The Japanese yen slipped to its lowest in 8 months against the dollar, as broad strength for the US currency and speculation that the Government Pension Fund would invest more in stocks, helped the Japanese stock market. USD/JPY climbed to 104.85, eyeing the 105 level and the 105.44 high for the year which was struck back in January.

EUR/USD was also under pressure but its drop was much more contained. The pair made a new 12-month low of 1.3115 and was trading around 1.3120. Overall the euro managed to resist the dollar’s advance for now, as it was already nursing substantial losses from the previous week.

The aussie slipped below 93 cents to 0.9285. The Reserve Bank of Australia kept its key interest rate unchanged at 2.50% at the end of its meeting today. In the accompanying statement by the Governor, the currency was blamed for being too high and for preventing the rebalancing of the economy away from the mining sector. The economy had plenty of spare capacity according to the statement, as the unemployment rate was at the relatively high level of 6.4%. This means that interest rates are unlikely to change in Australia for the foreseeable future.

Looking ahead to the remainder of the day, the UK construction sector PMI for August will be looked at closely after yesterday’s manufacturing PMI missed expectations. The United States returns from the Labor Day holiday as the ISM manufacturing PMI business survey will be announced. The previous month’s number at 57.1 was the highest since April 2011 and analysts were expecting it to remain near those highs at 57.0.

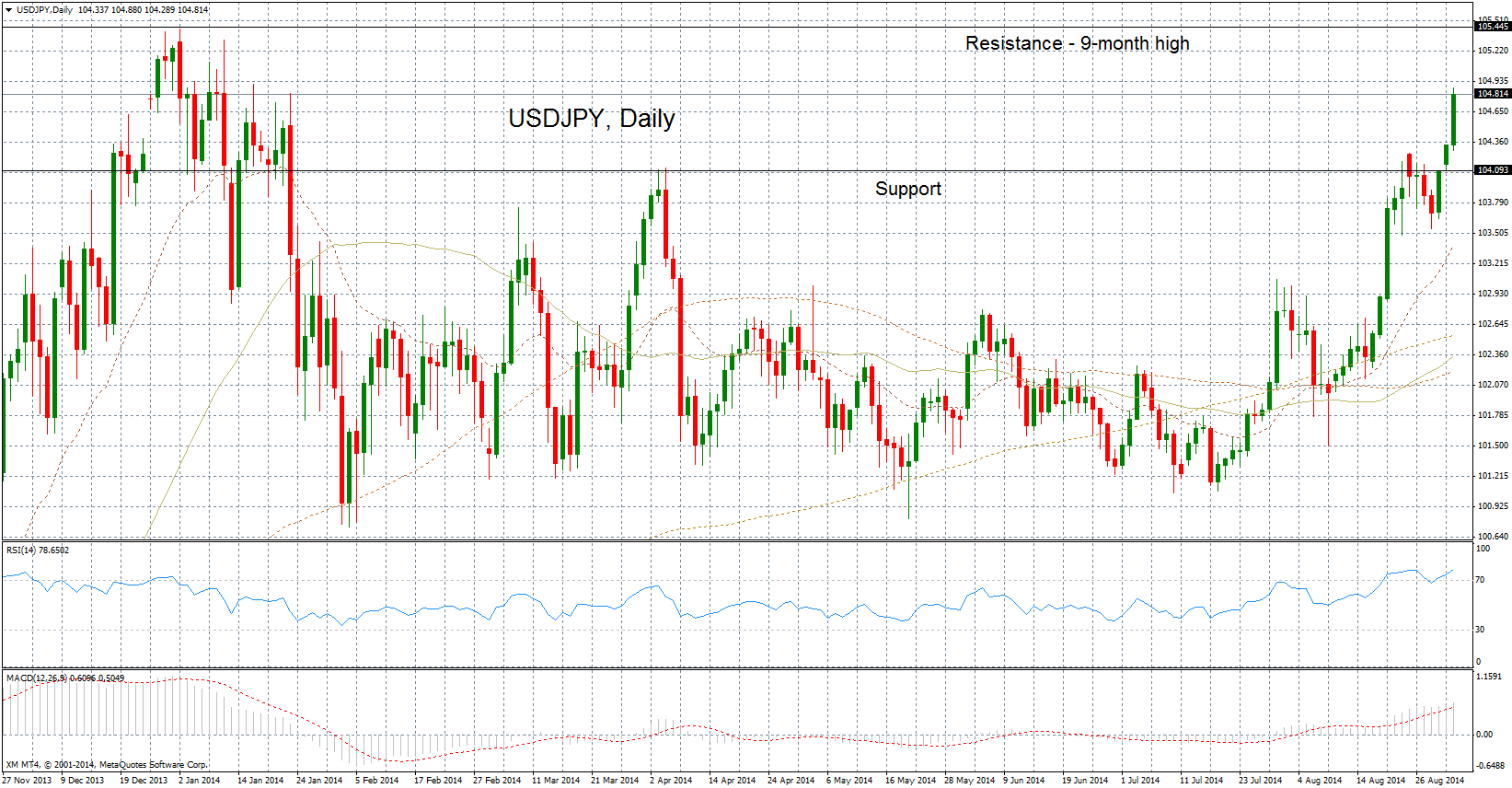

Technical Analysis – USD/JPY Daily: eyeing 105 and the 105.44 6-year high

Dollar bulls have been disappointed this year with action in USD/JPY. Instead of continuing the previous year’s trend beyond the 6-year high of 105.44 and challenging perhaps the 111 area, the dollar dipped back all the way to the 101 level. However, since late July, the dollar has rallied strongly and today it rose to 104.85. This has given fresh hope to dollar bulls that the 105.44 will soon be breached and that USD/JPY will continue higher to the 110-111 area; the 2008 highs. The uptrend for the dollar is in place following the sharp rally during August. Price is currently above all key moving averages such as the 50-, 100- and 200-day moving averages. However, USD/JPY is overbought in the short-run as indicated by the high Relative Strength Index reading of 78. Readings above 70 signal overbought conditions. This means there could be a period of consolidation or a correction before the 105.50 level is breached.

On the downside, the 104 level could hold any short-term decline. The 200-day average could provide additional support at 102.54. Overall the pair’s chart appears bullish but it could have trouble making more gains in the short-term as it appears overbought.