The Japanese yen has posted strong gains on Wednesday, recovering the losses of a day earlier. In the European session, USD/JPY is trading in the mid-117 range. On the release front, the BOJ kept BOJ held steady with its stimulus program. Later in the day, the US publishes the first major events of the week, with the release of Building Permits and Housing Starts for December. The markets are expecting slight improvement from both indicators.

As expected, the BOJ held the course with its stimulus program and stated in its policy statement that it would increase base money at a pace of JPY 80 trillion each year. This gave a boost to the yen, as many market players were expecting additional stimulus from the BOJ, given the weak economy and lack of inflation. With oil prices continuing to drop, the BOJ may be forced to reconsider additional stimulus steps in order to avoid a recurrence of deflation. which hobbled the Japanese economy for years.

World markets were in turmoil following last week’s bombshell from the Swiss central bank, which abruptly abandoned its EUR/CHF cap. As the markets await the ECB policy meeting on Thursday, is this the calm before the next storm? On Wednesday, French President Francois Hollande stated flat out that the ECB will announce a quantitative easing package at the ECB meeting. However, now that a QE is likely priced in, the question remains what will be the size of the program? The markets are anticipating QE of between EUR 500-600 billion, but some market players are saying that the ECB could go as high as EUR 800 billion. Will the euro take a hit on Thursday? The likelihood is yes, unless the ECB surprises with a “QE lite”, such as EUR 300 billion, which would be well below expectations.

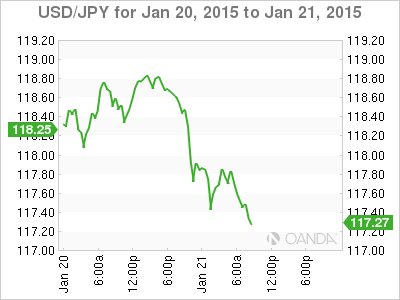

USD/JPY for Wednesday, January 21, 2015

USD/JPY January 21 at 12:30 GMT

USD/JPY 117.55 H: 118.76 L: 117.33

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 113.64 | 115.56 | 116.69 | 117.94 | 118.69 | 119.83 |

- USD/JPY posted strong losses in the Asian session, breaking below support at 117.94. The pair has shown limited movement in the European session.

- 117.94 has reverted to a resistance role after strong gains by the yen. 118.69 is stronger.

- 116.69 is an immediate support level.

- Current range: 116.69 to 117.94

Further levels in both directions:

- Below: 116.69, 115.56, 113.64 and 112.41

- Above: 117.94, 118.69, 119.83, 120.63 and 121.69

OANDA’s Open Positions Ratio

USD/JPY ratio is pointing to gains in short positions on Wednesday, reversing the direction seen a day earlier. This is consistent with the pair’s movement, as the yen has posted strong gains. The ratio currently has a majority of long positions, indicative of trader bias towards the US dollar reversing directions and moving to higher ground.

USD/JPY Fundamentals

- 3:29 BOJ Monetary Policy Statement.

- 4:30 Japanese All Industries Activity. Estimate 0.1%. Actual 0.1%.

- 6:30 BOJ Press Conference.

- 13:30 US Building Permits. Estimate 1.06M.

- 13:30 US Housing Starts. Estimate 1.04M.

*Key releases are highlighted in bold

*All release times are GMT

Disclaimer: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.