The Australian dollar has posted small losses on Thursday, reversing the upward direction, which marked the Wednesday session. AUD/USD is trading in the mid-0.74 range in the North American session. On the release front, Australian Private Sector Credit gained 0.5%, within expectations. In the US, Unemployment Claims rose to 268 thousand, close to the forecast. On Friday, the US manufacturing sector will be in focus, with the US release of the ISM Manufacturing PMI.

Brexit has ushered in a period of instability and uncertainty across the continent, with Brexit seemingly the only certainty one can point to. The vote to leave the EU is causing deep instability in Europe and the UK and wiped out a staggering $3 trillion from global stock markets. As the dust has begun to settle, the financial markets have stabilized. The pound plunged as much as 11 percent in the aftermath of the vote but has stabilized in the past few days. Still, political leaders on both sides of the Channel will have to pick up the pieces and deal with the radical new landscape, which was unthinkable just a few months ago – that of a European Union without Britain. The Chancellor of the Exchequer George Osborne and Bank of England Governor Mark Carney have sought to reassure the markets and the public that the situation is under control, but is it? The political picture is fluid, as the Conservatives are looking for a new leader, the Labor Party is in turmoil and general elections are likely later in the year. On the financial front, the pound and the markets have taken a beating and London’s position as a world financial center has been shaken. The uncertainty is not going to disappear anytime soon, so traders can expect further volatility in the currency markets.

British Prime Minister Cameron, a staunch supporter of the EU, finds himself in the unenviable position of explaining the Brexit decision to fuming Europeans. Cameron arrived in Brussels for an EU Summit on Tuesday and the meeting was fraught with tension, dismay and anger. Clearly, the “divorce of the “century” between Britain and the EU could be rancorous and messy. Cameron has asked for time to prepare Britain’s exit and wants to renew “productive” relations with Europe. However, the Europeans are in no mood for hugs and kisses on both cheeks. German Chancellor Merkel said that the UK could not “cherry pick” and that a relationship with Europe entailed obligations and not just rights – in other words, the Europeans are rejecting “half membership”. As well, Europe wants Britain to exit as soon as possible, in order to minimize the uncertainty and instability caused by the Brexit vote. French President Hollande went on the attack, saying that London should no longer remain a center for clearing euro trades. This market is worth trillions of euros in currency and derivative deals and such a move would be a severe blow to London’s financial sector. Already, the European Banking Authority has announced it is leaving London and moving to Paris or Frankfurt. In a strictly legal sense, Britain is still a member of the EU club, but politically, it is out (British EU Commissioner Jonathan Hill resigned after the Brexit vote). The markets are allergic to uncertainty, so Britain’s unclear status within the EU will likely continue to cause uncertainty and this could weaken the Australian dollar.

AUD/USD Fundamentals

Wednesday (June 29)

- 21:30 Australian Private Sector Credit. Estimate 0.5%. Actual 0.4%

Thursday (June 30)

- 8:30 US Unemployment Claims. Estimate 267K. Actual 268K

- 9:45 US Chicago PMI. Estimate 50.6

- 10:30 US Natural Gas Storage. Estimate 48B

- 13:30 US FOMC James Bullard Speaks

Upcoming Key Events

Friday (July 1)

- 14:00 US ISM Manufacturing PMI. Estimate 51.3

*Key releases are highlighted in bold

*All release times are EDT

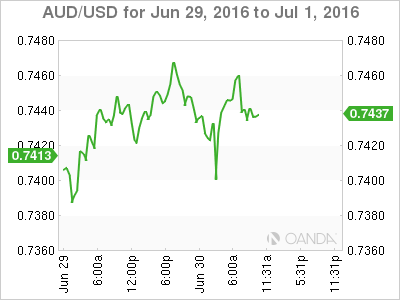

AUD/USD for Thursday, June 30, 2016

AUD/USD June 30 at 9:20 EDT

Open: 0.7467 Low: 0.7369 High: 0.7468 Close: 0.7451

AUD/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7160 | 0.7251 | 0.7339 | 0.7472 | 0.7612 | 0.7739 |

- AUD/USD posted slight losses in the Asian session and has rose slightly in European session. The pair is steady in the North American session.

- 0.7472 is a weak resistance line

- 0.7339 is providing strong support

- Current range: 0.7339 to 0.7472

Further levels in both directions:

- Below: 0.7339, 0.7251 and 0.7160

- Above: 0.7472, 0.7612, 0.7739 and 0.7835

OANDA’s Open Positions Ratio

AUD/USD ratio is almost unchanged on Thursday, consistent with the lack of significant movement by AUD/USD. Long positions have a majority (57%), indicative of trader bias towards AUD/USD reversing directions and moving to higher levels.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.