Forex News and Events:

The weakness in the antipodeans continues as the increased volatility on Fed bets trigger capital outflows from the high-beta currencies. The RBNZ gives policy verdict tonight and is expected to keep its official cash rate unchanged at 3.50%. After four consecutive months of rate hike from 2.50% to 3.50%, the pause in policy tightening (if materializes) is believed to be the perfect opportunity for Governor Wheeler to call for more NZD weakness. Especially now that the subdued commodity trading disfavors the NZ economic recovery. In Australia, the heavy sell-off in AUD pulled the oversold EUR/AUD back to levels before the ECB rate cut (of Thursday 4th).

RBNZ may face new challenges

The New Zealand national elections are scheduled on September 20th and may happen to result in more challenges for the RBNZ. The main opposition Labor Party, dissatisfied with the inflation targeting policy, is willing to set new policy target for the current account deficit and employ pension contributions as additional monetary policy tool. The polls show that the outcome of the elections will be tight. In this context, the selling pressures on the NZD are mostly justified. The Labor Party’s Parker said yesterday that the NZD is “overvalued” and that the RBNZ has got “structurally higher rates than the rest of the world”. Indeed, the RBNZ’s struggle against inflation and high housing prices brought it to higher the interest rates before its developed peers, pushing the NZD/USD to 33 year highs. Today, the NZ’s main opposition thinks that the inflation cannot be the sole target per se, as the price stability should be “in support of stronger economy and higher growth rates”.

On the currency markets, NZD/USD falls below the Fibonacci 23.6% on February-July rally. The failure to rebound from 0.8475/0.8500 (roughly 200-dma) keeps the bias skewed negatively. The key support is placed at 0.8052 (Feb 4th low), level at which the 2014 gains will be fully pared. Option offers for the four weeks ahead suggest that 0.8300-strikes are the next mid-term resistance. Despite the good interest rate differential with the USD, the NZD remains a UST-sensitive currency. Among the G10 high-beta currencies, the Kiwi is the best placed to taper the impact of the Fed tightening (foreseen by Q2, 2015), mostly due to hawkish RBNZ outlook. Yet in the short-run, the political risks will keep the pressures tight.

On broad based AUD weakness, AUD/NZD traded below the 21-dma for the first time since July 16th. The MACD (12, 26) indicator stepped in the bearish zone, suggesting room for more weakness. RBNZ decision will be determinant in the short-run direction. The key support zone stands at 1.1000/40 (psychological lvl & Fib 50% on Oct’13 – Jan’14 drop).

AUD loses the most versus EUR

The significant drop in Australian consumer confidence (-4.6% in month to September according to Westpac indicator) reinforced the AUD sell-off in Sydney. Despite the broad based EUR weakness, EUR/AUD gained more than 1.50% since yesterday, clearing offers at 1.4000 almost as fast as it had cleared support after the ECB rate cut on Thursday 4th. The 1-month implied vol spiked to 9.0%, highest since mid-March levels. So far, the move is interpreted as short-covering, as regular reaction to oversold territories. Yet a daily close above 1.41500/1.41550 (21-dma / MACD pivot) will suggest a short-term bullish reversal.

Today's Key Issues (time in GMT):

2014-09-10T11:00:00 USD Sep 5th MBA Mortgage Applications, last 0.20%2014-09-10T12:30:00 CAD 2Q Capacity Utilization Rate, exp 82.90%, last 82.50%

2014-09-10T14:00:00 USD Jul Wholesale Inventories MoM, exp 0.50%, last 0.30%

2014-09-10T14:00:00 USD Jul Wholesale Trade Sales MoM, exp 0.60%, last 0.20%

2014-09-10T21:00:00 NZD RBNZ Official Cash Rate, exp 3.50%, last 3.50%

The Risk Today:

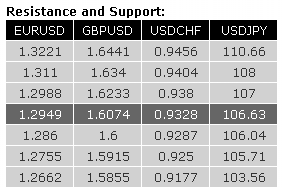

EURUSD EUR/USD is trying to bounce from its oversold decline. Hourly resistances can be found at 1.2988 (05/09/2014 high) and 1.3110 (02/09/2014 low). An hourly support now lies at 1.2860. In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the key support at 1.3105 (06/09/2013 low) opens the way for a decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low). A key resistance lies at 1.3221 (28/08/2014 high).

GBPUSD GBP/USD is trying to bounce from its oversold decline. Hourly resistances can be found at 1.6233 (08/09/2014 high) and 1.6340 (05/09/2014 high). An hourly support now lies at 1.6060, while a more significant support stands at 1.6000 (psychological threshold and 50% retracement). In the longer term, prices have collapsed after having reached 4-year highs. The breach of the key support at 1.6220 confirms persistent selling pressures and opens the way for further decline towards the strong support at 1.5855 (12/11/2013 low). A key resistance now stands at 1.6644.

USDJPY USD/JPY has broken the strong resistance at 105.44 (see also the 61.8% retracement and the long-term declining trendline), opening the way for further strength towards the major resistance at 110.66. Hourly supports can now be found at 106.04 and 105.71 (05/09/2014 high). A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 favours a resumption of the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

USDCHF USD/CHF moved higher yesterday only to close significantly lower, suggesting potential fading short-term bullish momentum. Hourly supports can be found at 0.9287 (05/09/2014 low) and 0.9250 (previous resistance). An hourly resistance now lies at 0.9380 (09/09/2014 high). Another resistance stands at 0.9404 (61.8% retracement). From a longer term perspective, the technical structure calls for the end of the large corrective phase that started in July 2012. The break of the strong resistance at 0.9250 (07/11/2013 high) opens the way for a move towards the next strong resistance at 0.9456 (06/09/2013 high). A key support now lies at 0.9104 (22/08/2014 low).