If I had to identify a half-dozen of my favorite movies, The Shawshank Redemption would definitely make the cut.

Why am I bringing it up? In essence, the film produced one of the more inspirational quotes in motion picture history. The hero pens a letter to his incarcerated friend and he included, “Remember, Red, hope is a good thing, maybe the best of things. And no good thing ever dies.”

Ironically, hope is not particularly helpful when it comes to successful investing. (And it is certainly not a strategy.) If one always anticipates positive outcomes in the future (a.k.a. “hope”) by indefinitely holding every stock asset, he/she is bound to be disappointed. The hope-n-hold act does not even take into account the psychological and financial damage associated with significant bearish retreats.

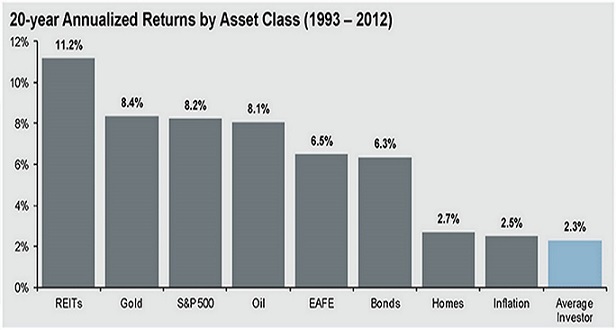

Indeed, investors rarely keep the faith through thin and thick. Not only does hope go into a coma when fear of further loss overwhelms, but hope may not return quickly enough if the financial losses become severe. Is it any wonder that Dalbar’s research over a 20-year period showed why the typical investor only earned 2.3% in a period when stocks earned 8.2%? Investors tend to give up hope at the worst possible moments.

The take-away for some folks is that one should simply maintain hope throughout their lifetime because it is better than selling in fear. Yet that notion is entirely misleading. For one thing, the annualized returns described above do not reflect the reality of the compounding path. Bear markets decimate dollar growth irrespective of an annualized percentage figure. Hoping without a plan to reduce bear-market destruction rarely produces anticipated results.

Why all of the focus on hope? There are mammoth structural concerns in the world economy that a “pro-growth” U.S. president cannot single-handedly overcome. And yet, the hope that Trump’s plans for lower tax rates, higher infrastructure spending and reduced regulation have sent U.S. stocks to all-time highs.

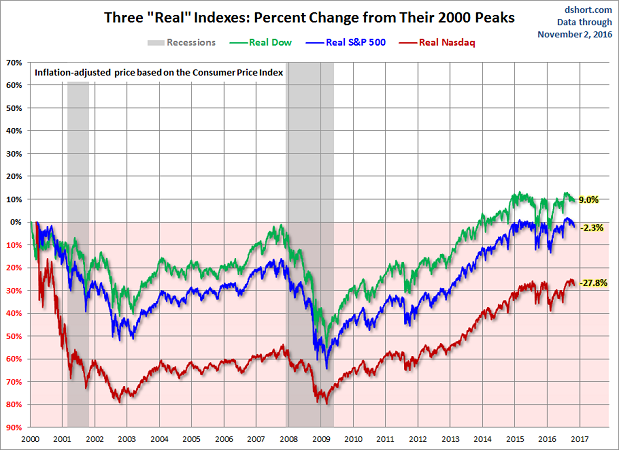

Can the president-elect dictate how much higher interest rates may climb? If they climb much further, stock valuation extremes lose their low-rate “justification” and real estate affordability could get tossed to the wolves.

Can the president-elect prevent the U.S. dollar from rocketing? The dollar’s ascent is already a major thorn in the sides of exporters; it is already going to hamper the earnings of S&P 500 companies that earn close to one-half of their profits in depreciating currencies. And that may make overvalued equities even more pricey.

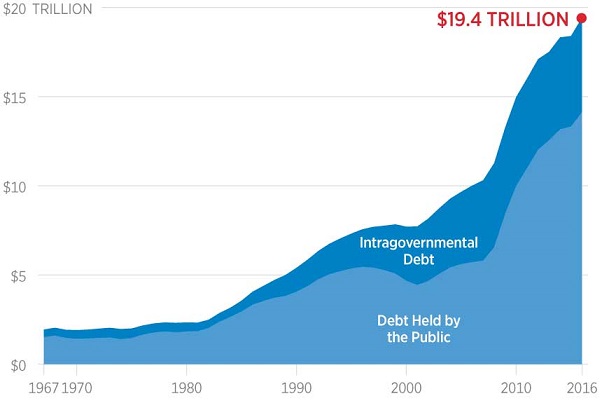

Can the president-elect outlaw $20 trillion in debt from continuing to balloon? Trump has already proposed at least $1 trillion for infrastructure. There will be other deficit-financed proposals coming down the pike, including tax cuts and shoring up the nation’s defense. The stimulus may or may not stimulate growth in the near-term, but some of the spending could adversely affect interest rates. And that would definitely be a headwind for other types of economic growth.

Let me paint the picture a little more broadly. For the time being, the federal government is spending less in total interest expense across all of its obligations than it did before the financial crisis in 2007. However, debt as a percentage of GDP has catapulted from roughly 65% to 105%. If higher interest rates remain elevated for an enduring length of time, the government will not be in a position to provide fiscal stimulus, as a much larger percentage of its budget will go to paying back the interest on its Treasury bond debt.

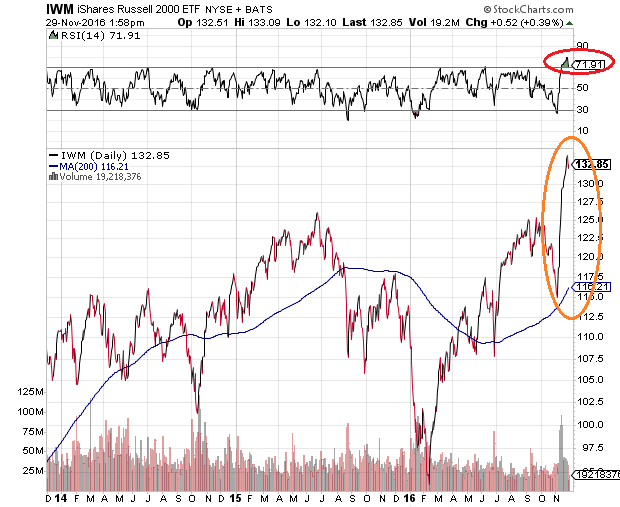

There is one area where I admit to being “hopeful”. I support less regulation. Yet even those who see reducing regulations on small business understand that it is not a panacea. What’s more, the hope trade for small-caps in the Russell 2000 could run into a fundamental and/or technical brick wall. According to the FTSE-Russell web site, the Russell 2000’s P/E was 25.8 at the start of the month, placing it closer to 29.2 today. And the iShares Russell 2000 ETF (NYSE:IWM)? It has not been more overbought on a Relative Strength Index (RSI) basis in at least three years.

Bottom line? The “Trump bump” may provide a tailwind for domestic equities through year-end. Underperforming money managers “hope” to play catch-up in the calendar year. On the flip side, it is a mistake to chase performance and an even bigger mistake to dismiss the headwinds of domestic valuation extremes in a stimulus-addicted, slow-growing world economy. Keep some dry powder.