Defensive Assets Strong Early In Week

When investors are fearful, common sense tells us demand picks up for more conservative assets, which is exactly what happened early Monday morning. From Bloomberg:

“Signs of distress in financial markets are gathering force as concern over the state of the global economy deepens. The Standard & Poor’s 500 Index declined as much as 2.2 percent, as U.S. shares joined a retreat in European and emerging-market stocks. Investors sought the safest assets, sending yields on Treasury 10-year notes to the lowest level in a year, and those on Germany’s 10-year bunds to the lowest since April. Meanwhile, yields on bonds of Europe’s most-indebted countries rose, while the cost of protecting against default by U.S. junk-rated companies climbed to the highest since 2012.”

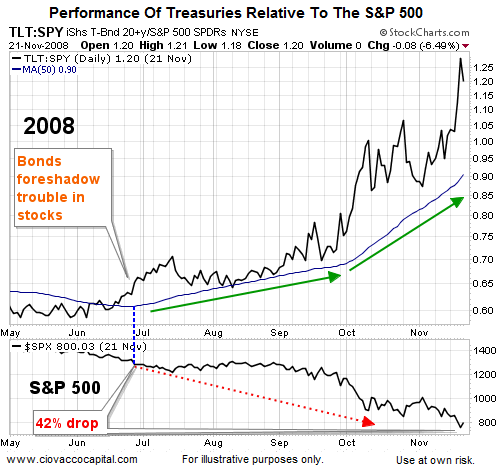

Red Flags In 2008

If you felt the economic outlook was uncertain and you wanted a relatively high degree of safety of principal, what investment might be appealing? Bonds with longer maturities that lock in rates and have a low probability of default, which sounds a lot like long-term U.S. Treasuries (N:TLT). When investors are very pessimistic and fearful, return of principal becomes highly important. Therefore, when fear increases we would expect to see defensive bonds outperform growth-oriented stocks. That is exactly what started to happen in a fairly convincing manner in late June 2007, when the S&P 500 was trading at 1,310. After the warning from bonds, the S&P 500 dropped an additional 42%.

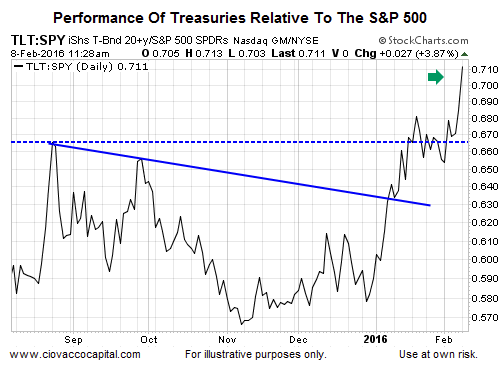

What Is The Ratio Telling Us Today?

The recent spike in the demand for Treasuries relative to the demand for (N:SPY) aligns with the bigger picture concerns outlined in this week’s stock market video (below chart).

Investment Implications - The Weight of The Evidence

This week’s stocks market video, recorded on Friday, February 5, covers the rationale for putting stocks on a “plunge watch” until conditions improve.

Since early December 2015, our market model has added to conservative positions (N:IEF), and significantly reduced exposure to stocks (N:VOO). We are happy to reverse that process when the hard evidence begins to improve.