This week, the biotech sector saw quite a few updates on the regulatory and pipeline front. While companies like Sarepta (NASDAQ:SRPT) , Biogen (NASDAQ:BIIB) , AbbVie (NYSE:ABBV) and Intercept (NASDAQ:ICPT) came out with encouraging news, Ionis (NASDAQ:IONS) suffered a setback.

Recap of the Week’s Most Important Stories

1. Sarepta’s shares shot up 26.7% on news that the FDA will not be able to deliver a decision regarding the approval status of the company’s experimental Duchenne muscular dystrophy (DMD) treatment, eteplirsen, by May 26. The agency informed the company that it continues to review the NDA and will return with a decision in a timely manner. The news has raised hopes among investors as well as the medical community that the agency may very well decide to approve eteplirsen (Read more: Why is Sarepta Therapeutics Stock Soaring 20% Today?).

We remind investors that DMD drugs have not really had much success on the regulatory front so far. While PTC Therapeutics had received a “refusal to file” letter from the FDA for its experimental DMD treatment, Translarna, BioMarin’s Kyndrisa received a complete response letter (CRL) earlier this year. BioMarin, in fact, announced this week that it does not intend to continue with the development of Kyndrisa. The company withdrew its marketing application in the EU following discussions with the Committee for Medicinal Products for Human Use (CHMP) which indicated the drug would receive a negative opinion from the CHMP.

2. Across the pond, quite a few drugs received positive CHMP opinions including Biogen’s Tysabri (label expansion for use in relapsing-remitting multiple sclerosis patients with highly active disease activity despite a full and adequate course of treatment with at least one disease modifying therapy) as well as Gilead’s (NASDAQ:GILD) experimental hepatitis C virus (HCV) drug, Epclusa (Read more: Gilead's New HCV Drug Epclusa Wins CHMP Backing). Amgen’s cancer drug Kyprolis and AbbVie’s flagship product Humira also got positive CHMP opinions for label expansions (Read more: Merck (NYSE:MRK), AbbVie & Amgen (NASDAQ:AMGN) Drugs a Step Closer to EU Approval).

3. The FDA granted approval to Biogen and AbbVie’s multiple sclerosis (MS) treatment Zinbryta making it the first once-monthly, self-administered MS treatment to be approved. However, the label has a black box warning regarding the risk of hepatic injury, including autoimmune hepatitis, and other immune-mediated disorders. Moreover, only prescribers, pharmacies and patients enrolled in the Zinbryta Risk Evaluation and Mitigation Strategy (REMS) Program, which includes required monthly liver function tests, will have access to the treatment. (Read more: Biogen & AbbVie's Multiple Sclerosis Drug Gets FDA Nod).

AbbVie’s cancer treatment, Imbruvica, also gained EU approval for the first-line treatment of chronic lymphocytic leukemia (CLL) patients. The label expansion was expected as the CHMP had recently issued a positive opinion for this indication. With this label expansion, Imbruvica can now be used across all lines of CLL.

4. Ionis’ shares were down 39.4% on news that Glaxo, which has the option to exclusively license Ionis’ IONIS-TTRRx, has decided against initiating a phase III outcome study in patients with TTR amyloid cardiomyopathy. The study had been placed on clinical hold earlier this year due to safety findings in the ongoing NEURO-TTR study. (Read more: Ionis Down, Glaxo Dumps IONIS-TTRRx Phase III Study Plans).

5. Intercept’s Ocaliva gained accelerated approval in the U.S. for the treatment of primary biliary cholangitis (PBC) making it the first new medicine to be approved for PBC in almost two decades. Shares were up on the news though approval was largely expected as an FDA advisory panel had voted unanimously in favor of approving the drug. (Read more: Intercept's Liver Dug Ocaliva Approved by the FDA). Of course, Ocaliva’s main potential lies in the nonalcoholic steatohepatitis (NASH) market which represents blockbuster potential.

Vertex (NASDAQ:VRTX) also got some good news with the FDA granting priority review for the company’s regulatory application for the use of cystic fibrosis drug Orkambi in a children aged 6 to 11 years. The FDA will issue a response regarding the label expansion by Sep 30.

Performance

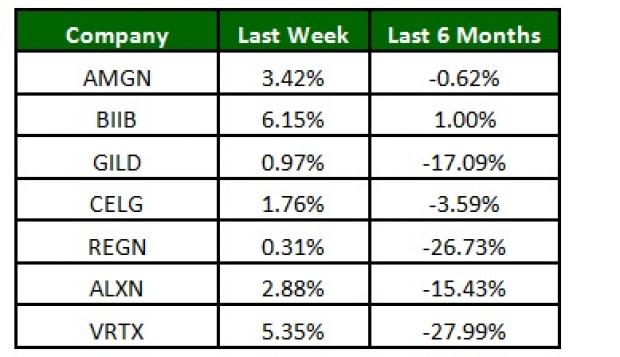

All major biotech stocks performed well last week with Biogen gaining the most (6.15%). Over the last six months, Biogen was up 1% while Vertex lost 27.99% during this period.

The NASDAQ Biotechnology Index was up 2.79% over the last four trading days (See the last biotech stock roundup here: XenoPort Soars on Acquisition Deal, AbbVie Crohn's Disease Drug Fares Well).

What's Next in the Biotech World?

Several biotech companies will be attending the annual meeting of the American Society of Clinical Oncology (ASCO) to showcase data on their cancer treatments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

VERTEX PHARM (VRTX): Free Stock Analysis Report

GILEAD SCIENCES (GILD): Free Stock Analysis Report

BIOGEN INC (BIIB): Free Stock Analysis Report

ABBVIE INC (ABBV): Free Stock Analysis Report

IONIS PHARMACT (IONS): Free Stock Analysis Report

SAREPTA THERAP (SRPT): Free Stock Analysis Report

INTERCEPT PHARM (ICPT): Free Stock Analysis Report

Original post

Zacks Investment Research