyback data. Below is the table detailing the top 20 or largest buybacks in the second quarter.