USD/JPY has posted gains on Thursday, as the pair trades in the low-101 range early in the North American session. The yen has gained about 100 points this week against the dollar. In Japan, manufacturing data disappointed, as Core Machinery Orders and Tertiary Industry Activity were well short of their estimates. The Corporate Goods Price Index continues to move higher and beat the forecast. On Thursday, Japanese 30-year bonds and Consumer Confidence remained steady. In the US, Unemployment Claims looked sharp, touching a six-month low.

Japanese manufacturing data was a mix on Thursday. Core Machinery Orders plunged 19.5%, its third decline in four readings. The markets had expected a respectable gain of 0.9%. Tertiary Industry Activity bounced back from a sharp decline in May, posting a gain of 0.9%. However, the markets had expected a much stronger gain of 1.9%. There was good news on the inflation front, as the Corporate Goods Price Index continues its impressive upward trend in the second quarter. The index improved to 4.6%, edging past the estimate of 4.5%.

Meanwhile, Unemployment Claims dropped, as employment data continues to impress. The key indicator dropped to 304 thousand, well below the estimate of 316 thousand. Employment numbers for June have looked sharp, led by a jump in Nonfarm Payrolls and a drop in the unemployment rate. The strong employment numbers have increased speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be under the market microscope.

The Federal Reserve minutes did not shed much light on when the Fed plans to raise interest rates, but policymakers did agree to wind up the QE scheme by October. The asset purchase program flooded the economy with over $2 trillion, and the Fed has been steadily reducing the program since last December. Winding down QE will require several more tapers by the Fed, but that shouldn't pose a problem, given the solid employment data the economy has been churning out.

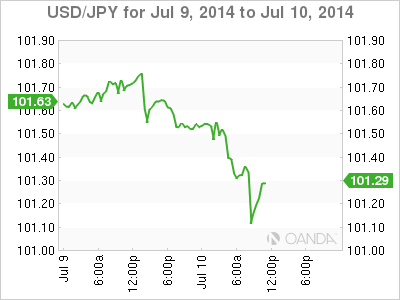

USD/JPY for Thursday, July 10, 2014

USD/JPY July 10 at 14:15 GMT

- USD/JPY 101.20 H: 101.57 L: 101.08

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.57 | 100.00 | 101.19 | 102.53 | 103.07 | 104.17 |

- USD/JPY was flat in the Asian session and lost ground in European trading. The pair is unchanged in the North American session.

- 102.53 has strengthened in resistance as the yen has improved.

- On the downside, 101.19 is under strong pressure. There is stronger support at the round number of 100, which has held firm since November.

- Current range: 101.19 to 102.53

Further levels in both directions:

- Below: 101.19, 100.00, 99.57 and 98.97

- Above: 102.53, 103.07, 104.17 and 105.70

OANDA's Open Positions Ratio

USD/JPY ratio is pointing to gains in long positions, continuing the trend which has characterized the pair throughout the week. This is not consistent with the movement we're seeing from the pair, as the yen has posted gains. The ratio is made up of a large majority of long positions, indicating strong trader bias towards the dollar reversing direction and moving higher.

USD/JPY Fundamentals

- 3:45 Japanese 30-year Bond Auction. Actual 1.70%.

- 5:00 Japanese Consumer Confidence. Estimate 40.7 points. Actual 41.1 points.

- 12:30 US Unemployment Claims. Estimate 316K. Actual 304K.

- 14:00 US Wholesale Inventories. Estimate 0.6%. Actual 0.5%.

- 14:30 US Natural Gas Storage. Estimate 92B. Actual 93B.

- 17:01 US 30-year Bond Auction.

- 20:30 US FOMC Member Stanley Fischer Speaks.

*Key releases are highlighted in bold

*All release times are GMT