By Michael S. Derby

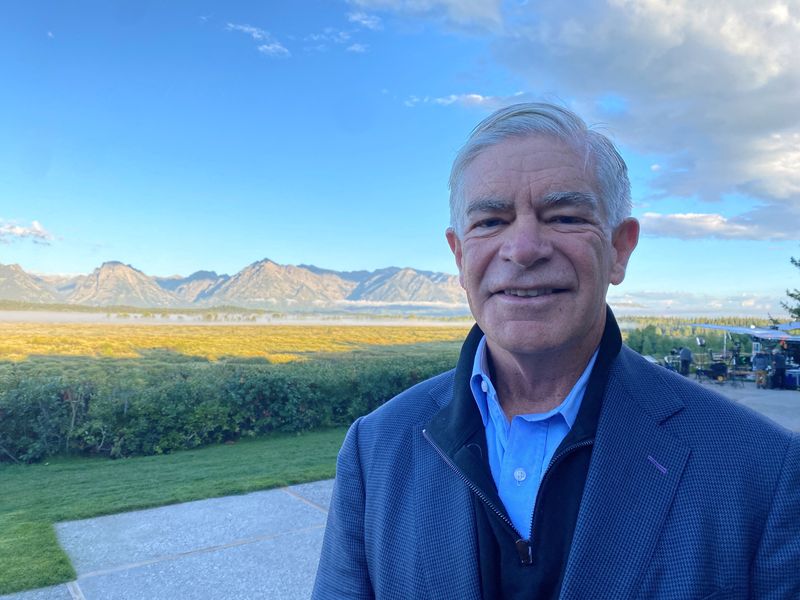

NEW YORK (Reuters) - Philadelphia Federal Reserve President Patrick Harker on Wednesday said he still opposes any further U.S. central bank interest rate hikes, while signaling openness to lowering short-term borrowing costs, albeit not imminently.

"I've been in the camp of, let's hold rates where they are for a while, let's see how this plays out, we don't need to raise rates anymore," Harker said in an appearance on WHYY, a Philadelphia-based radio station.

But looking ahead, "it's important that we start to move rates down," he said, adding that "we don't have to do it too fast, we're not going to do it right away, it's going to take some time."

Harker's comments were his first since the Fed decided last week to maintain its benchmark overnight interest rate in the 5.25%-5.50% range, while penciling in rate cuts in 2024 amid an expectation that inflation will continue to fall.

In recent days, a number of Fed officials have fanned out and cautioned markets to not get too far ahead of themselves regarding the prospect of policy easing amid a still uncertain economic outlook. Harker was a voting member of the central bank's policy-setting Federal Open Market Committee this year, but he won't be again, as he faces mandatory retirement in 2025.

Harker was among the leading group of Fed officials who believed the central bank had done enough with its rate increases and needed time to see how those aggressive rises in borrowing costs were playing out in the economy. The central bank has raised its policy rate by 5.25 percentage points since March 2022.

In the radio interview, Harker said a "soft landing" for the economy in which a recession is avoided, inflation returns to 2% and the job market is not badly damaged is quite possible. He said he expects unemployment to rise modestly, but added that companies are having better luck finding workers. One reason to lower rates, Harker said, is to help businesses that are struggling with expensive borrowing rates.

But he added a note of caution on the outlook. "Let me be clear: The job on inflation is not done, but we are moving in the right direction, things are starting to look better and better."