The drop in US bond yields is perhaps the biggest surprise for investors this year. The gradual decline in Federal Reserve buying, faster growth and the prospects for a rate hike in 2015 were expected to lift bond yields.

Who would buy US Treasuries when the largest buyer was pulling back and yields would inevitably rise? Moreover, with China's current account having been reduced and reserve growth slowing (and went into reverse in Q3), and less reserve accumulation, foreign central banks' demand was likely to soften.

In fact, some central bank, like Russia, and a few other central banks, appeared to be liquidating some Treasury holdings to defend their currencies. Indeed, over the past four weeks, the Federal Reserve's custody holdings of Treasuries for foreign central banks have fallen by $48.5 bln.

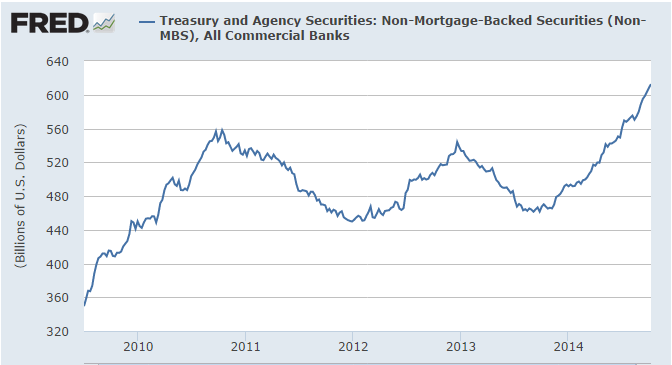

Here we only address one source of persistent demand for US Treasuries: US banks. This Great Graphic from the St. Louis Fed shows the surge in commercial banks holdings of US Treasuries and Agencies, but excluding MBS since late last year. In 2013, banks mostly were sellers. For the past twelve months, US banks have consistently bought US government bonds and agencies. Over this period a little more than $145 bln have been purchased.

Having easily established this bank demand for government paper, it is both more interesting and disturbing to think about their motivation. It is both an expression of, and an attempt to resolve a fundamental problem, which is ironically the exact opposite of what orthodox thinking tells us. The banks simply have too much money.

Deposit growth is outpacing loans. At the end of September, deposits were a record high of almost $10.4 trillion (since the time series began in 1973). Deposits exceed loans by a record in September. Banks are supposed to disintermediate between savers (deposits) and borrowers (loans). They are taking in deposits, but are not lending it out. Households not re-leveraging. The S&P 500 are reporting record earnings but have the lowest debt burden since Clinton was President.

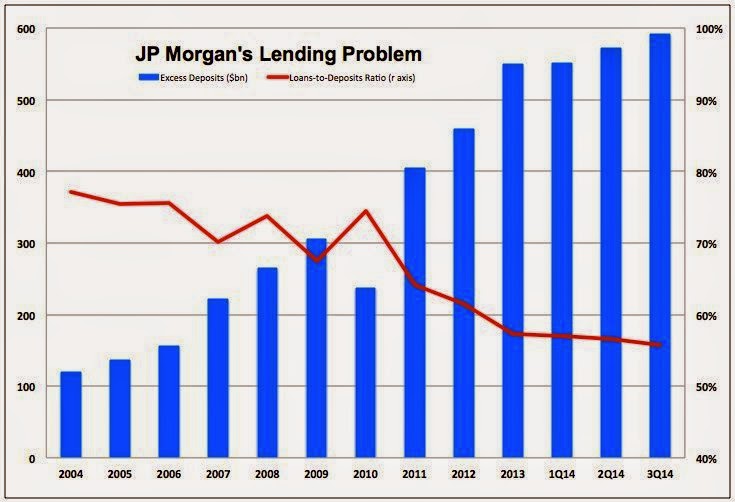

This Great Graphic of posted by Ben Walsh on the Huffington Post, provides a specific example of this generalization. It looks at J P Morgan Chase & Co (NYSE:JPM), which reported Q3 earnings this week. Excess deposits (blue bar) have more than doubled since 2010. The loan-to-deposit ratio (red line) has continued to edge lower. It Q3 it lent out 56 cents for every dollar in deposits.

Walsh reports that the other large banks have higher loan-to-deposit ratios. Citigroup (NYSE:C) lends out 67 cents for each dollar of deposits. Wells Fargo & Company (NYSE:WFC) 76 cents. Bank of America Corporation (NYSE:BAC) 80 cents. Together these three banks have $766 bln excess deposits. Walsh notes that JP Morgan alone has $590 bln in excess deposits.

These excess deposits are part of the highly liquid capital sloshing around the system. Roughly half of the excess deposits are being used to buy US government paper. The deposits costs practically nothing, so the banks earn the entire carry.

There is another consideration encouraging banks to hold more government paper. New liquidity rules come into effect at the start of the year that essentially requires that banks hold more high quality and liquid assets. The Federal Reserve, according to reports, estimates that banks may need to raise another $100 bln to reach the necessary $2.5 trillion.

The way the US appears to be trying to rein in the too-big-too-fail banks may increasing the required capital ratios. This source of pressure on bank to own more government paper is unlikely to ease up soon, though some hope that if the Republicans gain control of the Senate, some effort to ease the regulatory burden could be seen.

Commercial banks have been one notable source of demand for government paper. They were net sellers last year, but have been net buyers consistently through this year. The gap between deposits and loans is a key source of funds for banks. The new and evolving regulatory environment strongly encourage banks to buy US government paper.

Sometimes this regulatory inducement to hold more government bonds is called financial repression, but this is unnecessarily pejorative. The banks have too much deposits relative to the effective demand for loans. They only have used around half of the new growth in excess deposits to buy government bonds. This does not represent any crowding out. They can meet whatever increase in loan demand that may arise.

What would the banks do with half of the excess deposits if not buy Treasuries? However the question is answered, it would likely be in riskier and more disruptive direction that putting it in the safest (counterparty risk) and most liquid market. The regulatory burden not only makes the banks stronger, but also denies them some the means of causing mischief.