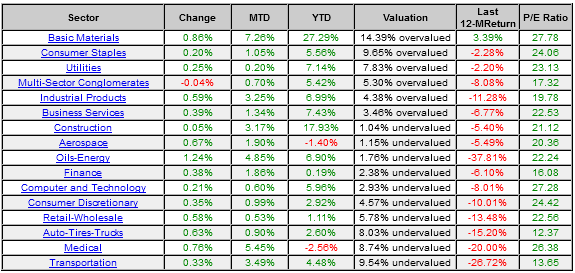

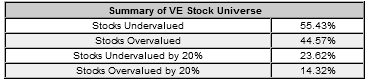

VALUATION WATCH: Overvalued stocks now make up 44.57% of our stocks assigned a valuation, and 14.32% of those equities are calculated to be overvalued by 20% or more. Six sectors are calculated to be overvalued.

Rose-Colored Glasses: Apple Updates MacBook Line

Apple Inc. (NASDAQ:AAPL) is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. Apple Inc. is headquartered in Cupertino, California.

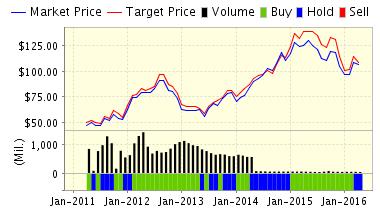

As we have noted for a while now, investors have had a lot of questions about the future of Apple. The formerly high-flying stock has had some issues over the past few months, and the share prices have reflected the uncertainty.

Today, the company announced a series of updates to the MacBook laptop line, and, as is often the case, these differences are more incremental than revolutionary. Speed is the newest feature, with both processor and storage upgrades that the company claims will make the machines 20% faster than prior models.

In addition, the machines will be available in pink to match the latest iPhones, watches, and iPads. That sort of upgrade isn't exactly "cutting-edge." On the other hand, the company has held the MacBooks to the same price points as last year's models, which is nice for consumers who simply must have a laptop that matches their phone and/or watch.

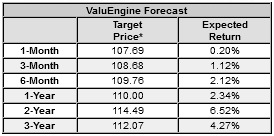

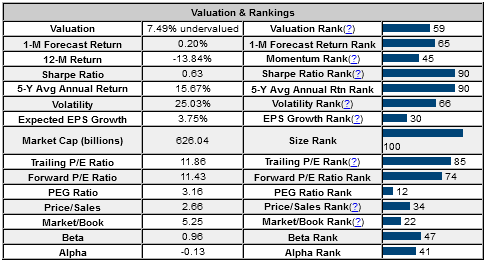

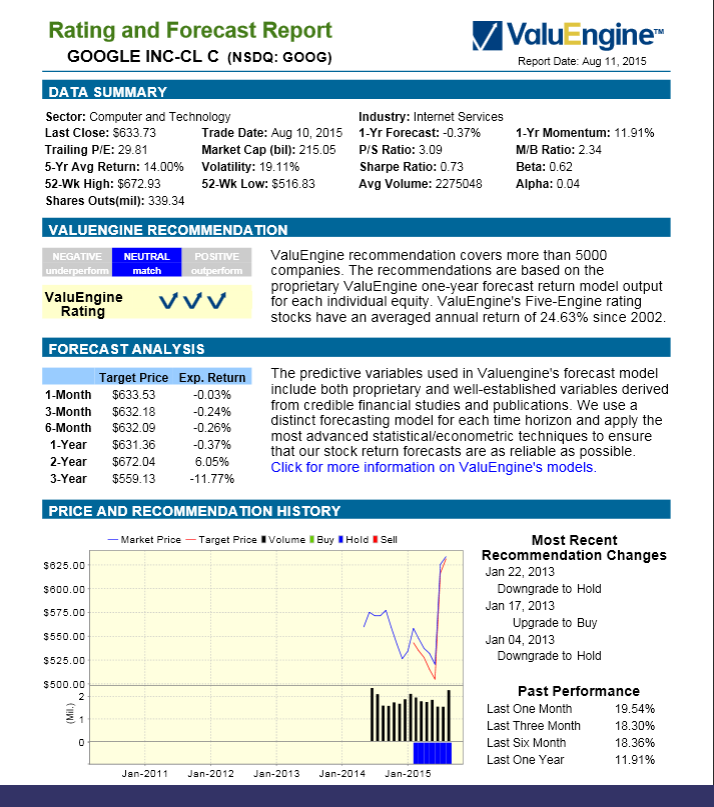

ValuEngine continues its HOLD recommendation on APPLE INC for 2016-04-18. Based on the information we have gathered and our resulting research, we feel that APPLE INC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE company size but UNATTRACTIVE book market ratio.

You can download a free copy of a detailed report on Apple from the link below.

ValuEngine Market Overview

ValuEngine Sector Overview